- Home

- Data Visualization

- Tools

- AI Data Analyst

- Excel Formula Generator

- Excel Formula Explainer

- Google Apps Script Generator

- Excel VBA Script Explainer

- Excel VBA Script Generator

- Excel VBA Code Optimizer

- Excel VBA Code Debugger

- Google Sheets Formula Generator

- Google Apps Script Explainer

- Google Sheets Formula Explainer

- Google Apps Script Optimizer

- Google Apps Script Debugger

- Excel File Translator

- Excel Template Generator

- Excel Add-in

- Your Virtual AI Assistant For Excel Spreadsheets

- AI Answer Generator

- AI Math Solver

- AI Graph Generator

- AI SQL Generator

- Pricing

- Resources

- Home

- Blog

- Calculators

- Free NPV Calculator Online: Calculate Net Present Value

Free NPV Calculator Online: Calculate Net Present Value

Explore other articles

- No Code Analytics: Business Impact and Top Tools in 2025

- Top Automation Tools for Excel in 2025: Built-In and Third-Party Solutions

- 5 Healthcare Data Analytics Trends 2025

- Which is the Best Analytics Platform for Startup Data Needs in 2025

- 10 Must-Have AI Tools for Startups in 2025

- 7 Best AI Tools for Excel Data Analysis (2025 Comparison)

- Why is AI-driven Data Intelligence the Key to Success?

- The Essential Role of AI in Conversational Analytics

- Which AI Model Will Survive Our Test: Claude vs Perplexity?

- Will AI Replace Data Analysts?

