- Home

- Product

- Tools

- AI Data Analyst

- Excel Formula Generator

- Excel Formula Explainer

- Google Apps Script Generator

- Excel VBA Script Explainer

- AI VBA Code Generator

- Excel VBA Code Optimizer

- Excel VBA Code Debugger

- Google Sheets Formula Generator

- Google Apps Script Explainer

- Google Sheets Formula Explainer

- Google Apps Script Optimizer

- Google Apps Script Debugger

- AI Excel Spreadsheet Generator

- AI Excel Assistant

- AI Graph Generator

- Pricing

- Home

- Blog

- Calculators

- Free Future Value Calculator Online: Calculate FV

Free Future Value Calculator Online: Calculate FV

Explore other articles

- Google Sheets AI Agents That Autonomously Perform Tasks

- Advanced Agentic Research With AI Agents

- GLM-5 is Now Available on Ajelix AI Chat

- AI Spreadsheet Generator: Excel Templates With AI Agents

- Excel Financial Modeling With AI Agents (No Formulas Need!)

- AI Landing Page Generator: From 0 To Stunning Page With Agent

- Creating Charts In Excel with Agentic AI – It Does Everything!

- Create Report From Google Sheets Data with Agentic AI

- How To Create Powerpoint Presentation Using AI Agent (+Video)

- Ajelix Launches Agentic AI Chat That Executes Business Workflows, Not Just Conversation

