- Home

- Data Visualization

- Tools

- AI Data Analyst

- Excel Formula Generator

- Excel Formula Explainer

- Google Apps Script Generator

- Excel VBA Script Explainer

- AI VBA Code Generator

- Excel VBA Code Optimizer

- Excel VBA Code Debugger

- Google Sheets Formula Generator

- Google Apps Script Explainer

- Google Sheets Formula Explainer

- Google Apps Script Optimizer

- Google Apps Script Debugger

- AI Excel Spreadsheet Generator

- AI Excel Assistant

- AI Graph Generator

- Pricing

- Resources

- Home

- Blog

- Calculators

- Free EBIT Calculator Online With Formula Examples

Free EBIT Calculator Online With Formula Examples

Explore other articles

- 7 Productivity Tools and AI Plugins for Excel

- Julius AI Alternatives: Top 5 Choices 2026

- No Code Analytics: Top Tools in 2026

- Automation Tools for Excel in 2026: Built-In & Third-Party

- 5 Healthcare Data Analytics Trends 2026

- Best Analytics Platform For Startups In 2026

- 15 Best AI Tools For Startups In 2026 We Tried

- 7 Best AI Tools for Excel Data Analysis (2026 Comparison)

- AI Data Intelligence For Workspace

- Conversational Analytics & AI

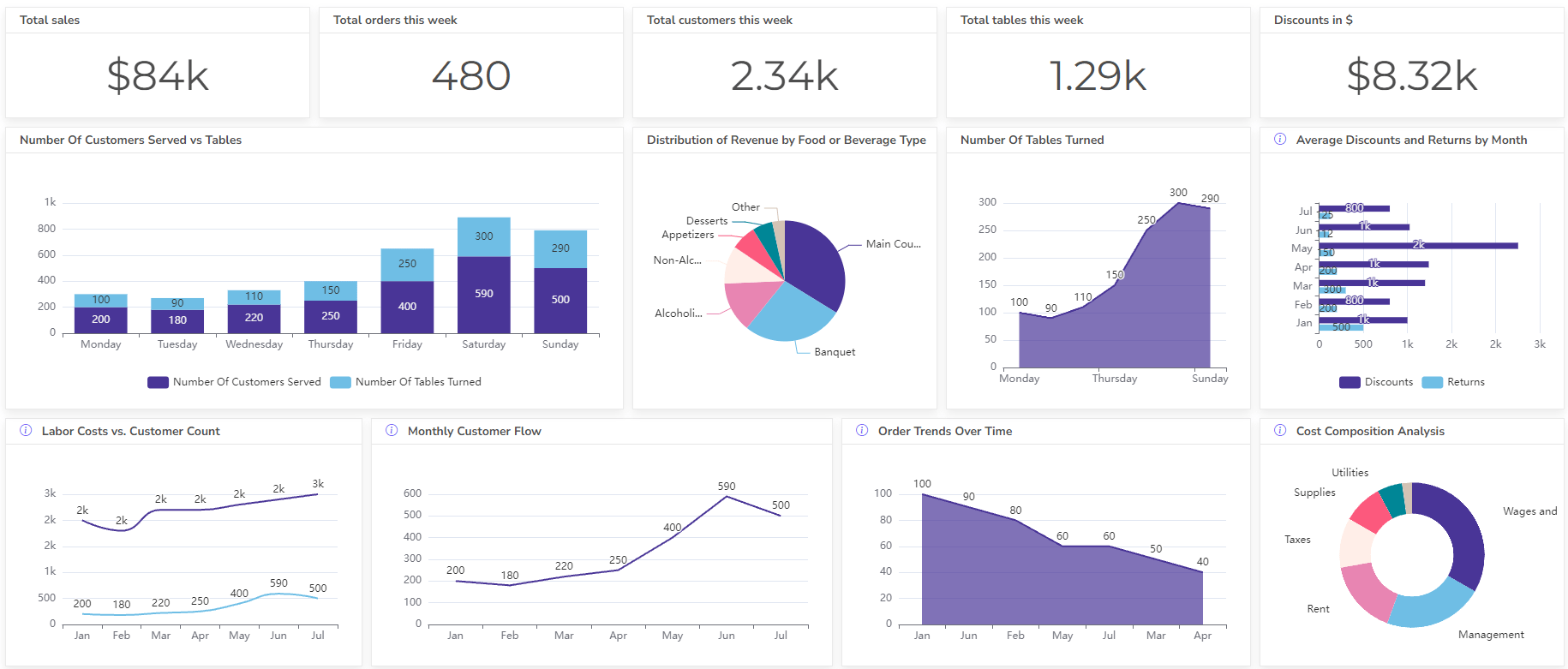

Set up dashboard & track KPIs

An EBIT calculator is a tool that helps you calculate a company’s earnings before interest and taxes (EBIT). EBIT is a financial metric that shows a company’s profitability from its core operations, excluding the effects of financing decisions and taxes.