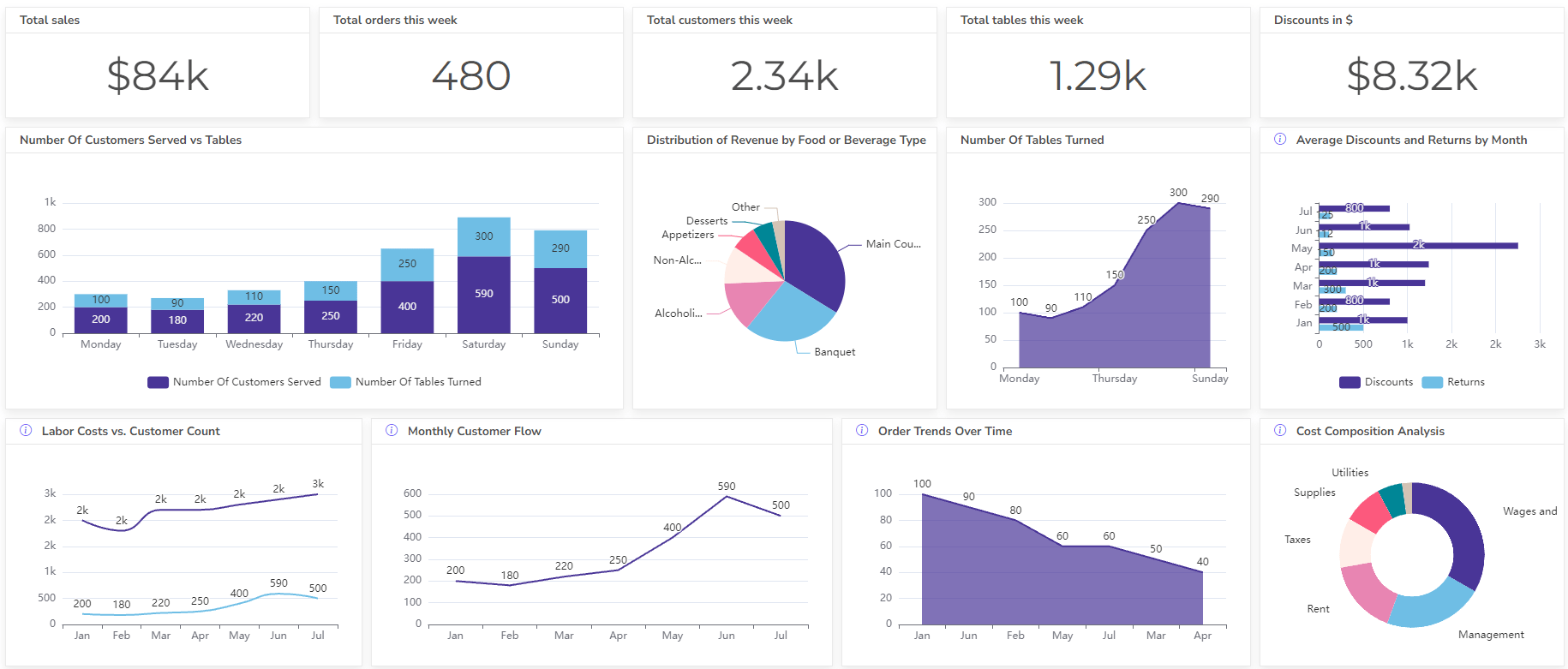

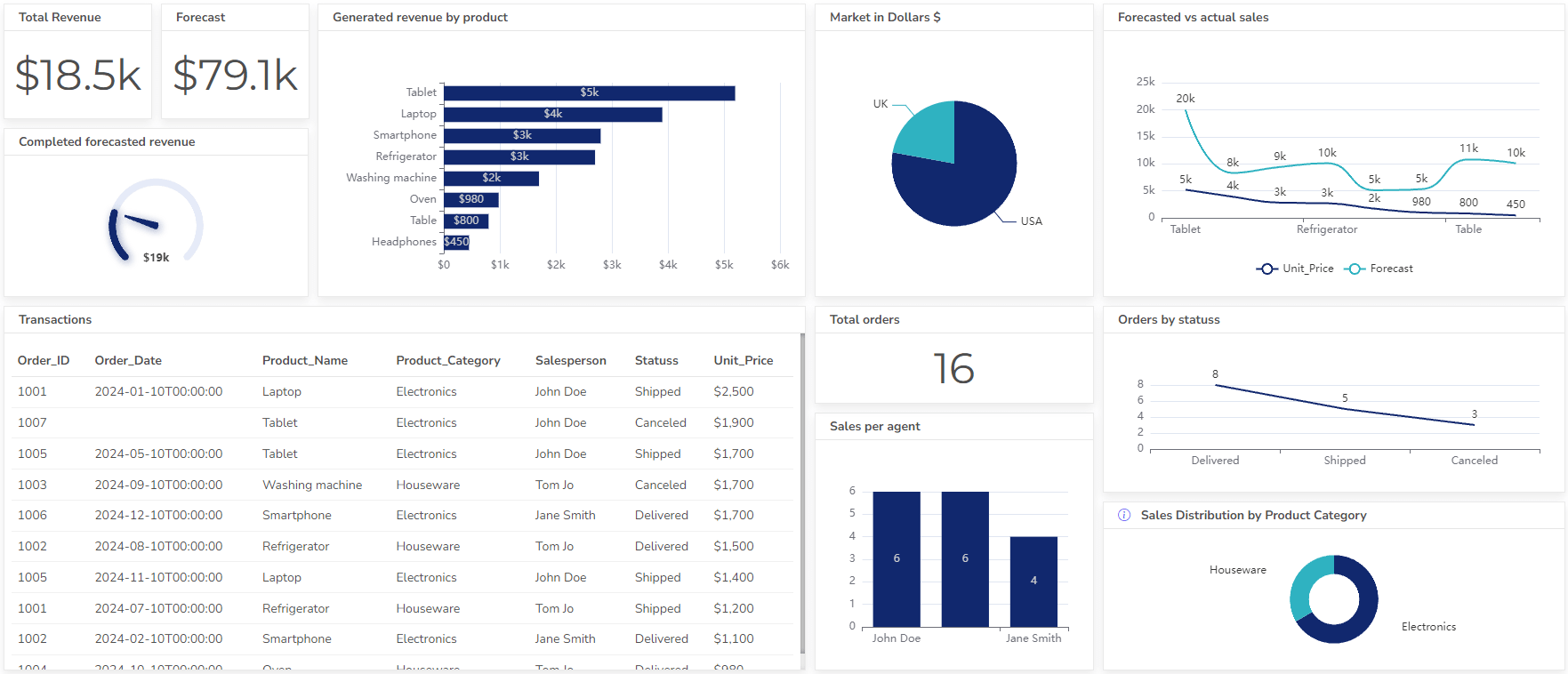

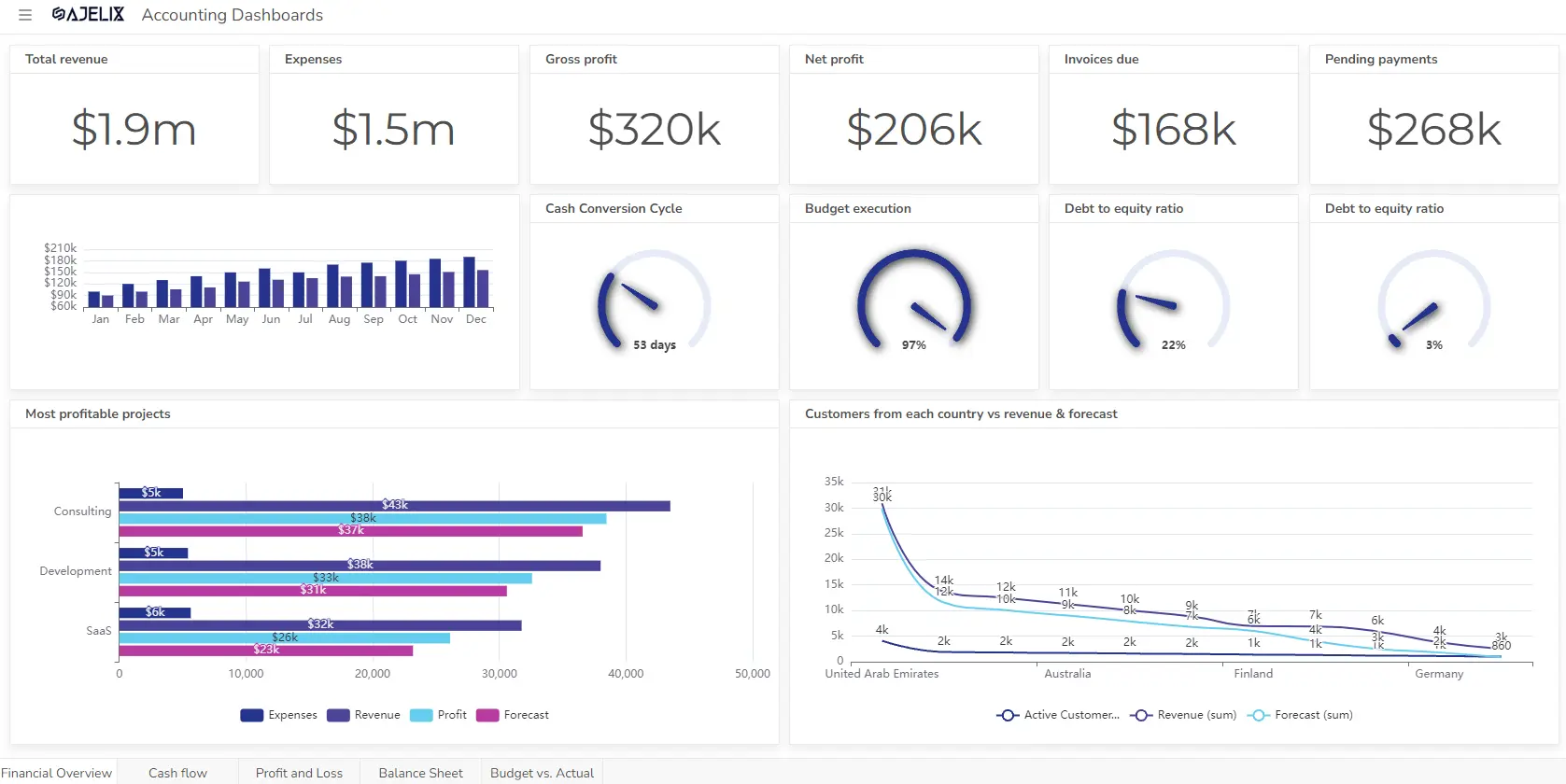

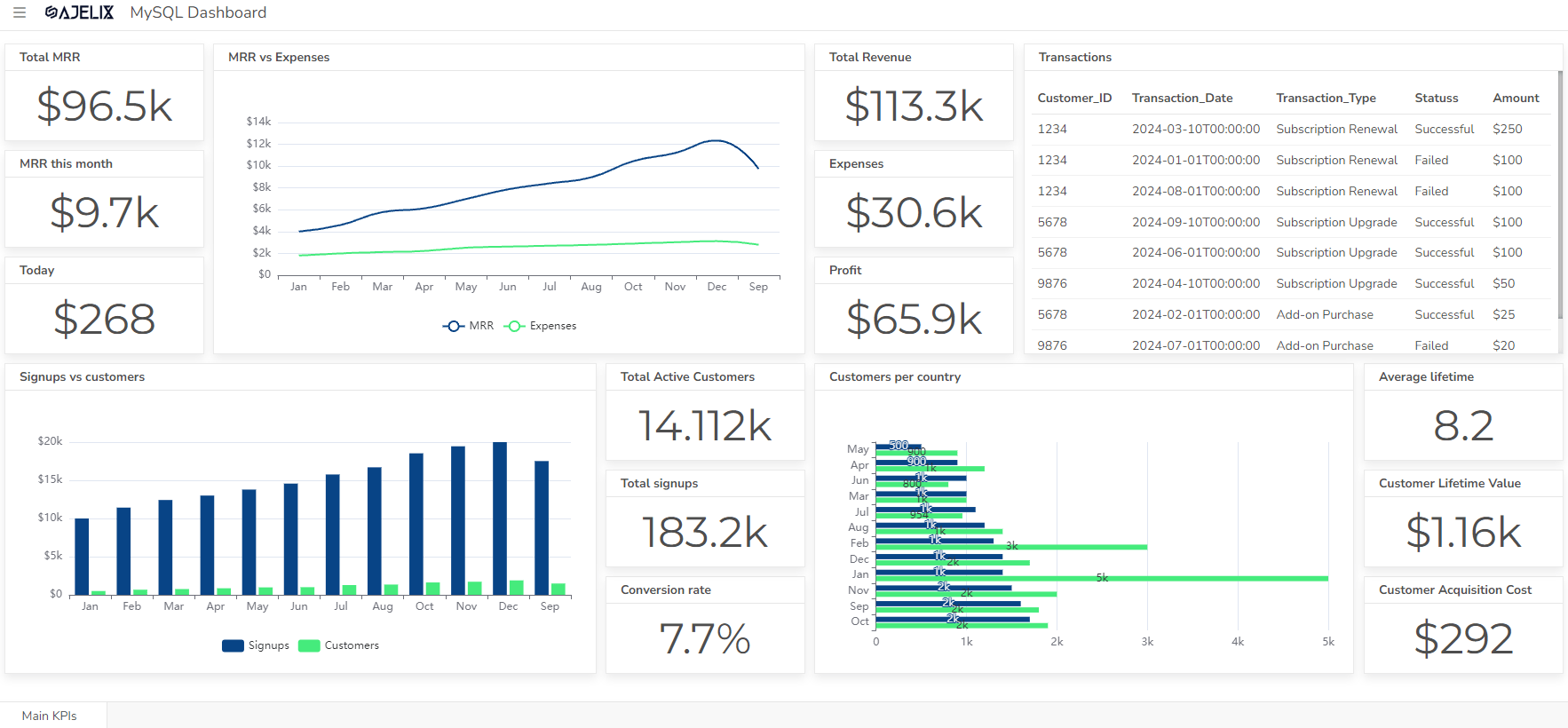

Set up dashboard & track KPIs

An NPV calculator is a tool that helps you assess the profitability of an investment by calculating its Net Present Value (NPV).

