- Home

- Data Visualization

- Tools

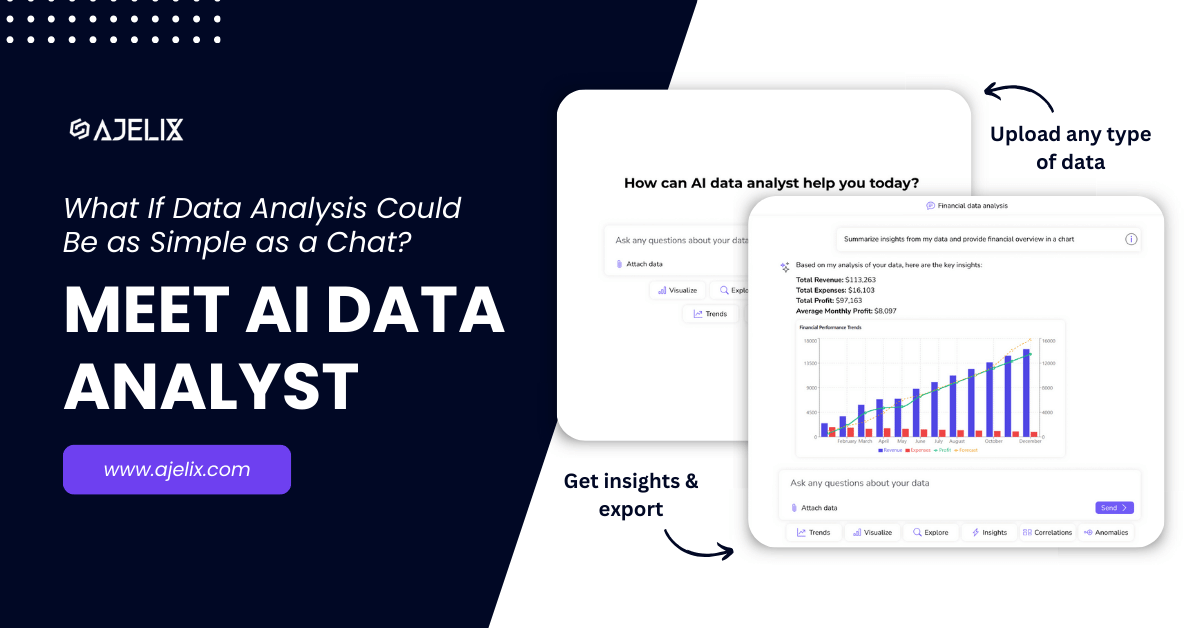

- AI Data Analyst

- Excel Formula Generator

- Excel Formula Explainer

- Google Apps Script Generator

- Excel VBA Script Explainer

- Excel VBA Script Generator

- Excel VBA Code Optimizer

- Excel VBA Code Debugger

- Google Sheets Formula Generator

- Google Apps Script Explainer

- Google Sheets Formula Explainer

- Google Apps Script Optimizer

- Google Apps Script Debugger

- Excel File Translator

- Excel Template Generator

- Excel Add-in

- Your Virtual AI Assistant For Excel Spreadsheets

- AI Answer Generator

- AI Math Solver

- AI Graph Generator

- AI SQL Generator

- Pricing

- Resources

Get Work Done Faster With an AI Data Analyst! 🚀 Get started for free.

Agnese

Jaunosane

About Author:

Agnese Jaunosane is Ajelix co-founder, data enthusiast and business intelligence expert who shares her knowledge and insights on Ajelix.com. With a strong background in data analytics, Agnese has a knack for making complex concepts accessible to a wider audience. She is passionate about helping individuals and businesses leverage the power of data to make informed decisions. Agnese’s recent articles cover a range of topics including Excel tips and tricks, data visualization best practices, and the latest trends in business intelligence.