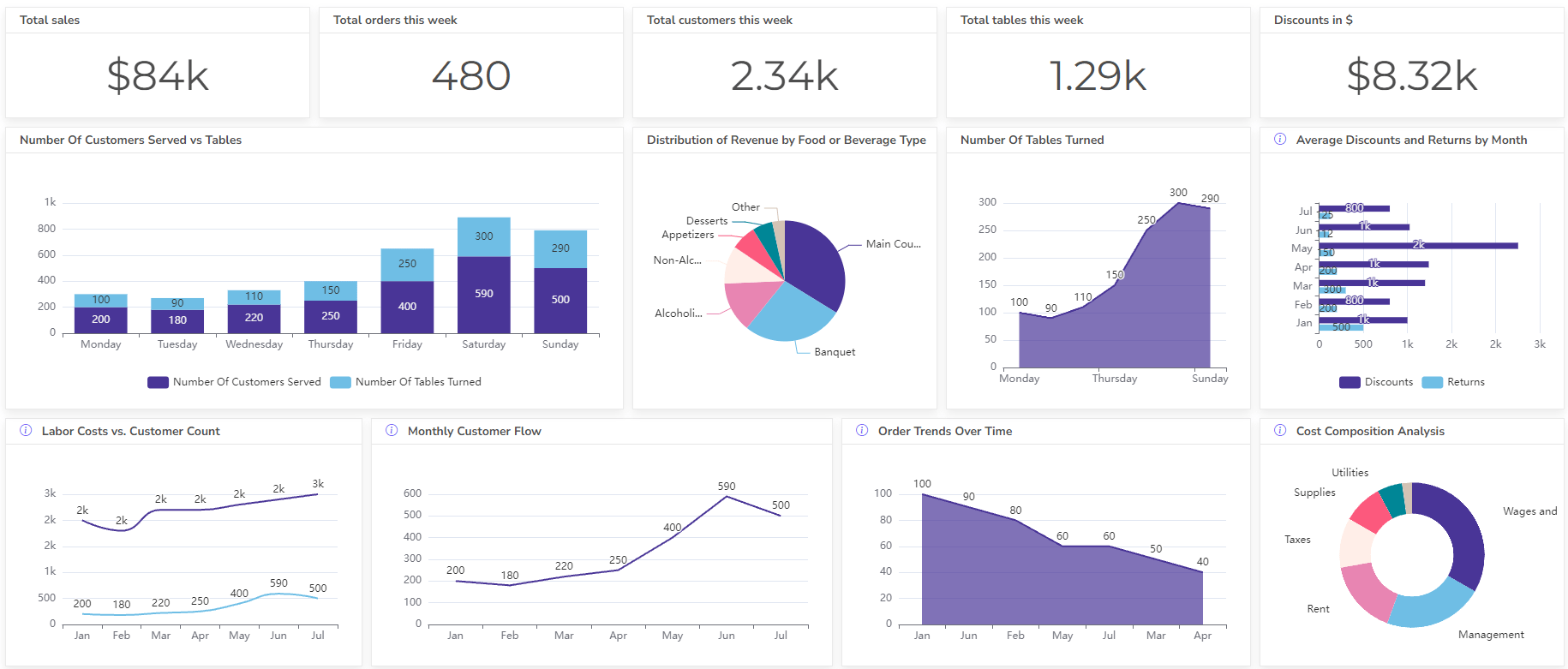

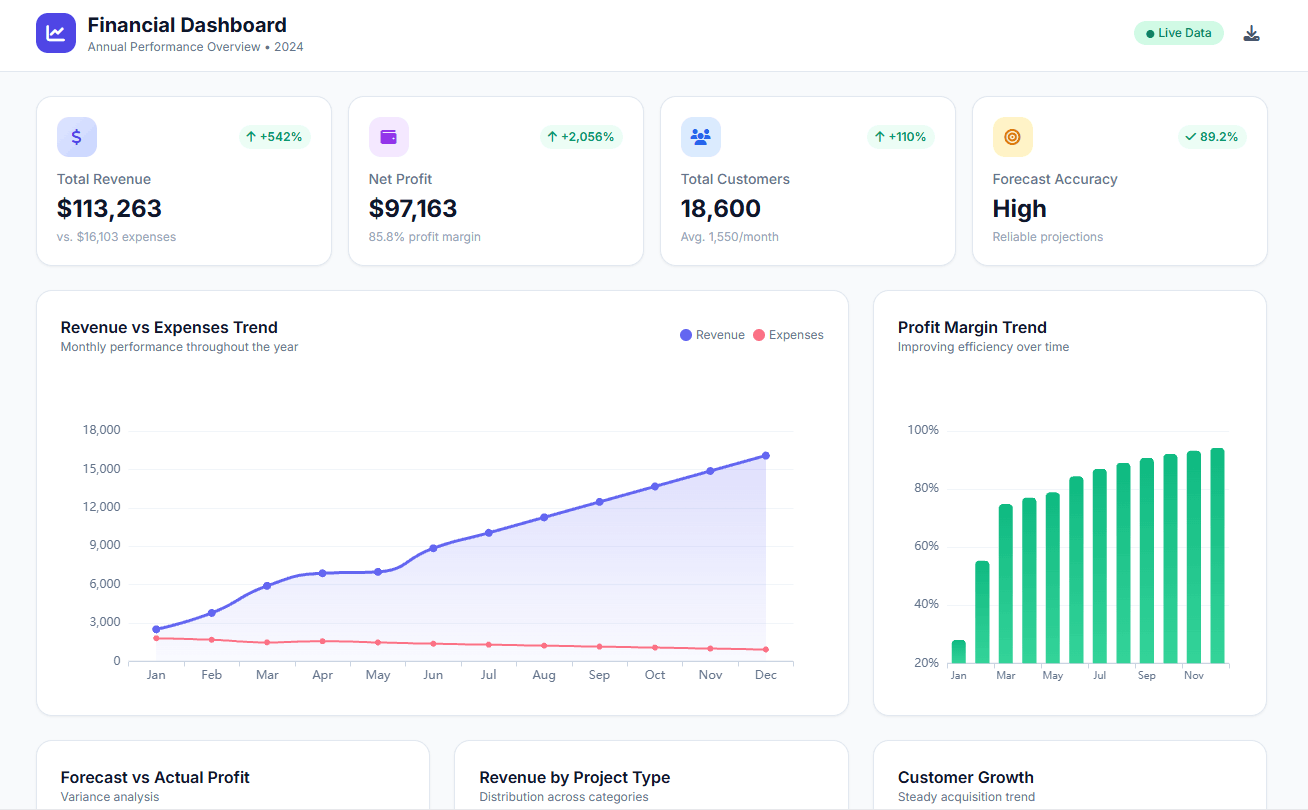

Set up dashboard & track KPIs

A future value calculator helps you estimate how much an investment will be worth in the future, taking into account factors like interest rate and time. It’s an estimate of your investment’s growth over time.