Calculate Net Present Value

Looking to create reporting system fast & painlessly?

Build dashboards and track KPIs in one place with Ajelix BI

What is NPV?

NPV is a financial metric that considers the time value of money. It expresses the present value of all future cash flows (both positive and negative) expected from an investment or project.

Net Present Value Formula

NPV = Σ (CFt / (1 + r)t) - Initial Investment

where:

- NPV is the Net Present Value

- Σ (sigma) represents the summation over all periods (t)

- CFt is the cash flow at time period t (can be positive or negative)

- r is the discount rate (minimum acceptable rate of return)

- t is the time period

What is Cash Flow (CFt) in NPV?

Represents the expected income or expense in each period of the investment's lifespan. It can be positive for inflows (revenue) and negative for outflows (costs).

What is Discount Rate (r)?

Reflects the time value of money and the minimum return you expect from the investment. A higher discount rate reduces the present value of future cash flows.

What is Time Period (t)?

Refers to each year, quarter, or other period over which the cash flows are projected.

What is Present Value (PV)?

Dividing each cash flow (CFt) by (1 + r)t adjusts it to its present value, considering the time value of money and the discount rate.

What is Summation (Σ)?

The present values of all cash flows are then summed up.

What is Inital Investment?

This is subtracted from the sum of the present values to arrive at the Net Present Value (NPV).

