- Home

- Product

- Tools

- AI Data Analyst

- Excel Formula Generator

- Excel Formula Explainer

- Google Apps Script Generator

- Excel VBA Script Explainer

- AI VBA Code Generator

- Excel VBA Code Optimizer

- Excel VBA Code Debugger

- Google Sheets Formula Generator

- Google Apps Script Explainer

- Google Sheets Formula Explainer

- Google Apps Script Optimizer

- Google Apps Script Debugger

- AI Excel Spreadsheet Generator

- AI Excel Assistant

- AI Graph Generator

- Pricing

- Home

- Blog

- Dashboards

- Budget vs Actual Dashboard Example: Variance Analysis

-

Written by:

Budget vs Actual Dashboard Example: Variance Analysis

-

Last update:December 1, 2025

Discover other dashboards

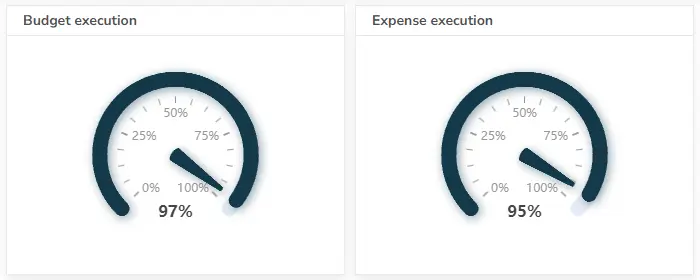

- Restaurant Dashboard Examples & Templates

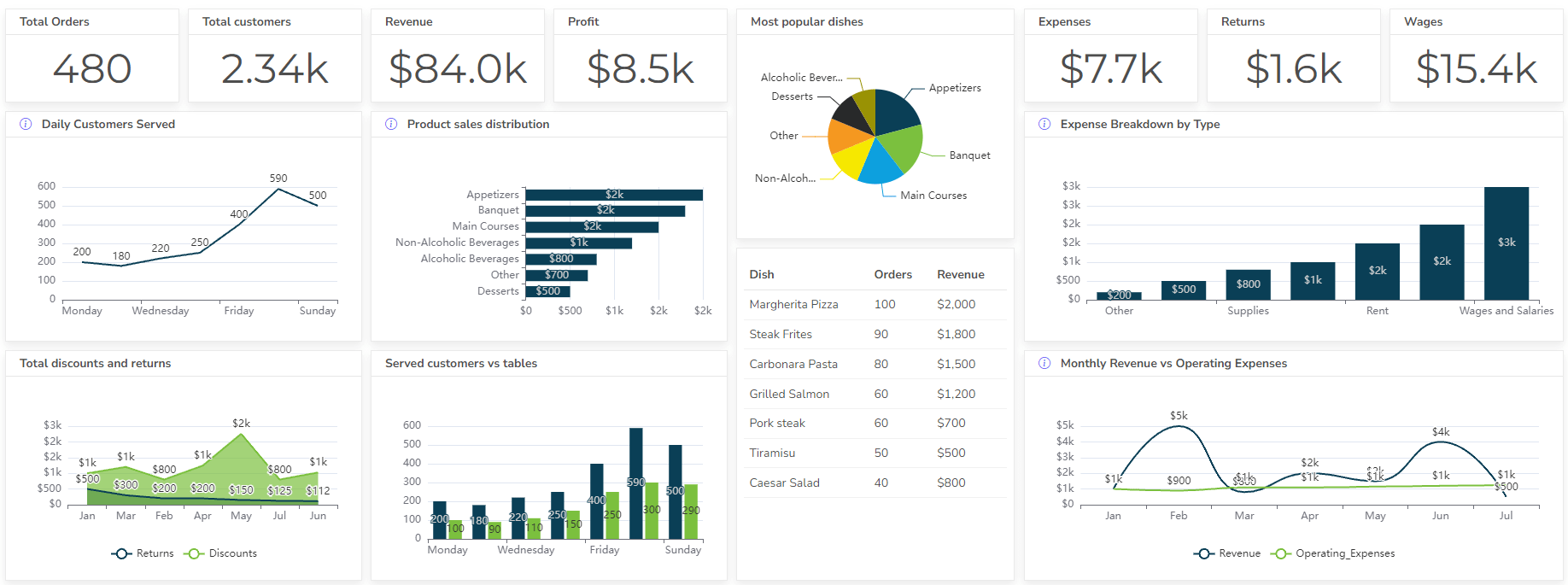

- Manufacturing Dashboard Examples & KPIs

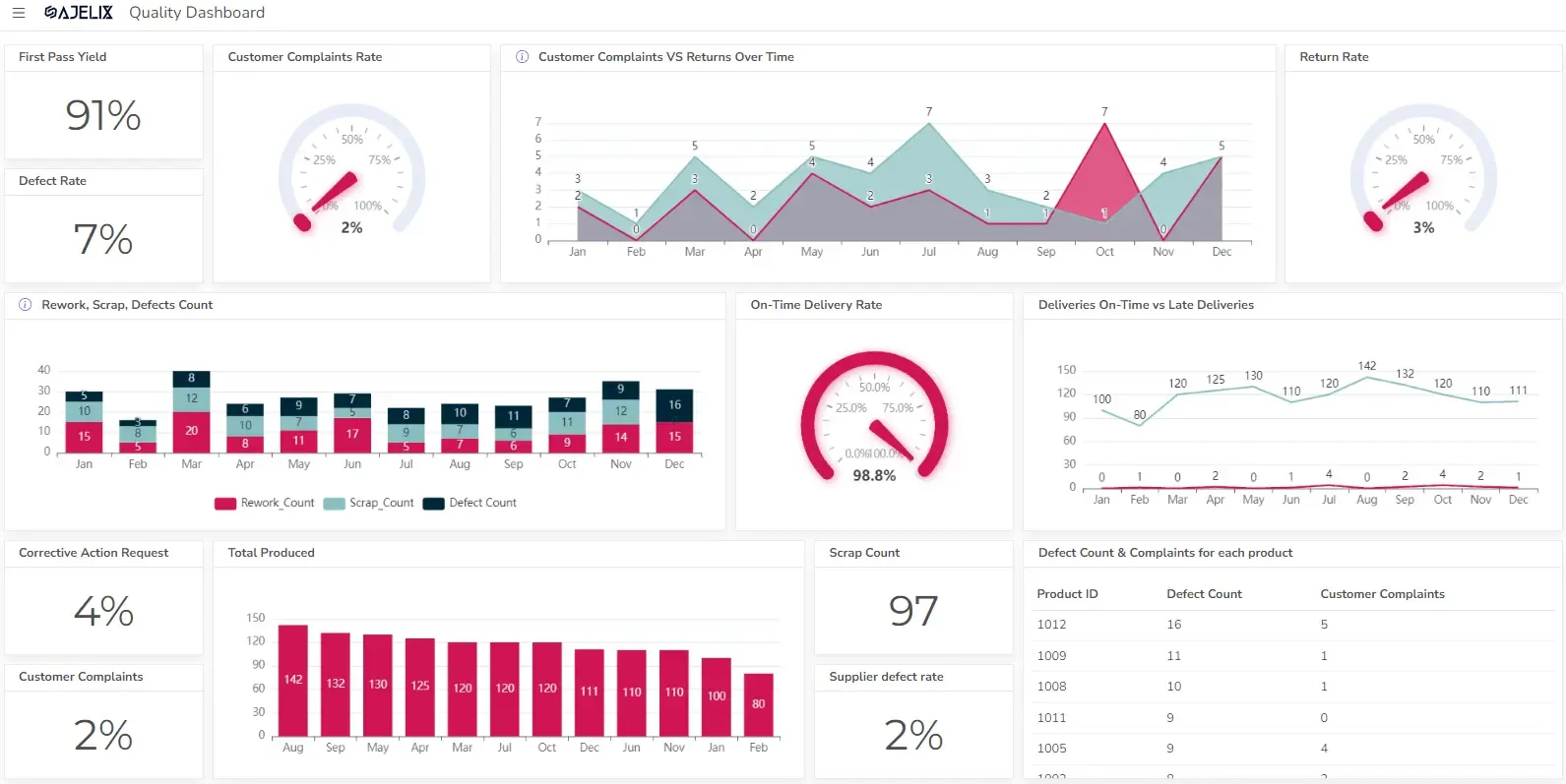

- Quality Dashboard Examples For Quality Control

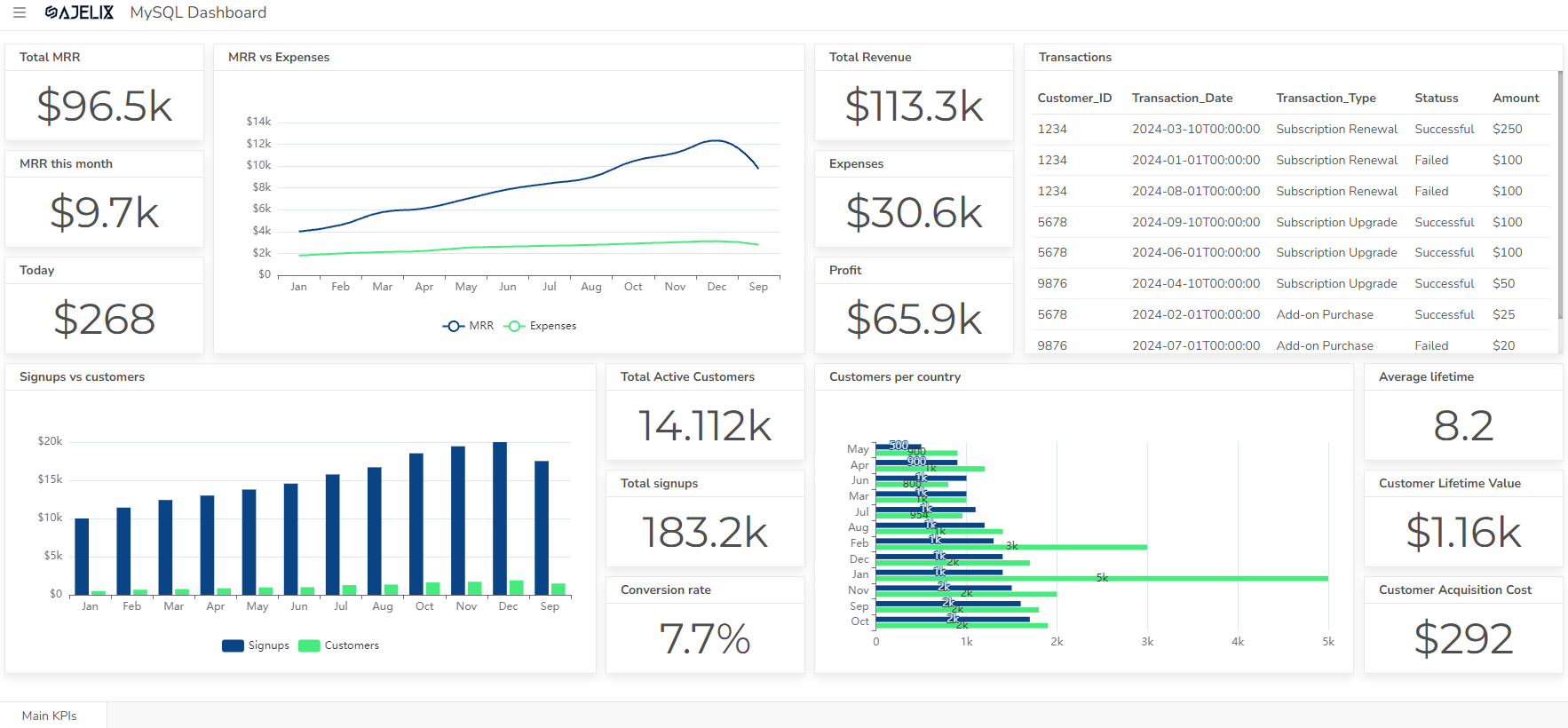

- SaaS Dashboard Examples & KPIs

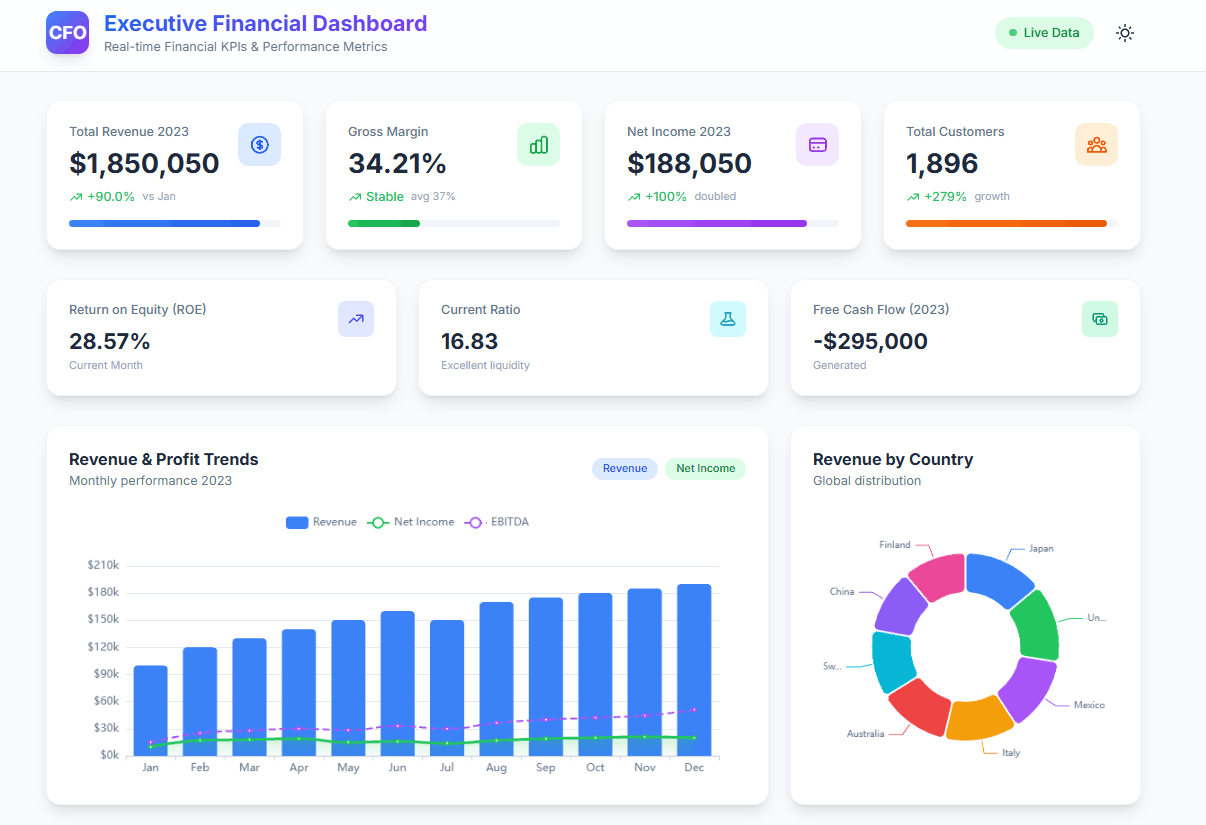

- CFO Dashboard Example & KPIs (Created With Agentic AI)