Struggling with your Excel formulas?

Looking for a faster and easier way to write Excel formulas? Try AI Excel Formula Generator and turn your text into formulas with just a few clicks.

What Is EBIT?

EBIT stands for Earnings Before Interest and Taxes. It’s a financial measure of a company’s profitability focusing on core operations.

Think of it as profit before considering how the company financed its operations (interest) and how much it owes in taxes.

EBIT Formula

There are two main ways to calculate EBIT:

- Subtracting expenses from revenue:

EBIT = Revenue – Cost of Goods Sold (COGS) – Operating Expenses

Here, revenue refers to total sales, COGS represents the direct cost of producing the goods sold, and operating expenses include all other costs associated with running the business (e.g., rent, salaries, marketing).

- Adding back interest and taxes to net income:

EBIT = Net Income + Interest Expense + Taxes

Net income is the company’s final profit after all expenses. This method works well if you already have the net income figure.

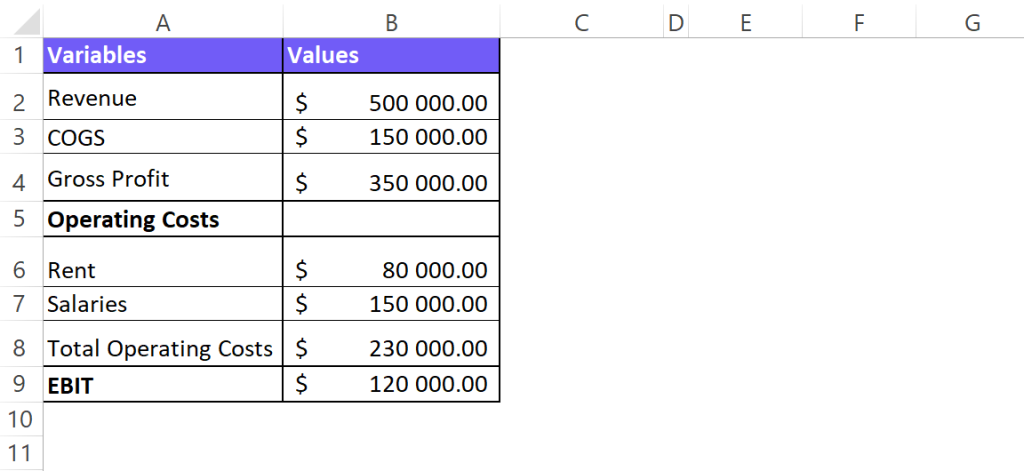

How To Calculate EBIT In Excel? (Download Template)

Time needed: 5 minutes

Here’s the most common approach to calculating EBIT in Excel using Revenue, COGS, and Operating Expenses.