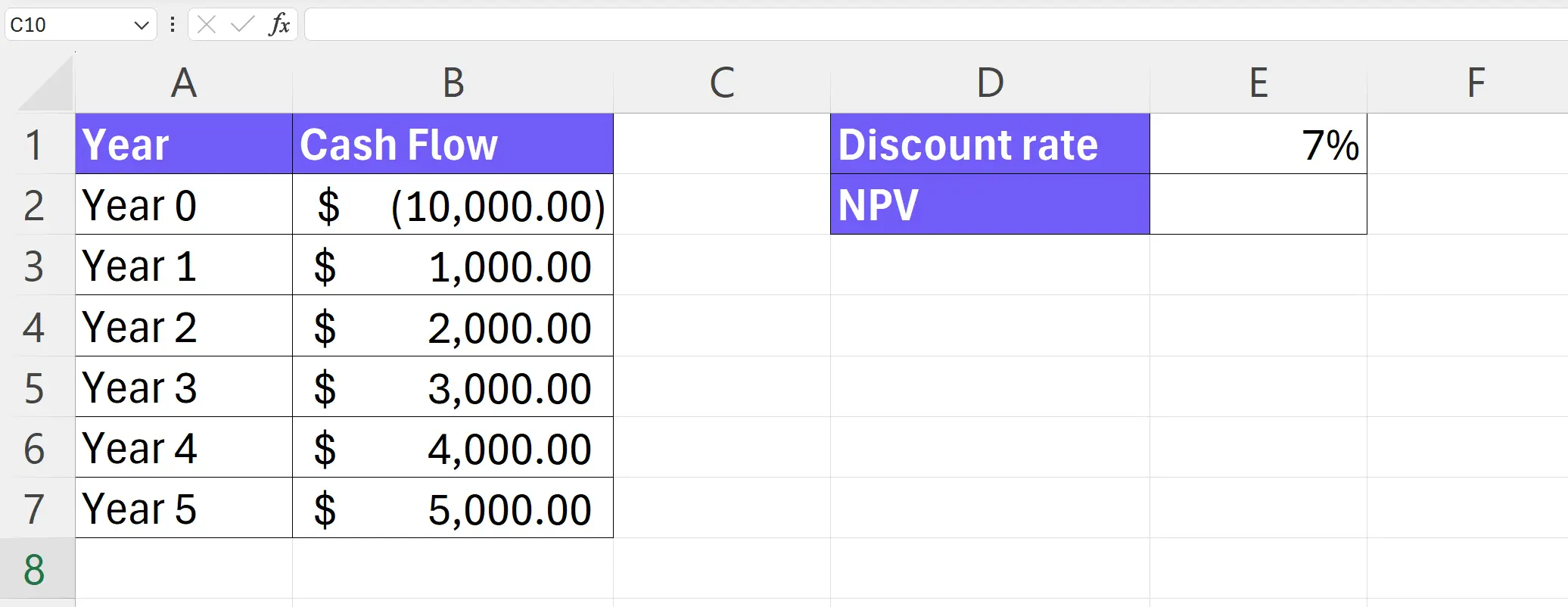

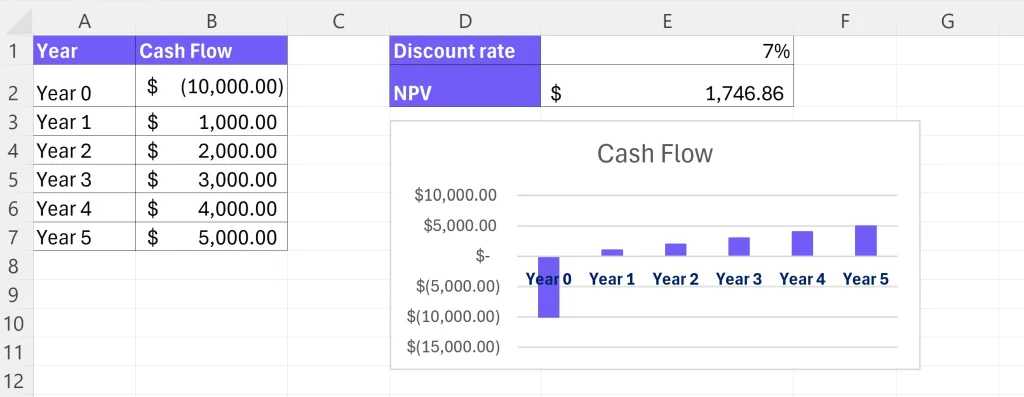

How To Calculate NPV in Excel? (Download NPV Excel Template)

Time needed: 10 minutes

Here's a step-by-step guide on how to calculate NPV in Excel

- Prepare your data

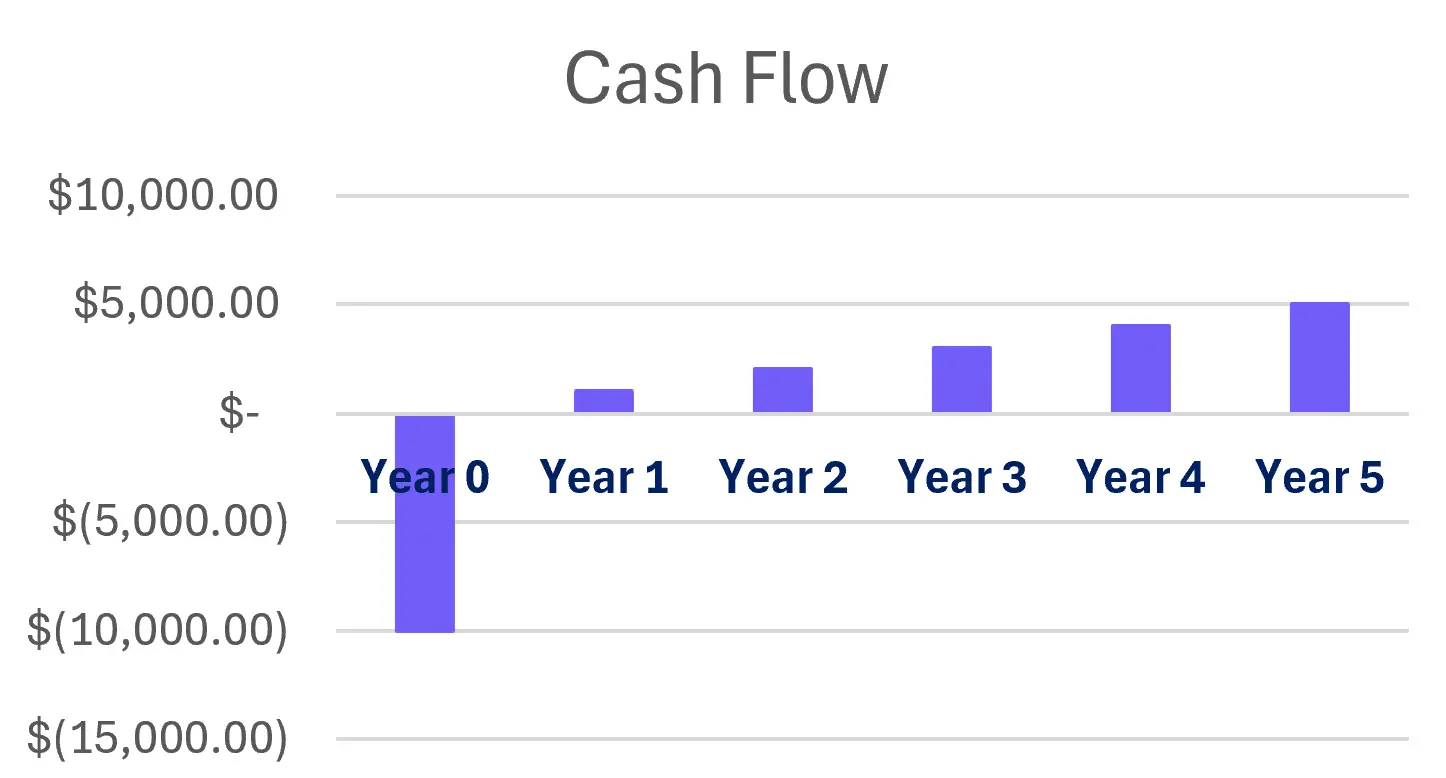

Create a table with headings for Year, Cash Flow (can be positive or negative). Enter the initial investment amount in the first row (Year 0) with a negative value (outflow). In subsequent rows (Years 1 onwards), enter the expected cash flow for each year.