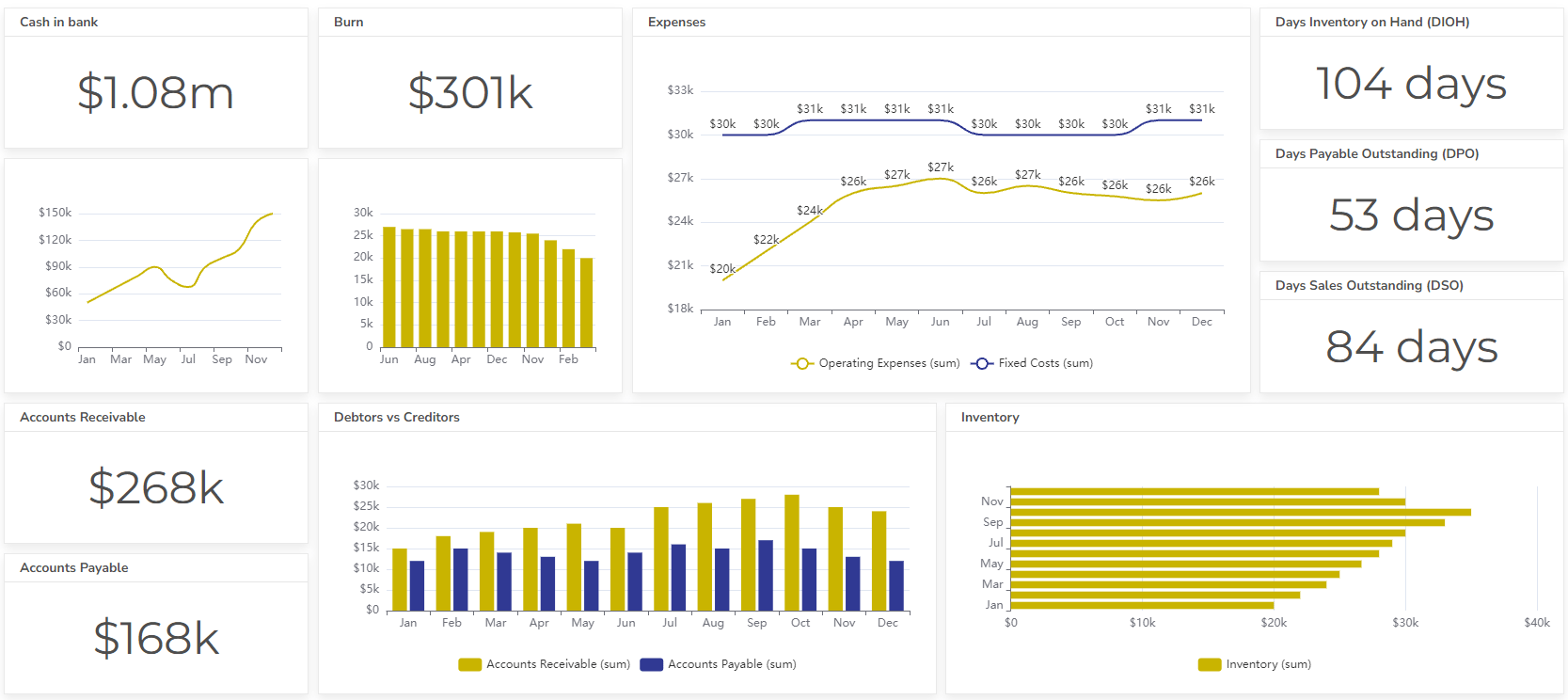

- Cash Flow Dashboard Example For Mastering Your Finances

- Budget vs Actual Dashboard Example: Variance Analysis

- Online Profit And Loss Dashboard Example: P&L Template

- IT Dashboard Examples For IT Department Managers

- SQL Dashboard Examples: Create A Real-Time Dashboard

Visualize Data Fast & Easy

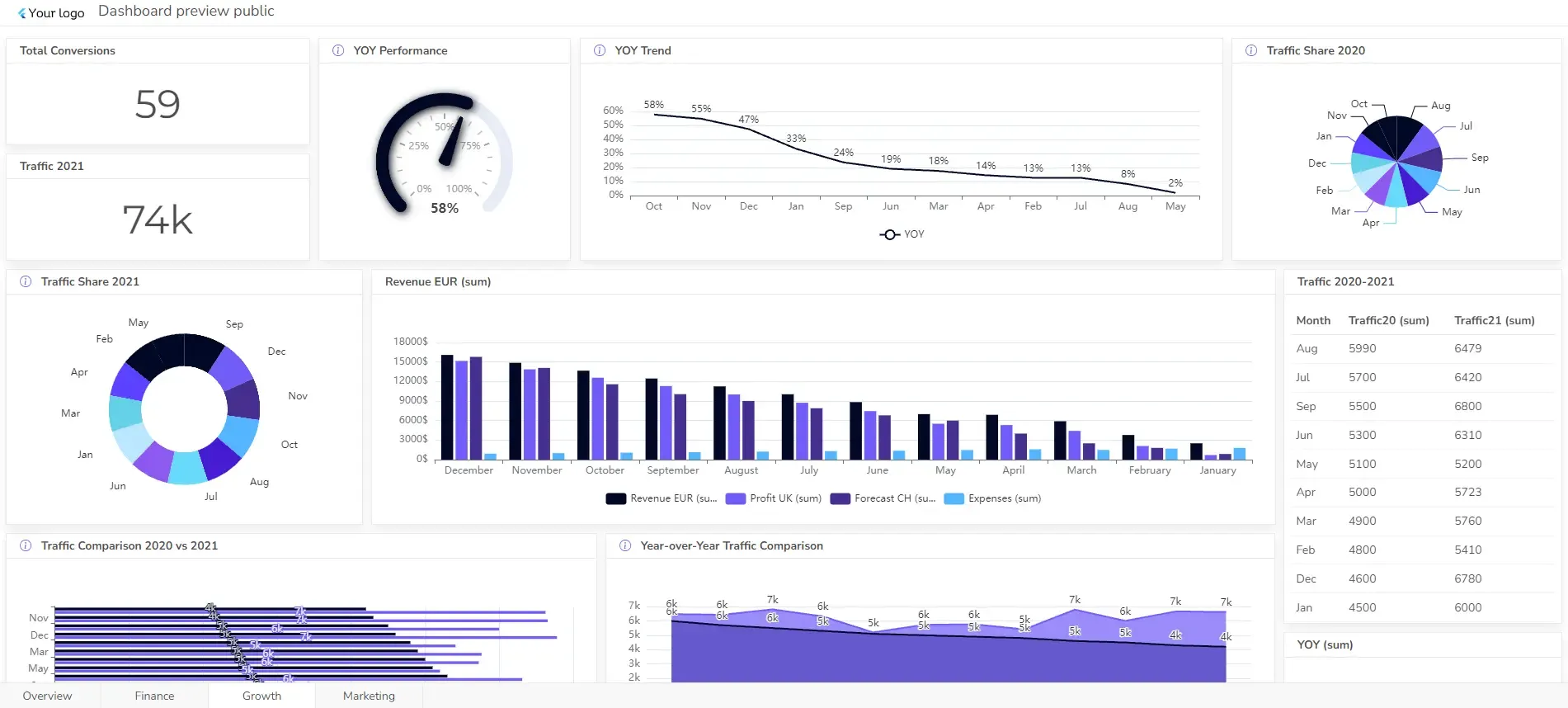

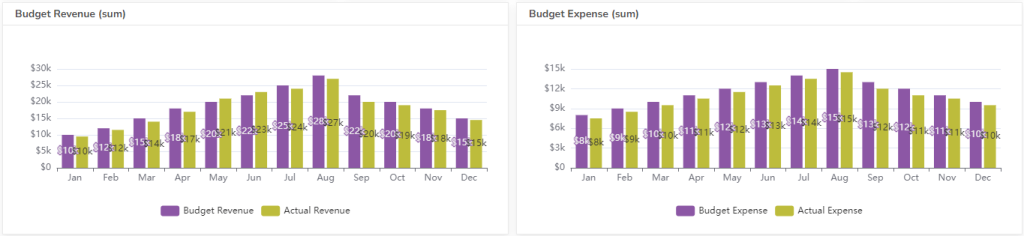

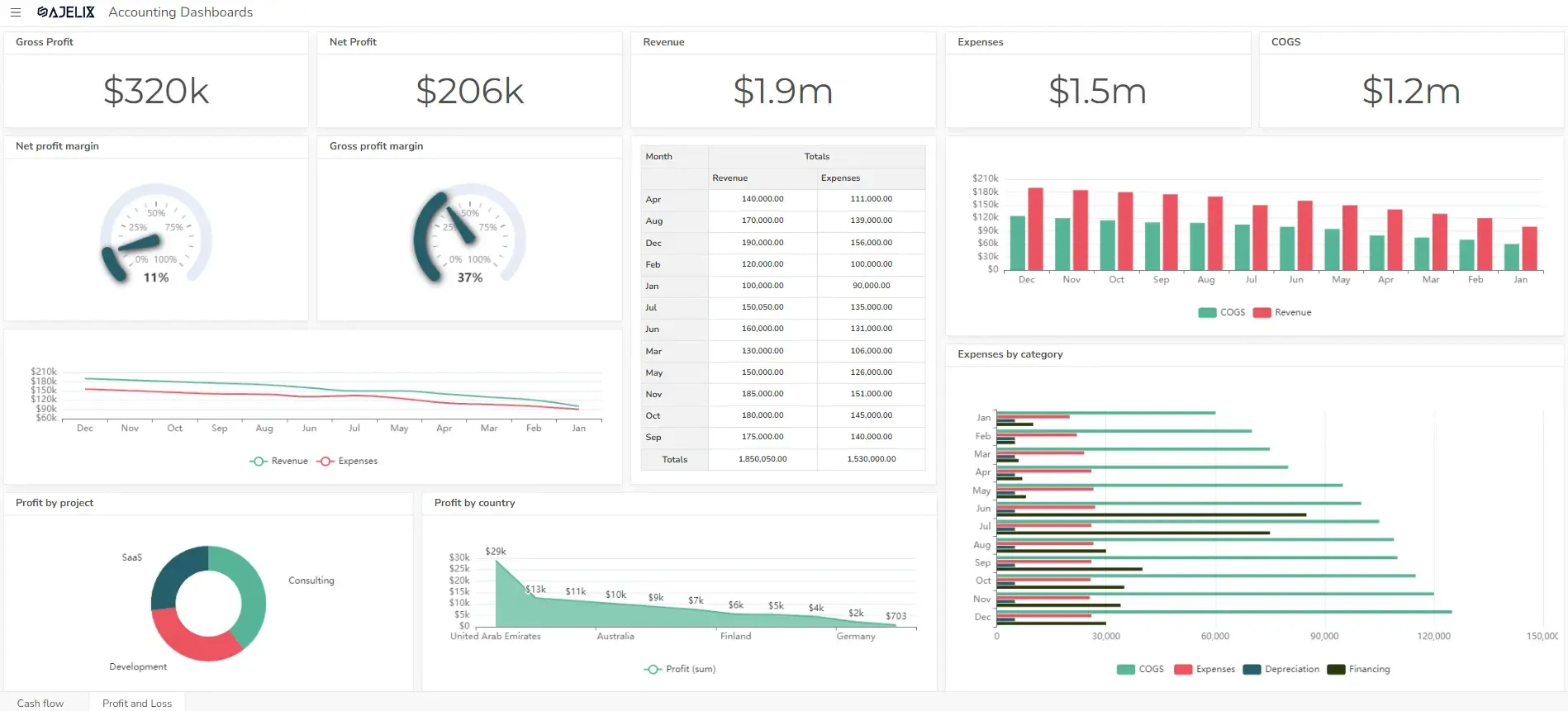

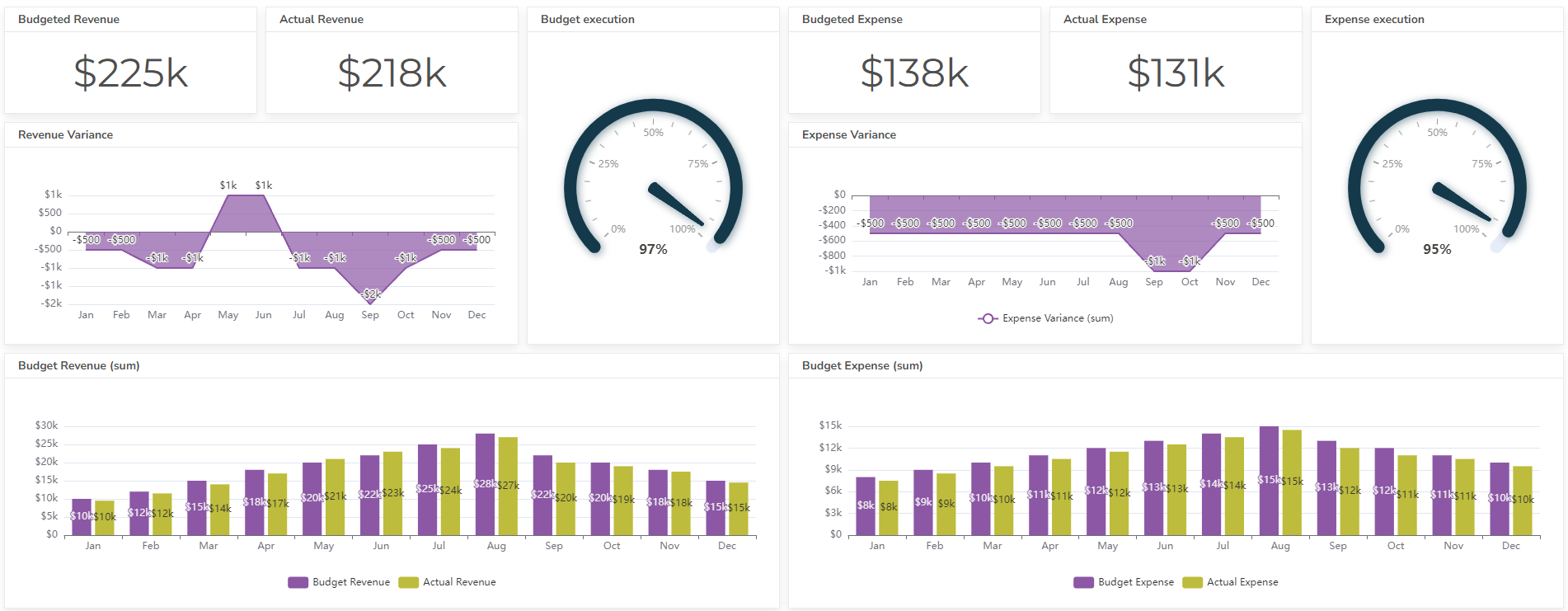

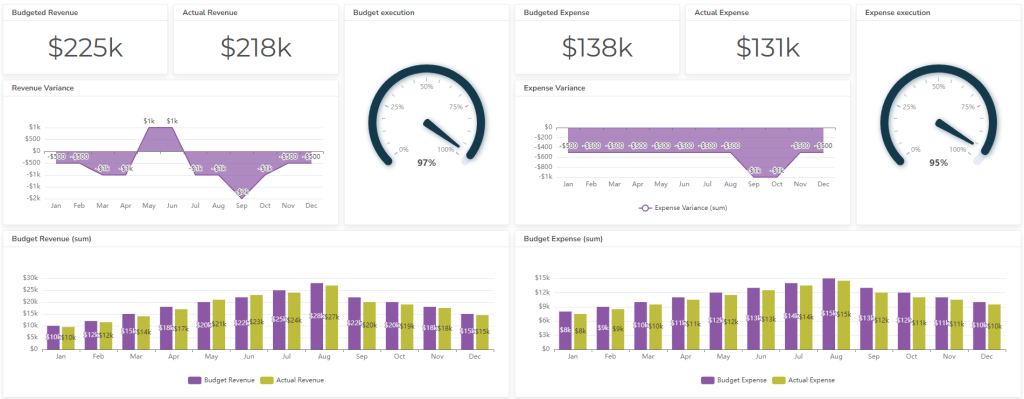

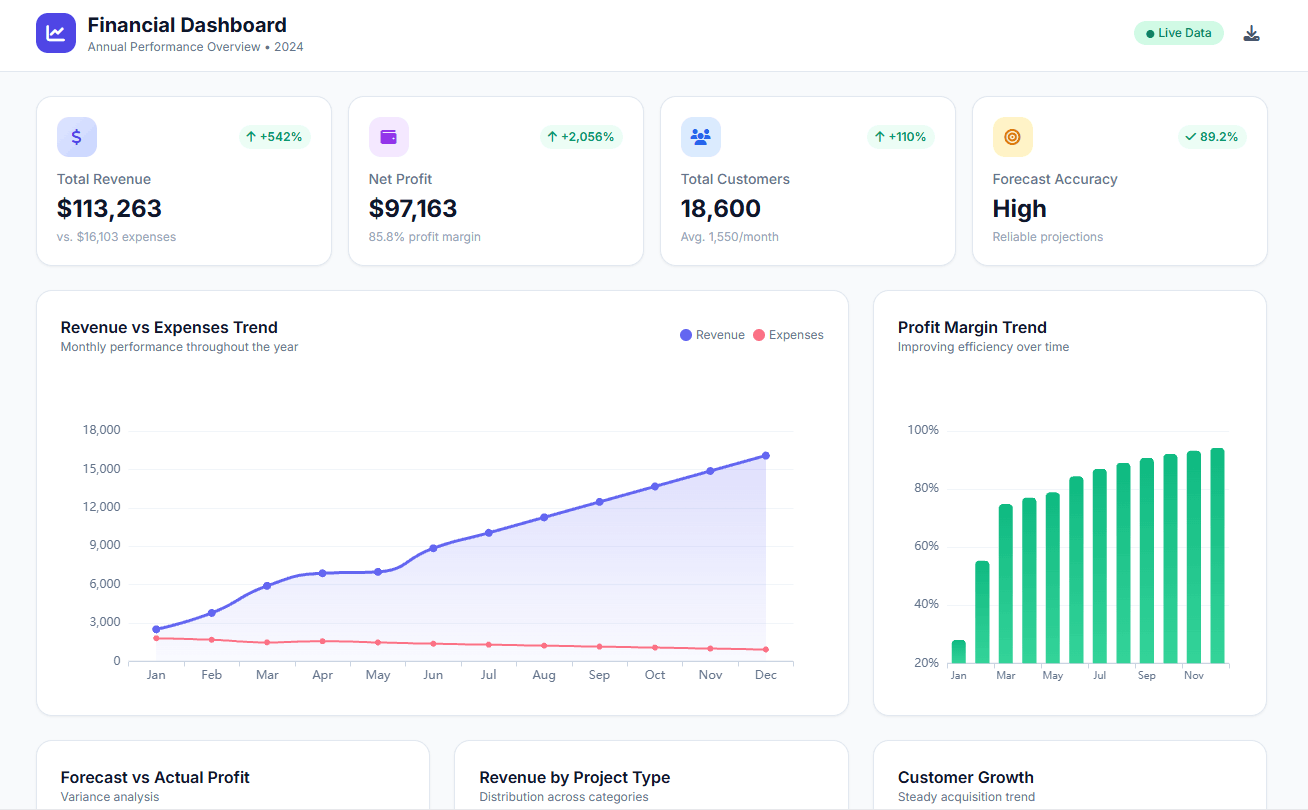

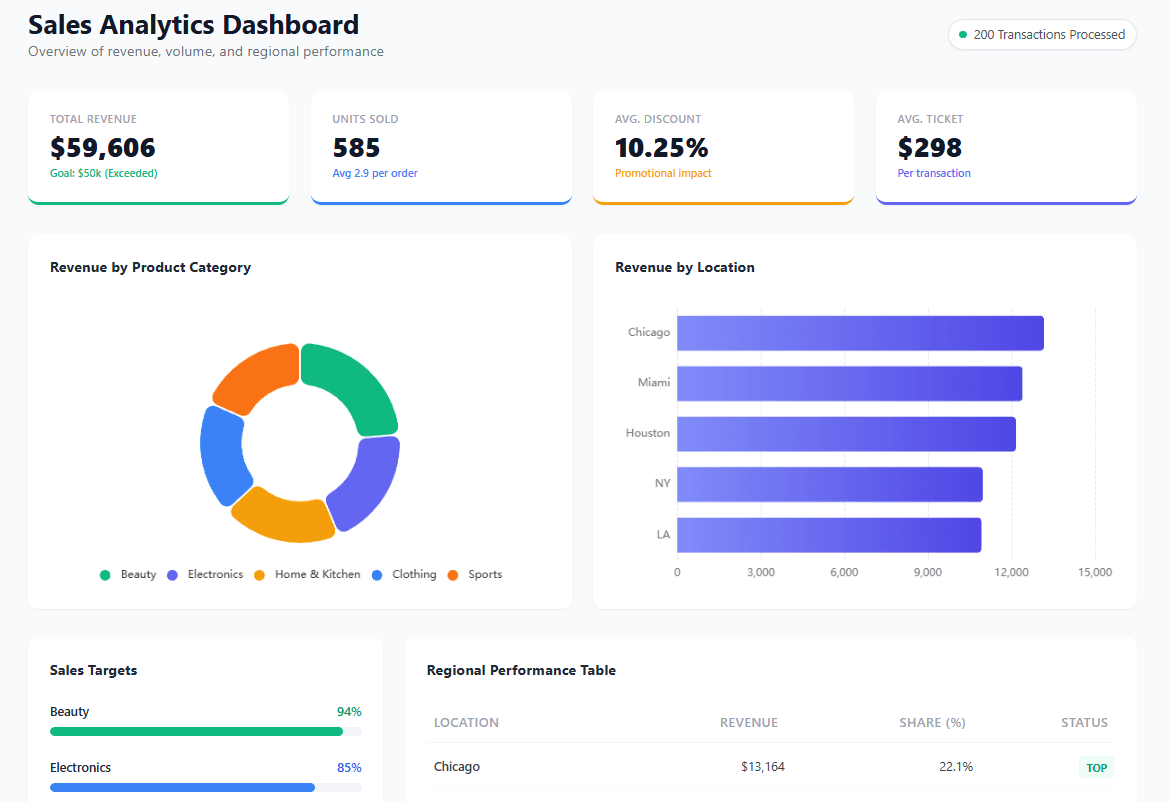

A robust budgeting and reporting system is essential to track and analyze financial health. One crucial tool that can help you do that is the budget vs actual dashboard. By visually comparing budgeted figures against actual results, businesses can quickly identify variances, make adjustments, and plan accordingly.

This article will explore key components of a budget vs actual dashboard, explore essential KPIs, and provide practical guidance on building a dashboard that delivers actionable insights.

Change the way you work with agentic AI

One-click dashboards,KPI tracking, and AI-powered insights—for work that actually gets done.

What is budget vs actual dashboard?

A budget vs actual dashboard is a visual tool that compares a company’s budgeted financial performance with its actual results. It provides a clear and concise overview of how well the company is performing against its financial goals.

By visualizing the differences between budget and actual figures, businesses can:

- Identify variances: Pinpoint areas where spending is exceeding or falling short of expectations.

- Analyze trends: Spot patterns and understand the reasons behind variances.

- Make informed decisions: Use the insights to make adjustments to budgets, operations, or strategies.

These dashboards typically include key metrics like revenue, expenses, profit, and cash flow, presented in charts, graphs, or tables for easy interpretation.