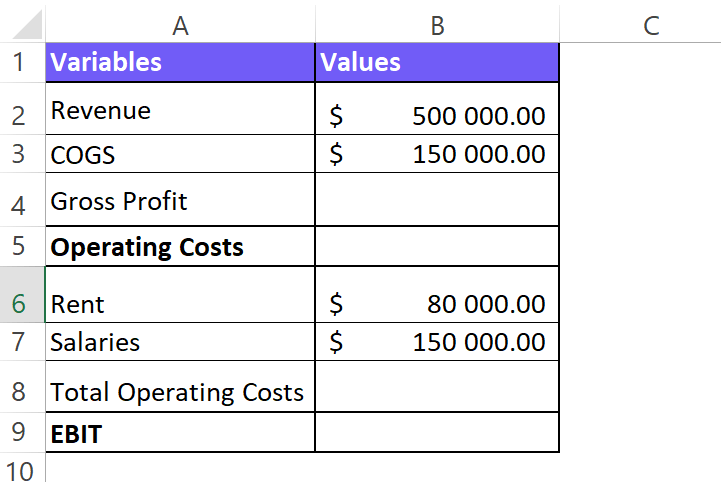

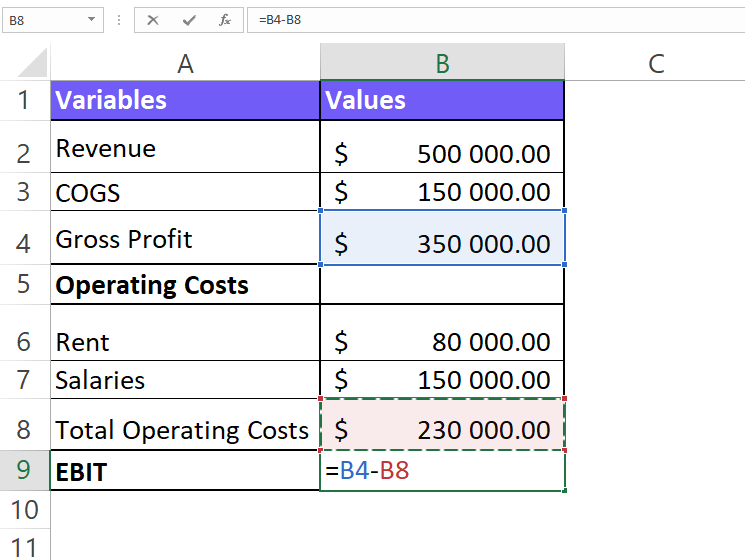

- Set up your spreadsheet

Label columns for Revenue, Cost of Goods Sold (COGS), Operating Expenses, and EBIT.

Enter the corresponding values for Revenue and COGS in their respective rows.

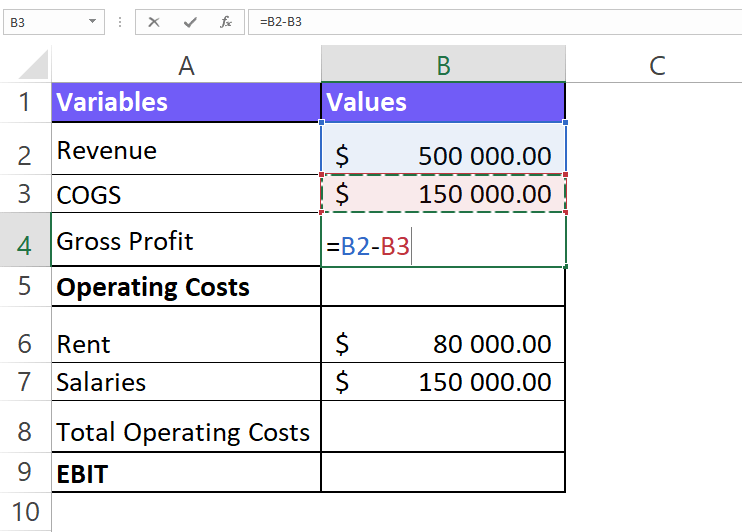

- Calculate Gross Profit

In an empty cell, use the formula

=Revenue - COGSto calculate the gross profit.

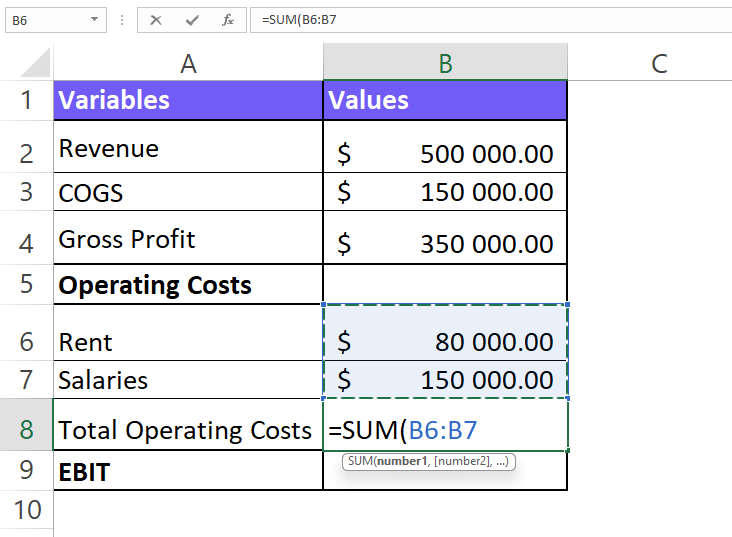

- Calculate Total Operating Expenses

List all your operating expenses (rent, salaries, etc.) in separate rows below COGS.

In an empty cell below the last operating expense, use the formula=SUMto add all the operating expenses.

- Calculate EBIT

In the EBIT cell, use the formula

=Gross Profit - Total Operating Expenses.

Tips

- Use clear cell references instead of hardcoded numbers in your formulas for better readability and easier updates.

- Format the cells for currency to display the results appropriately.

- You can expand this approach to calculate EBIT margin by adding a formula that divides EBIT by Revenue and multiplies it by 100 to express it as a percentage.