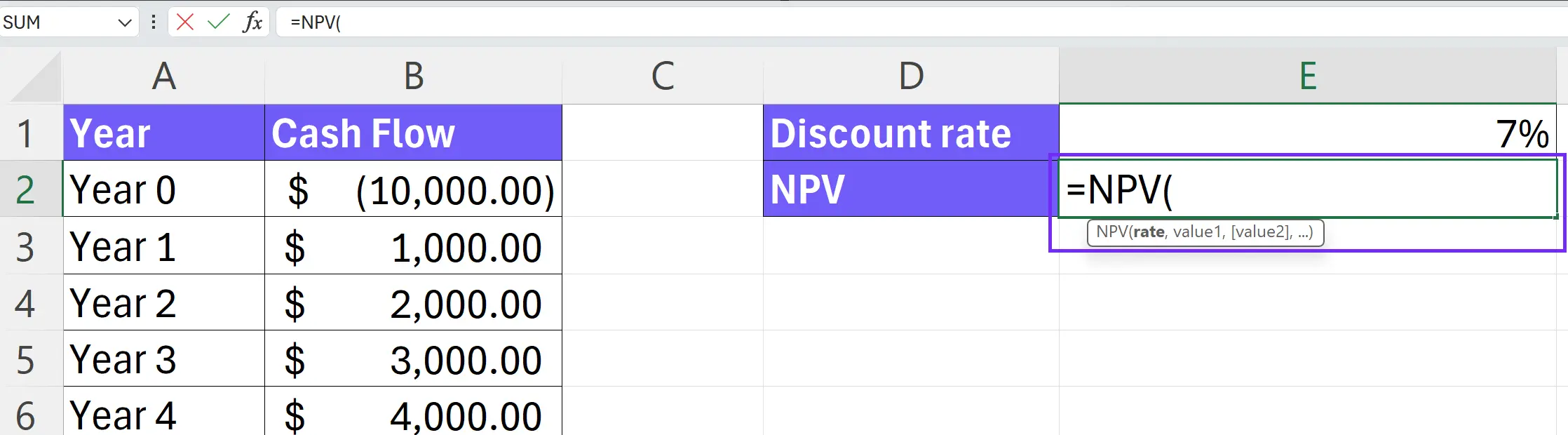

- Insert the NPV function

Click on the cell where you want the NPV result to appear. Go to the formula bar and type

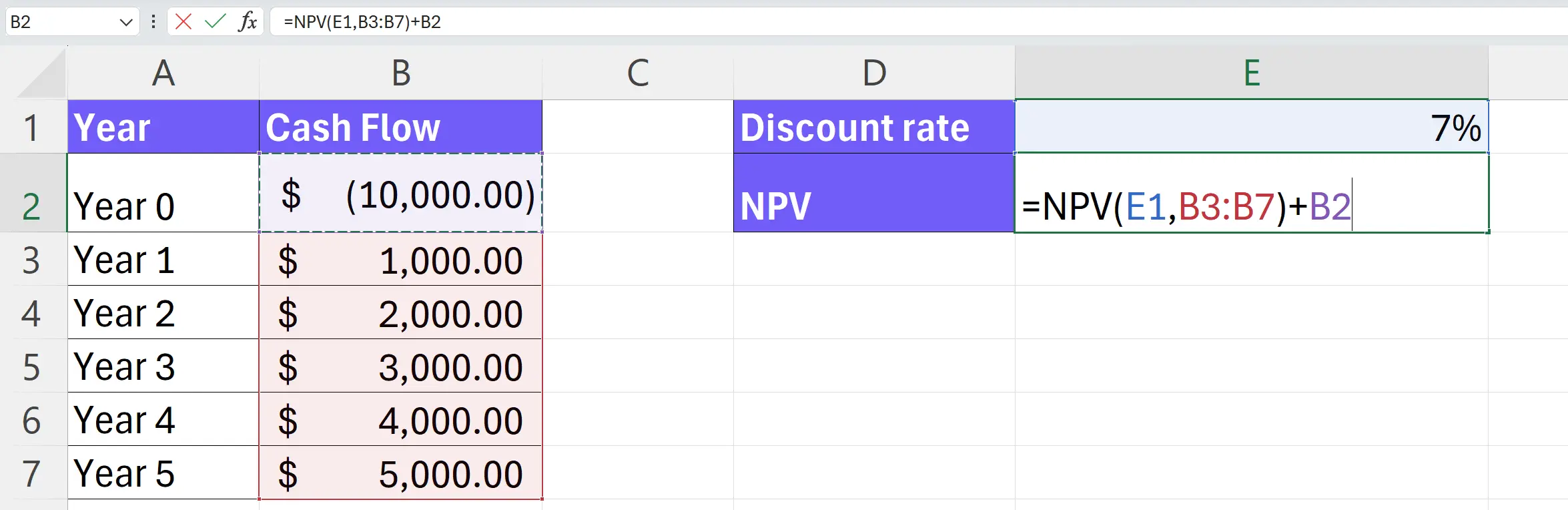

=NPV(. - Enter the NPV arguments

Inside the parentheses, follow this order (separated by commas):

- Discount Rate: Enter the discount rate as a decimal (e.g., 0.1 for 10%).

- Cash Flow Range: Select the range of cells containing your cash flow values (excluding Year 0).

- Add Year 0 to the formula: Close the brackets and add investment amount (make sure the Year 0 value is formatted as a minus) - Close the formula and calculate

Press

Enterto complete the formula. Excel will calculate the NPV based on your discount rate and cash flows. - Visualize your NPV cash flow

For better understanding you can visualize your cash flow in a chart. Select Year and Cashflow cells, go to insert and pick from recommended charts.

How To Generate Formulas With AI?