Key Metrics for a Budget vs Actual Dashboard

A comprehensive budget vs actual dashboard should include business financial performance metrics. Here are some essential metrics to consider:

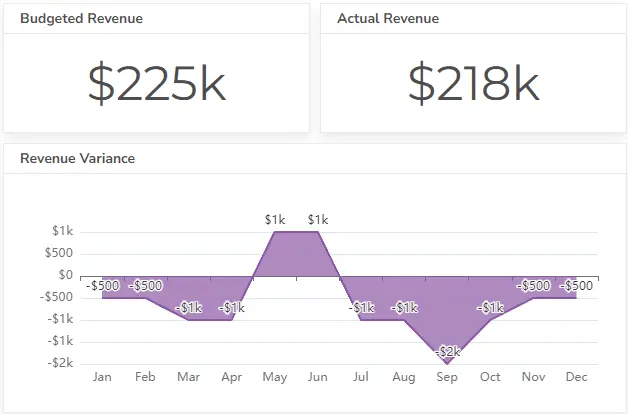

Revenue Metrics

- Total Revenue: Compare budgeted and actual revenue to assess overall sales performance.

- Revenue by Product/Service: Analyze revenue performance for specific offerings.

- Revenue by Region: Evaluate sales performance across different geographic areas.

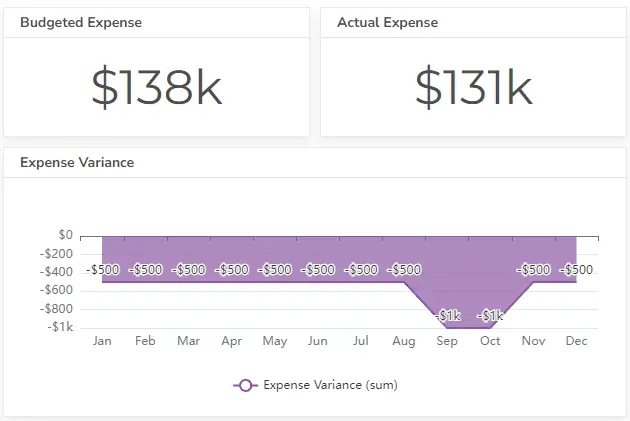

Expense Metrics

- Total Expenses: Compare budgeted and actual expenses to identify cost overruns or underruns.

- Expenses by Category: Analyze spending in various categories (e.g., labor, materials, overhead).

- Expense Variances: Highlight significant differences between budgeted and actual expenses.

Struggling with manual calculations & tiring setups?

Let agentic AI do the heavy lifting.

Start free

Fast sign up & easy setup

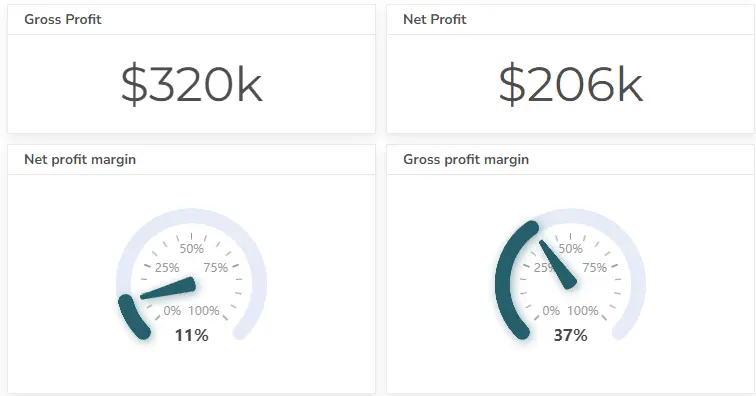

Profitability Metrics

- Gross Profit: Calculate the difference between revenue and cost of goods sold. You can also use a gross profit calculator.

- Operating Profit: Determine profit before interest and taxes.

- Net Profit: Calculate the company’s overall profitability. Or use an online net profit calculator.

Cash Flow Metrics

- Cash Flow from Operations: Assess cash generated or used by core business activities.

- Cash Flow from Investing: Analyze cash flows related to investments.

- Cash Flow from Financing: Evaluate cash flows from borrowing or repaying debt.

Key Performance Indicators (KPIs)

- Budget execution: Percentage indicating how big part of the budget was completed

- Budgeted vs actual: Correlation charts visualizing

- Profit Margin: Measure profitability relative to revenue.

- Expense Ratio: Assess the efficiency of expense management.

- Return on Investment (ROI): Evaluate the effectiveness of investments.

- Days Sales Outstanding (DSO): Measure the average time it takes to collect receivables.

- Inventory Turnover: Assess the efficiency of inventory management.

How To Create Budgeted vs Actual Dashboard?

Time needed: 5 hours

Create a profit and loss dashboard in minutes using a business intelligence tool. This guide will walk you through 6 steps to create a digital dashboard using Ajelix BI.