Calculate Future Value

What is Future Value?

The Future value (FV) represents investments’ anticipated worth at a specified future date. It considers the effect of factors like interest earned or a constant growth rate applied to the current value (present value) of the investment.

Struggling with manual calculations & tiring setups?

Let agentic AI do the heavy lifting.

Start free

Fast sign up & easy setup

The Difference between Future and Present Value

Future value is like the ending balance in your savings account – it’s how much your money will be worth in the future due to interest. Present value is the opposite – it’s like the discounted price you’d pay today for that future sum, considering inflation and the time value of money.

Simply put:

- Future value: How much your money will grow to.

- Present value: What something in the future is worth today.

Related Article: Generative AI For Data Analytics: What You’re Missing Out

Future value formula

FV = PV x (1 + r)^n

where:

- FV is the future value

- PV is the present value (the amount you’re investing today)

- r is the interest rate (in decimal form)

- n is the number of compounding periods (e.g., years)

Source: Foundations and Applications of the Time Value of Money

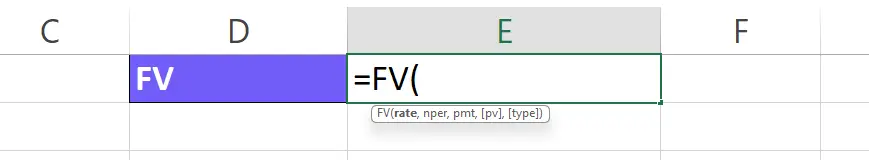

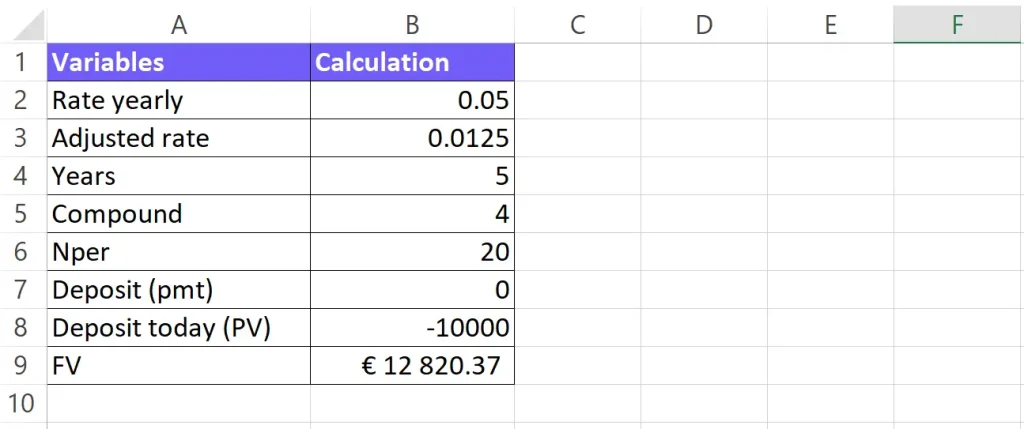

future value formula Excel

In Excel, you can calculate the future value using the built-in FV function. Here’s the formula:

=FV(rate, nper, pmt, [pv], [type])

where:

- rate (required): The interest rate per period.

- nper (required): The total number of payment periods. This depends on how often you compound the interest (e.g., monthly, annually).

- pmt (optional): The amount of the periodic payment made at the end of each period. If you’re not making any payments, leave this blank (0).

- pv (optional): The present value (initial investment). If omitted, it defaults to 0.

- type (optional): A logical value indicating when payments are due. 0 = payments are due at the end of the period (default), 1 = payments are due at the beginning of the period.

What is Rate in the FV formula?