AI is making spreadsheet life easier by generating formulas based on your descriptions. Here's a step-by-step guide to get started:

1. Create a free Ajelix account

Ajelix platform offers more than 15 AI tools for spreadsheet tasks including Excel formula generator. You can sign up using your Gmail account or any other email.

Screenshot from Ajelix registration page, image by author

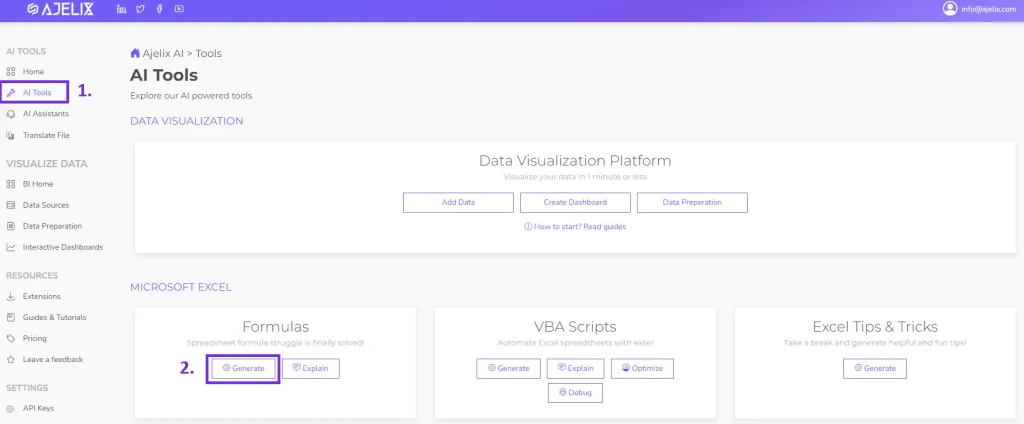

2. Locate the Formula generator tool

Once you have logged in to the portal you can find the Excel formula generator under the AI tools section.

Screenshot from Ajelix portal on how to find formula generator, image by author

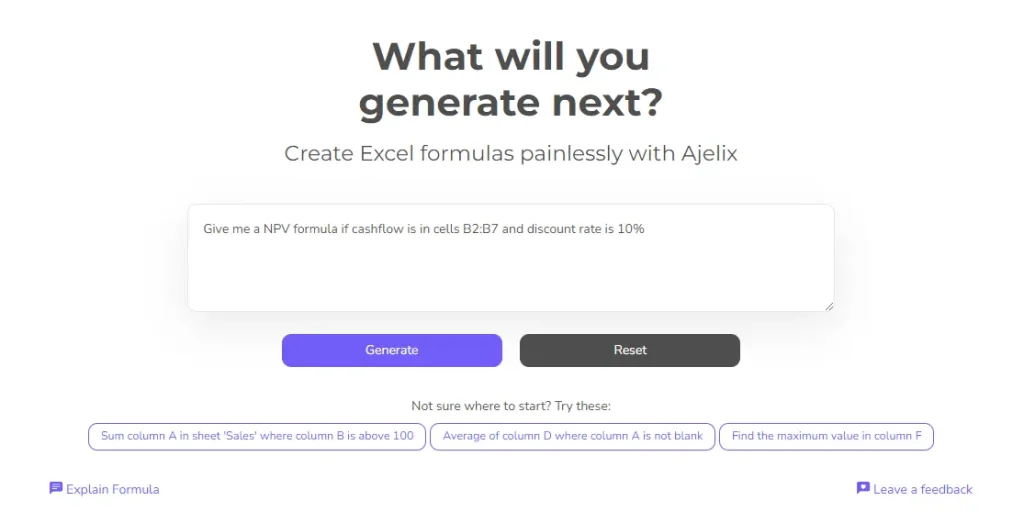

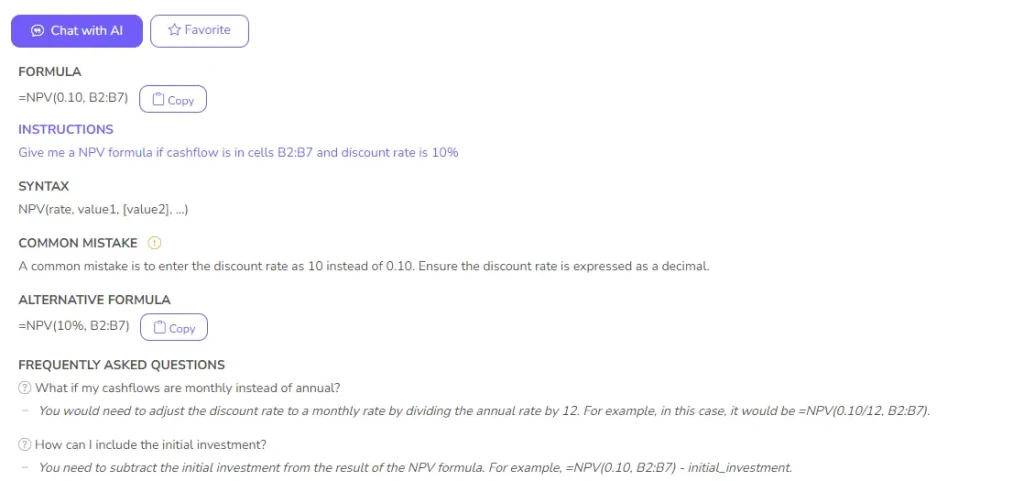

3. Write a clear and concise prompt

The key to getting an accurate formula is providing a clear description of what you want to achieve. For example, if you want to get the NPV formula, you would write: "Give me the NPV formula if cashflow is in cells B2:B7 and the discount rate is 10%".