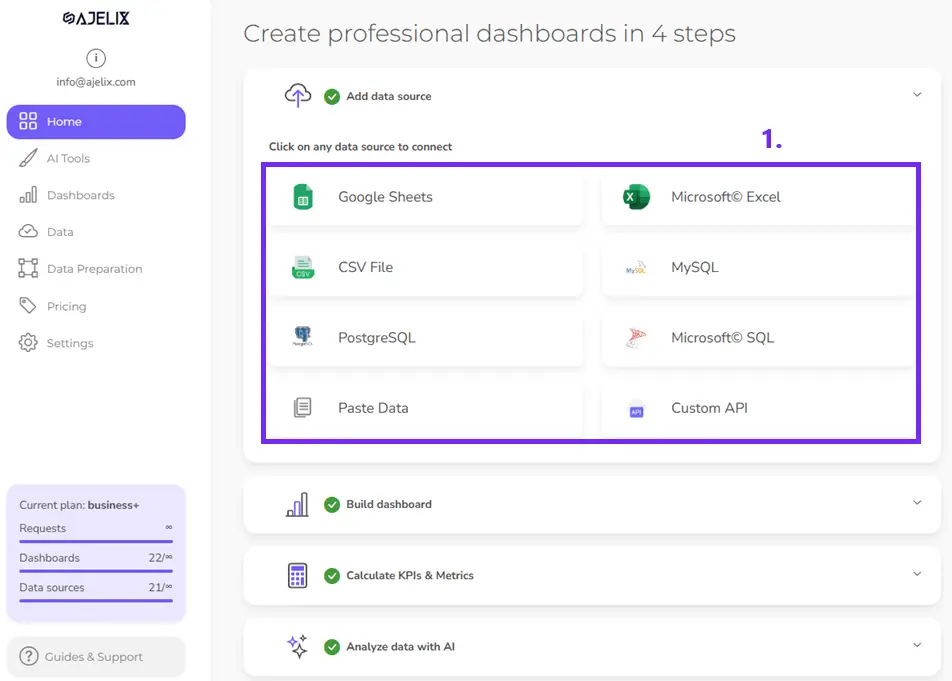

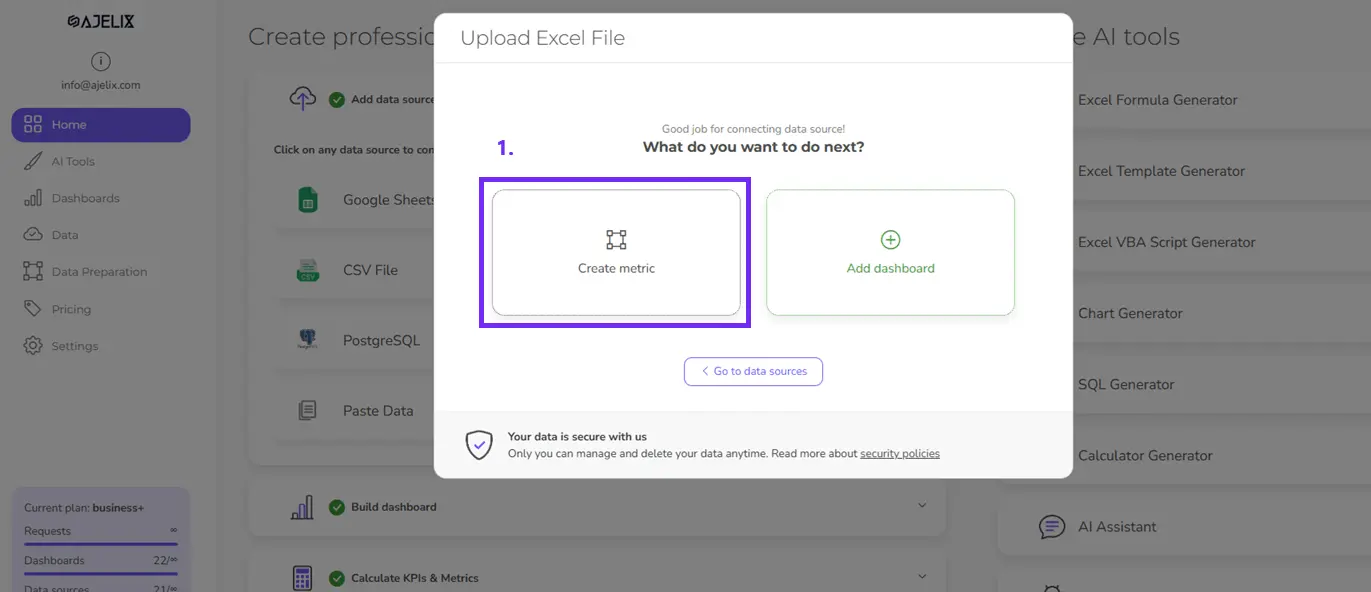

- Connect your data

Ajelix BI offers flexible data connectivity options. You can easily upload Excel or CSV files, connect to Google Sheets, or establish a connection with an SQL server. For advanced users, Ajelix BI also supports custom API integrations. This allows you to connect directly to data sources like accounting software, providing a seamless and efficient data flow.

- Clean and transform your data (optional)

Ajelix BI provides robust data cleaning and transformation capabilities. You can easily convert data formats, filter out unnecessary information, and ensure data consistency. While not strictly required, data cleaning is highly recommended for accurate and reliable analytics, especially when calculating KPIs.

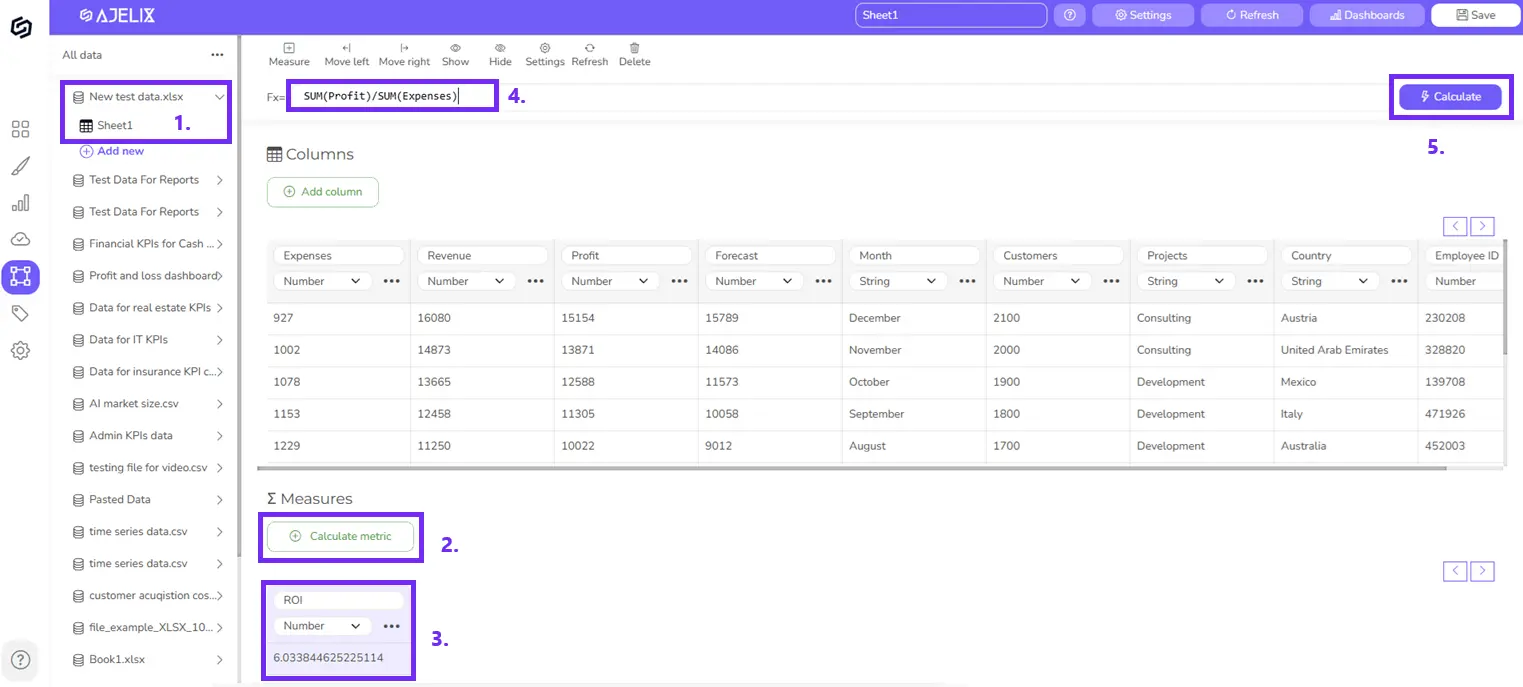

- Create calculated fields (optional)

Leverage a data preparation tool to calculate essential KPIs like gross profit. Once calculated, you can visually represent these metrics in a comprehensive profit and loss dashboard.

Follow these steps to create a KPI using data modeling:

1. Select your data source.

2, Choose the ‘Calculate metric’ option.