The rate in FV formula represents the interest rate applied per compounding period. It’s crucial to consider the compounding frequency here.

Example: If your annual interest rate is 8% and you compound interest monthly, then the rate would be 8% / 12 (months) = 0.00667 (in decimal form). This is because the interest is added to your investment every month, not just once a year.

Related Article: Free CLV Calculator: Calculate Customer Lifetime Value

What is NPER in FV Formula?

NPER in the FV formula represents the total number of payment periods over which you’re calculating the future value. It depends on how often the interest compounds.

Example: If you’re investing for 5 years with monthly compounding, nper would be 5 years * 12 months/year = 60 periods.

What is PMT in FV Formula?

PMT in the future value calculator formula represents the amount of a periodic payment made at the end of each period. It’s typically used for calculating future values of loans or annuities where you’re making regular deposits/payments.

Example: If you’re contributing $100 every month to your investment, pmt would be 100.

Note: If you’re not making any payments (lump sum investment), leave pmt blank (0).

What is PV in Future value formula?

The PV variable in the fv function represents the present value, which is the initial amount you’re investing today. If you don’t specify this, the function assumes a present value of 0.

What is Type in FV formula?

Type is a logical value (0 or 1) that indicates when payments are due within the period.

- 0 (default): Payments are due at the end of the period (most common scenario).

- 1: Payments are due at the beginning of the period (less common).

Related Article: Free IRR Calculator: Calculate Internal Rate of Return

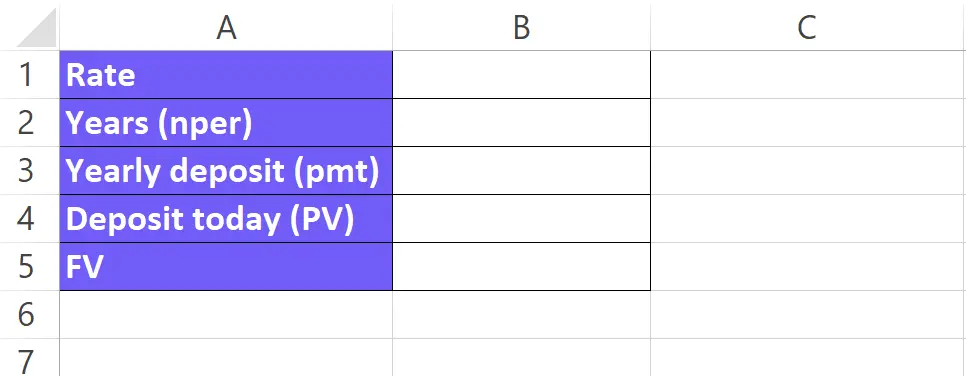

How To Calculate FV in Excel?

Time needed: 5 minutes

Here’s a step-by-step guide on how to calculate future value in Excel using the FV function:

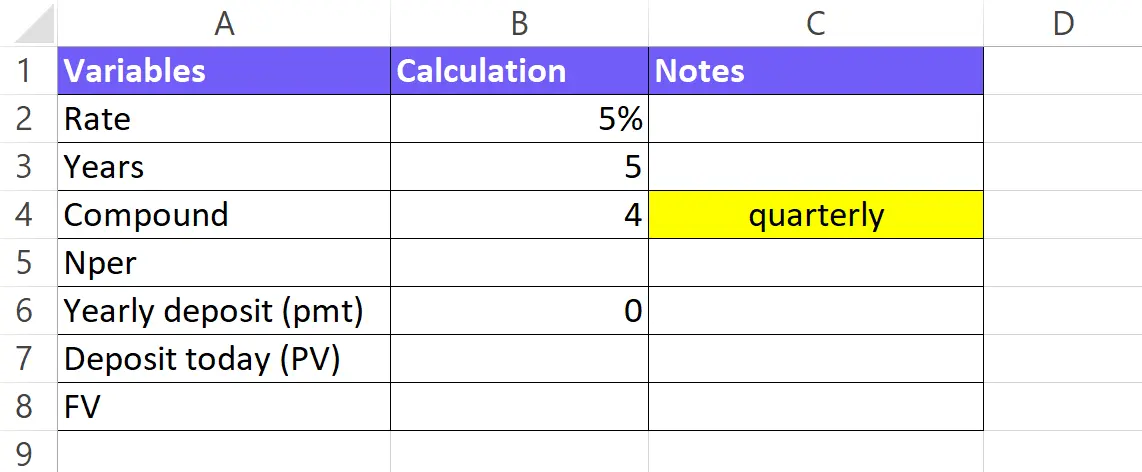

- Set up your data

Enter the data for calculations: Present value (PV): The initial amount you’re investing today. Interest rate (rate): The annual interest rate in decimal or percentage form. Number of years (nper): The total number of years for the investment. Yearly deposit (pmt): if you have any.

- Determine compounding frequency

Decide how often the interest gets compounded (e.g., monthly, quarterly, annually). This will affect the

rateandnpervalues.

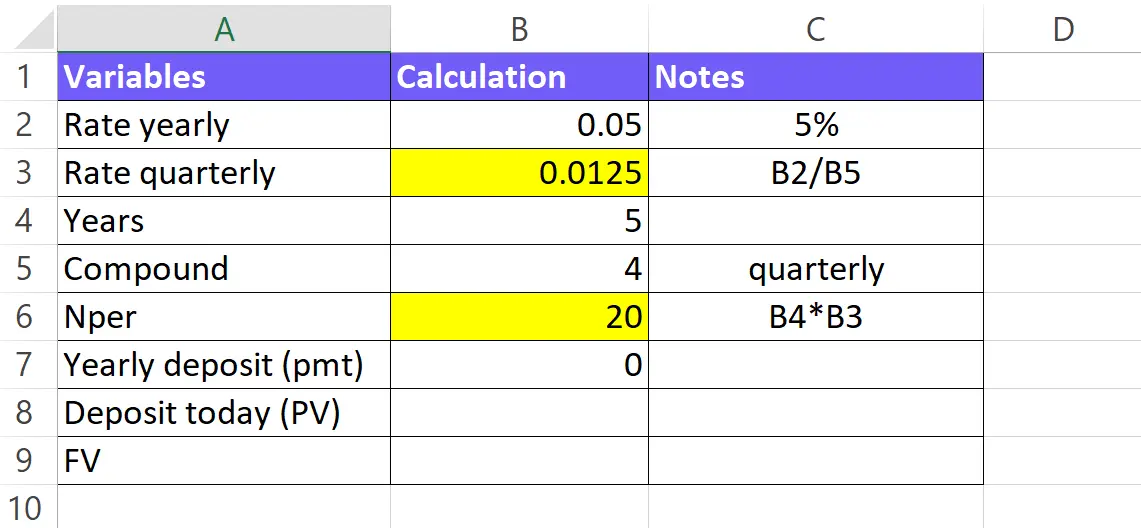

- Adjust for compounding

Rate: Divide the annual interest rate by the number of compounding periods per year.

Example: If your annual interest rate is 5% and you compound quarterly, thenratewould be 5% / 4 (quarters) = 0.0125 (in decimal form). In our example, we compound quarterly.

Nper: Multiply the number of years by the number of compounding periods per year.

Example: If you’re investing for 5 years with quarterly compounding,nperwould be 5 years * 4 quarters/year = 10 periods.