Screenshot from Ajelix formula generator with NPV prompt, image by author

Here are some tips for writing your prompt:

- Focus on the desired outcome: Instead of saying "I need a formula for calculations," specify what you want to calculate, like "Calculate the average of sales in column B for approved items (marked 'Yes' in column A)".

- Use cell references: If your platform allows, mention specific cells or ranges by name (e.g., "Calculate total cost (column C) by multiplying quantity (column A) by price (column B)").

- Be specific about conditions: If your formula involves conditions, explain them clearly (e.g., "Return 'Bonus' in cell D2 if sales (column B2) exceed target (cell E1), otherwise return 'No Bonus'").

4. Get your formula

Once you have the prompt AI will give you a ready-to-use formula to insert in your spreadsheet. You can also use Excel or Google Sheets add-on for easier formula writing. In the answer below you can see that AI gave the correct formula and in the FAQ wrote that you need to subtract the initial investment for correct output.

Screenshot from Ajelix with NPV formula result, image by author

Ready to give it a go?

Test AI tools with freemium plan and only upgrade if formula generator can help you!

Download NPV Excel Template

Screenshot from NPV calculation Excel template, image by author

Struggling with manual calculations?

Create KPIs and track your data regularly

Learn more

Fast registration and easy setup

How does an NPV calculator work?

An NPV calculator typically asks you to input the following:

- Initial investment cost

- Expected cash flows for each period (year, quarter, etc.) over the investment's lifespan

- Discount rate (your expected rate of return on the investment)

The calculator then uses a formula to determine the present value of each cash flow, considering the time value of money and the discount rate. Finally, it sums the present values of all cash flows and subtracts the initial investment cost to arrive at the Net Present Value.

What does the NPV tell you?

| NPV Score | Interpretation | Action |

|---|---|---|

| Positive NPV | The project is expected to generate a return that exceeds the discount rate. This indicates a profitable investment. | Consider moving forward with the project. |

| Zero NPV | The project is expected to break even, meaning its return will exactly match the discount rate. | This option might be acceptable if it aligns with other strategic goals, but there might not be significant financial gain. Further analysis of alternatives is recommended. |

| Negative NPV | The project is expected to generate a return that is lower than the discount rate, suggesting a potential loss. | Reconsider the project. It might be best to reject it or revise the plan to improve its profitability. |

NPV is a single metric, and you should consider several factors, such as project risk, strategic fit, and potential intangible benefits during investment decisions.

The discount rate used in the NPV calculation can significantly impact the final score. A higher discount rate will result in a lower NPV and vice versa. Businesses should carefully choose a discount rate that reflects the project's risk and their required rate of return.

Benefits of using an NPV calculator

There are several advantages to using an NPV calculator compared to manually calculating the Net Present Value yourself:

Infographic with 6 benefits of using NPV, image by author

- Saves Time and Effort: The NPV formula involves multiple calculations for each cash flow period. An NPV calculator automates these computations, saving you significant time and reducing the chance of errors.

- Improves Accuracy: Manual calculations are prone to mistakes, especially when dealing with multiple cash flows and complex formulas. An NPV calculator eliminates this risk by performing the calculations precisely.

- User-Friendly Interface: Most NPV calculators offer a simple interface where you can easily input the required data (initial investment, cash flows, discount rate). The calculator then presents the NPV in a clear and concise format.

- Accessibility: NPV calculators are readily available online and often built into financial spreadsheet programs. This makes them convenient to use anytime, anywhere.

- Comparison Capabilities: Some NPV calculators allow you to compare the NPVs of multiple investment options side-by-side. This helps you quickly identify the project with the most promising potential return.

- Scenario Analysis: Certain calculators might allow you to adjust variables like the discount rate or cash flow estimates to see how they impact the NPV. This can be helpful for sensitivity analysis and exploring different investment scenarios.

Ready to give it a go?

Connect your data and create professional reports

Start free

Try free and upgrade whenever

FAQ

Businesses use NPV to see if an investment will be profitable in the long run. It considers the time value of money, ensuring they don't prioritize future promises over actual present returns.

Predicting future cash flows is tricky, and the chosen discount rate can heavily influence the NPV. It's a valuable tool, but not the whole picture for investment decisions.

A negative NPV suggests a potential loss. Re-evaluate costs, cash flow projections, or consider a higher discount rate if justified. If the project holds strategic value, explore ways to improve its profitability before investing.

The discount rate reflects your minimum acceptable return and project risk. Research typical rates for similar projects or use your company's cost of capital as a starting point. You can adjust the rate in the calculator to see its impact on NPV.

Unpredictable cash flows are common. Use a range of optimistic, pessimistic, and realistic estimates to gauge the NPV's potential swing. You can also run a sensitivity analysis in the calculator. This involves adjusting cash flow values to see how they impact the NPV, helping you identify potential risks.

Other calculators

Setup and monitor your KPIs regularly using Ajelix BI