Download the EBIT Calculator in Excel Template

Download your EBIT calculator template below 👇

Did you know you can use an AI Template generator to create Excel templates from your keywords?

What’s The Difference Between EBIT and EBITDA?

Both EBIT and EBITDA are profitability metrics, but they differ in one key aspect: Depreciation and Amortization.

- EBIT (Earnings Before Interest and Taxes): This metric reflects a company’s profit from core operations after accounting for the cost of goods sold, operating expenses, interest, and taxes. It shows how efficient the company is at generating profit from its core business activities.

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): This metric is similar to EBIT but goes a step further by adding back depreciation and amortization expenses.

Here’s why depreciation and amortization are treated differently:

Depreciation and amortization are non-cash expenses. They represent the allocation of the cost of tangible (depreciation) and intangible (amortization) assets over their useful life. While they impact the income statement, they don’t involve a current cash outflow.

EBITDA is often used by analysts because:

- It allows for a more apples-to-apples comparison between companies, especially those with different asset bases or depreciation policies.

- It provides a better view of a company’s operating cash flow, as depreciation and amortization don’t require a current cash outlay.

However, it’s important to remember that EBITDA:

- Doesn’t consider the impact of a company’s capital expenditure decisions.

- Can be misleading if a company is heavily investing in assets with significant depreciation or amortization.

When to use EBIT And When EBITDA

| Use EBIT When | Use EBITDA When |

|---|---|

| Comparing profitability within the same industry | Comparing profitability across industries |

| Analyzing core operating efficiency | Evaluating operating cash flow generation potential |

| Less emphasis on capital expenditures | Significant differences in asset bases or depreciation policies |

What Does EBIT Calculator Tell You?

EBIT calculator (Earnings Before Interest and Taxes) tells you a company’s profitability from its core operations, but with some key exclusions:

- Focuses on core business: EBIT removes the impact of financing decisions (interest expense) and government regulations (taxes). This allows you to see how well the company itself is generating profit from its main activities.

- Efficiency analysis: By focusing on core operations, EBIT helps assess how efficient a company is at converting revenue into profit before outside factors come into play.

- Industry comparisons (limited): EBIT can be useful for comparing profitability within the same industry, assuming companies have similar capital structures (amount of debt and assets).

EBIT limitations

EBIT, while a valuable metric, has some limitations to consider when analyzing a company’s financial health:

- Ignores Financing Decisions: EBIT excludes interest expense, which doesn’t show how efficiently a company manages its debt. Companies with high debt may have lower EBIT compared to those with less debt, even if their core operations are similar.

- Limited Cash Flow View: Depreciation, a non-cash expense, reduces EBIT. So, a company with high EBIT might not necessarily have high cash flow, as depreciation represents the ongoing decline in the value of assets.

- Industry Comparison Challenges: Companies in different industries may have varying asset bases and depreciation policies. Comparing EBIT across such industries can be misleading without considering these differences. EBITDA (which adds back depreciation) can be a better option for such comparisons.

- Doesn’t Reflect Capital Expenditures: EBIT doesn’t account for capital expenditures (investments in property, equipment, etc.). Companies requiring significant ongoing investments in assets might have lower EBIT despite strong core operations.

To overcome these limitations, consider these strategies:

- Combine EBIT with other metrics: Use EBIT alongside EBITDA, profit margin, and cash flow analysis for a more holistic view.

- Industry-specific analysis: When comparing EBIT, focus on companies within the same industry with similar capital structures.

- Investigate further: If EBIT seems low, delve deeper into the company’s capital expenditures and depreciation policies.

Remember, EBIT is a good starting point, but a well-rounded financial analysis requires considering its limitations and using it in conjunction with other metrics.

FAQ

EBIT and profit (often referred to as net income) are similar, but EBIT excludes financing costs (interest) and taxes. It focuses purely on the profit generated from a company’s core operations. Net income considers everything, including financing and taxes.

EBIT is important for investors and analysts because it isolates a company’s core profitability from financing decisions and taxes. This allows them to compare a company’s efficiency at generating profits from its main business activities.

EBIT allows you to compare a company’s profitability within the same industry, assuming similar capital structures. It removes the effects of financing and taxes, offering a clearer picture of core business efficiency. However, for comparisons across industries, EBITDA (which adds back depreciation) might be more suitable.

EBIT shows a company’s core business profit, excluding financing (interest) and taxes. It helps analysts assess how well a company generates profit from its main activities.

Other calculators

Setup and monitor your KPIs regularly using Ajelix BI