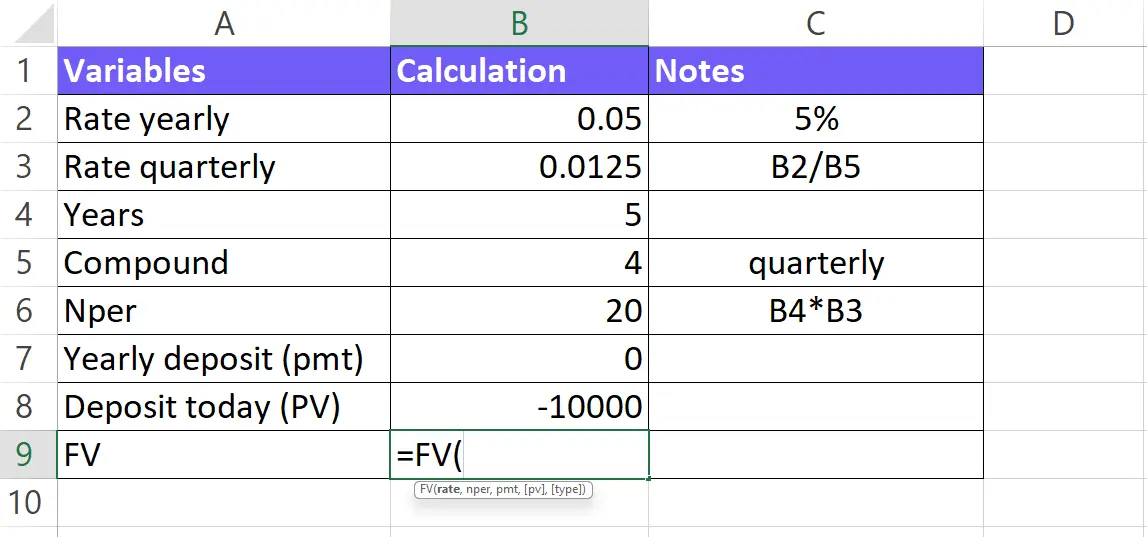

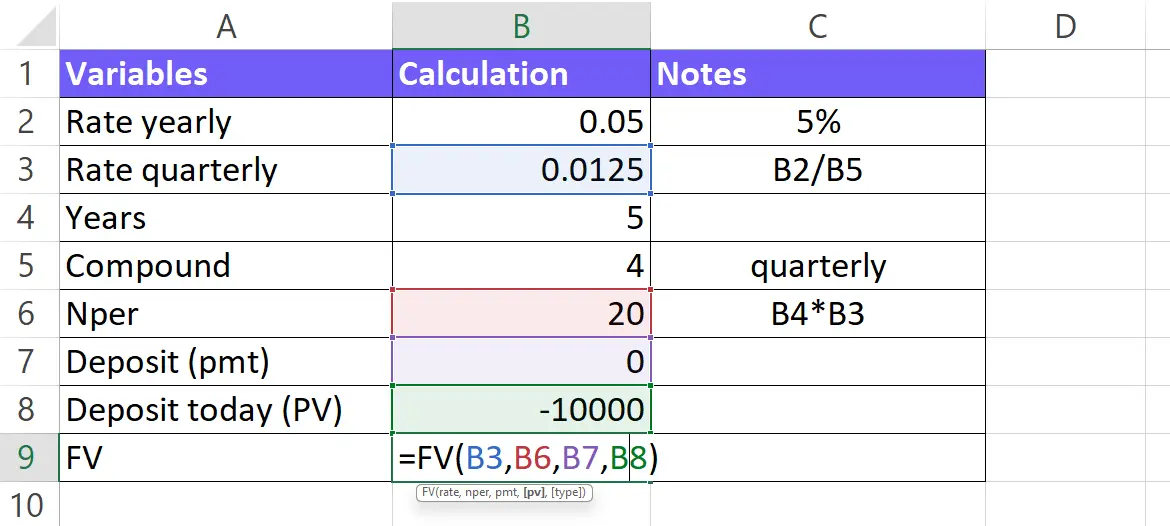

- Enter the FV formula

In a blank cell where you want the future value to be displayed, type the following formula:

=FV(rate, nper, pmt, [pv], [type])

- Fill in the arguments

rate: The adjusted interest rate per compounding period (from step 3).

nper: The total number of compounding periods (from step 3).

pmt: Leave blank (0) if it’s a lump sum investment. Otherwise, enter the periodic payment amount (optional).

pv: The present value (initial investment amount).

type: Leave blank (0) for payments due at the end (common scenario). Use 1 for payments at the beginning (less common).

- Press Enter

Excel will calculate the metric based on the provided information.

Related Article: NPV Calculator Online: Calculate Net Present Value

Download the Future Value Excel Template

Get your FV Excel calculator, change the values, and calculate your future value.

How To Generate Formulas With AI?

Artificial intelligence (AI) is transforming spreadsheet use by enabling the generation of Excel formulas based on user descriptions. This guide provides a step-by-step process to leverage this functionality and enhance your spreadsheet efficiency.

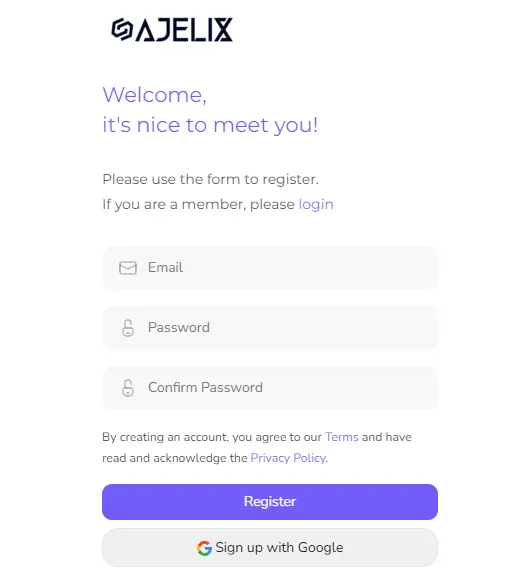

1. Create a free Ajelix account

Ajelix empowers spreadsheet users with over 15 AI-powered tools, including a robust Excel formula generator. Streamline your workflow and unlock new efficiencies by signing up with your Gmail account or any preferred email address.

Screenshot from Ajelix registration page, image by author

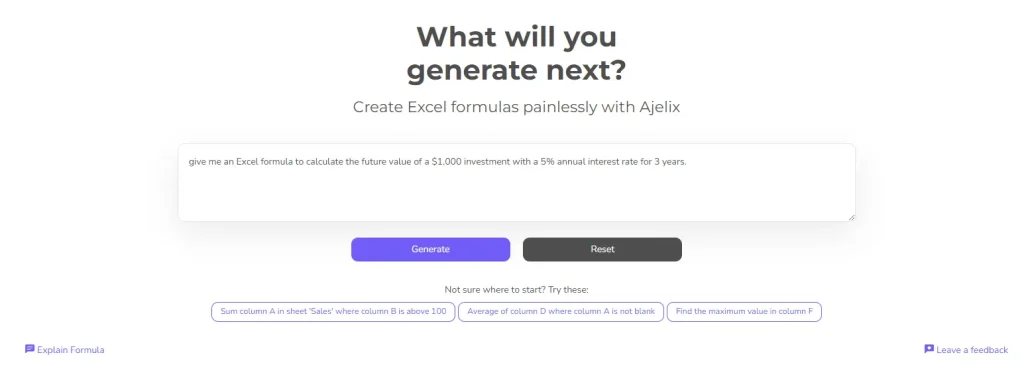

2. Write a clear and concise prompt

To get the most accurate result, you’ll need to provide details about your situation. Here’s an example: “Give me a Excel formula to calculate the future value of a $1,000 investment with a 5% annual interest rate for 3 years.”

With this clear description, you can ensure the FV formula considers the initial investment (present value), interest rate, and number of years to calculate the accurately.

Screenshot from Ajelix formula generator with FV prompt, image by author

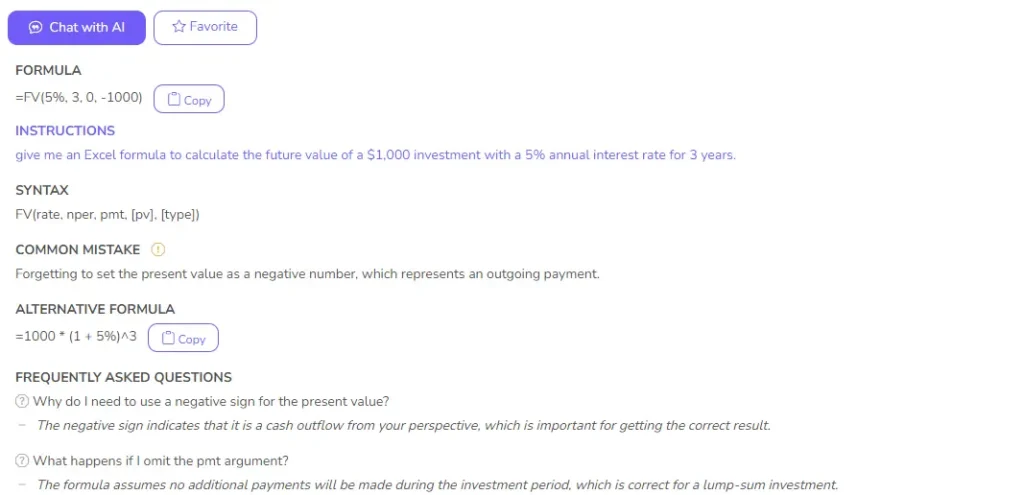

3. Get your formula

Simply describe your desired outcome, and the AI will generate a ready-to-use formula for your spreadsheet. This eliminates the need for manual formula construction.

For even greater convenience, consider using the available Google Sheets or Excel add-on. This add-on streamlines the process by integrating the AI functionality directly into your spreadsheet.

Screenshot from Ajelix with FV formula result, image by author

Ready to give it a go?

Test AI tools with freemium plan and only upgrade if formula generator can help you!

What’s a good future value?

Determining a “good” future value depends on your individual circumstances and financial goals. This table outlines key factors to consider when evaluating your results:

| Factor | Description |

|---|---|

| Goal | What are you saving for (retirement, house, education, etc.)? |

| Timeframe | How long do you have to invest? |

| Risk Tolerance | How comfortable are you with potential losses? |

| Current Financial Situation | Consider your income, expenses, and existing debts. |

| Economic Conditions | Economic factors can impact investment returns. |

By considering these factors alongside your future value calculations, you can gain a clearer picture of whether your investment strategy is on track to meet your financial objectives. Remember, consulting with a financial advisor can provide personalized guidance for achieving your specific goals.

Why Businesses Should Calculate Future Value?

Future value, the concept of a sum of money’s worth at a future date, is a crucial financial tool for businesses. By incorporating factors like interest and inflation, it allows for informed decision-making. Here’s a breakdown of key reasons why businesses should calculate this metric:

| Reason | Description |

|---|---|

| Informed Investment Decisions | Compare the metric of different investments to prioritize those with the highest potential for growth and profitability. |

| Strategic Planning | Project future financial needs to budget for expenses, plan for equipment or expansion, and ensure sufficient cash flow. |

| Debt Management | Calculate the total cost of loans or credit lines by considering the future value of payments with interest, ensuring resources to meet obligations. |

| Budgeting for Long-Term Goals | Understand the FV needed for long-term goals like retirement plans or capital reserves, allowing for effective resource allocation. |

| Inflation Considerations | Factor in inflation to understand the impact of rising prices on future costs and revenue, allowing for adjustments to maintain purchasing power. |

Understanding this calculation empowers businesses to navigate financial decisions with greater clarity. By incorporating this concept into their planning process, businesses can position themselves for long-term success and achieve their financial objectives.

FAQ

Future value is most beneficial when evaluating the long-term growth of investments, planning for future financial needs (retirement, equipment), and understanding the total cost of debt (loans with interest).

Use the annualized interest rate matching your compounding frequency (e.g., annual for yearly compounding, monthly for monthly compounding).

It assumes a steady growth rate, which investments often deviate from. Additionally, the accuracy of your results relies on predicting future interest rates and economic conditions, which can be uncertain. Lastly, the formula doesn’t factor in the impact of taxes that can eat into your final returns.

Inflation reduces future value. As prices rise, the same dollar amount buys less in the future. You’d need to consider inflation to get a more realistic picture of your future purchasing power.

Other calculators

Setup and monitor your KPIs regularly using Ajelix BI