3. Name your KPI.

4. Insert the appropriate Excel-like or SQL function.

5. Click ‘Calculate’ to get the KPI.

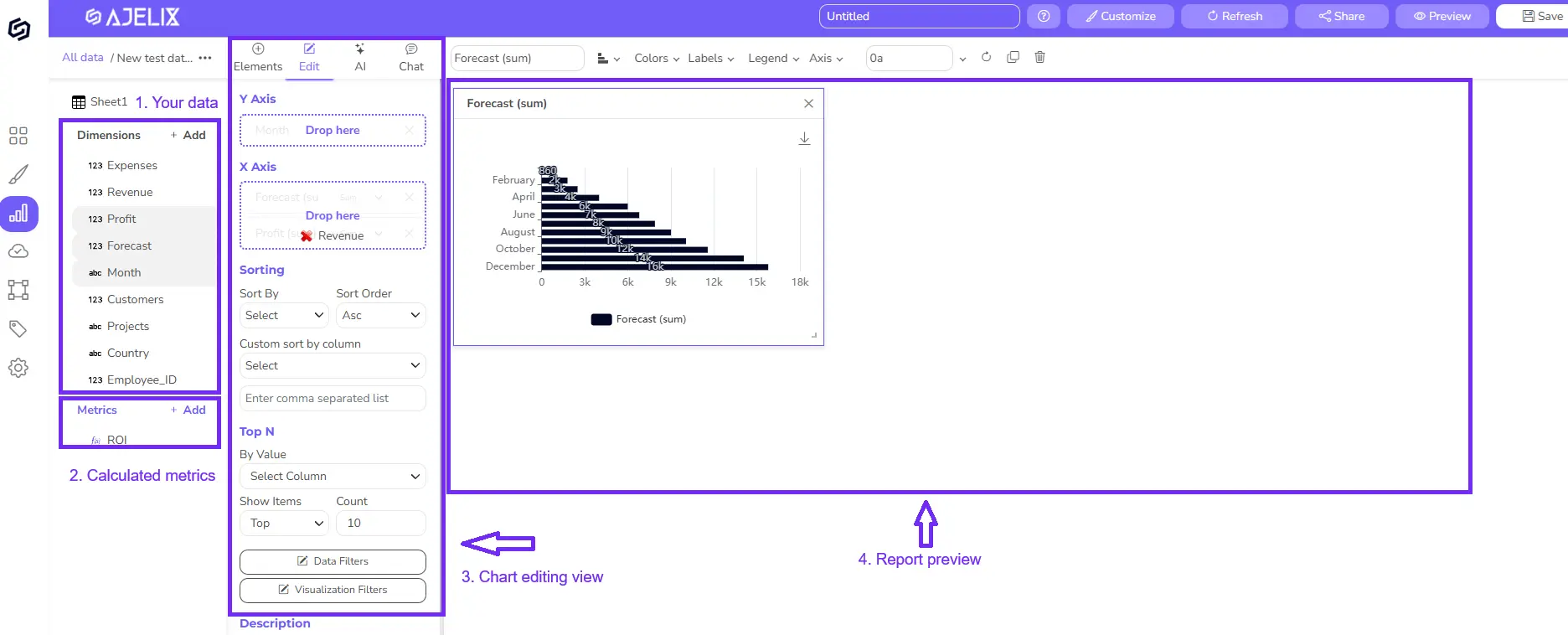

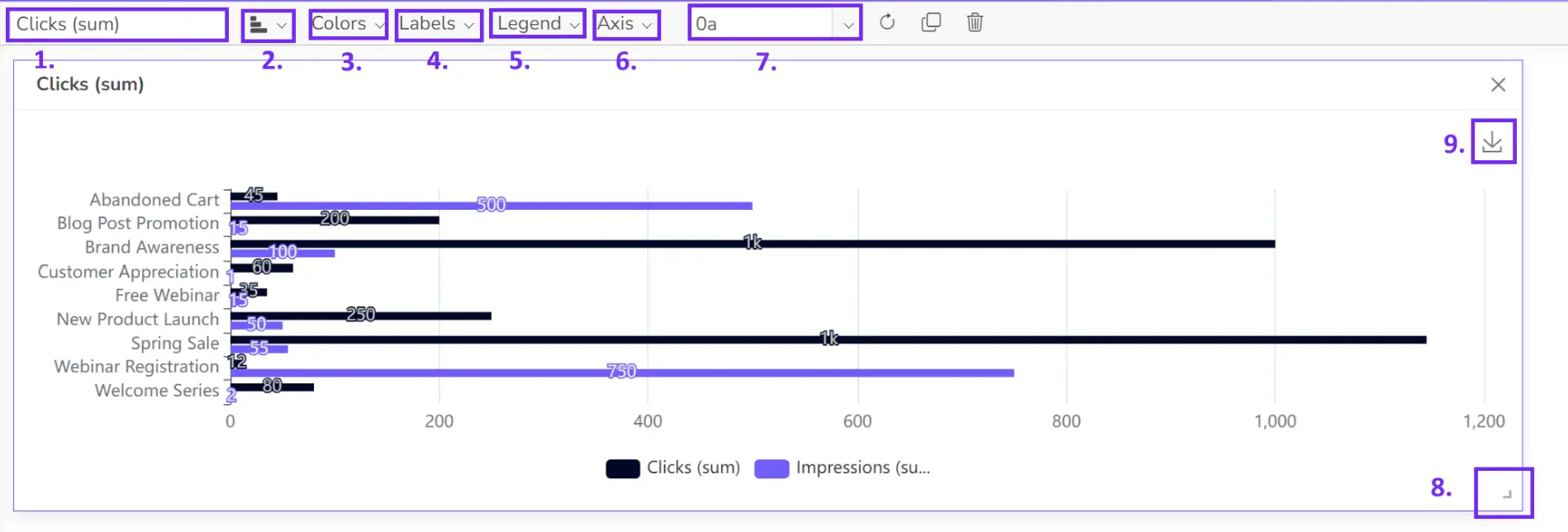

- Build your visualizations

Select the most suitable visual format for each KPI, such as a card, gauge chart, or line graph. Simply drag and drop your data fields into the visualization tool. Ajelix BI also features an AI-powered dashboard generator that automatically creates charts based on your data. If you require assistance with customization, our comprehensive documentation is available.

- Customize your dashboard

Add titles, and descriptions, and format the layout for clarity and visual appeal.

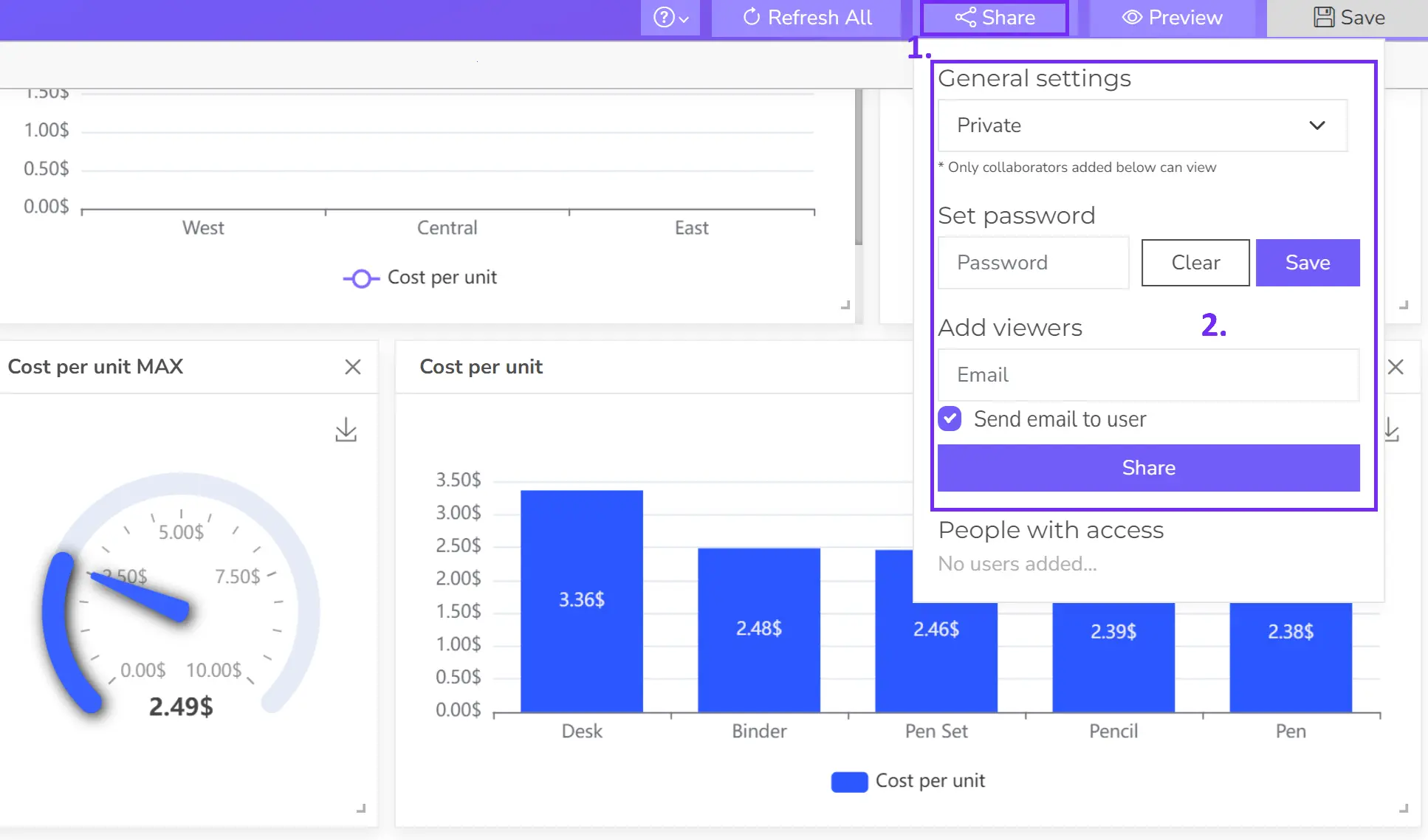

- Share your dashboard

Once happy, publish your dashboard and share it with relevant users for real-time insights.

Reporting gives you a headache?

Upload your data and create professional reports with agentic AI

Start free

Try free and upgrade whenever

Conclusion

A well-constructed budget vs actual dashboard is an invaluable tool for businesses seeking to understand their financial performance, identify areas for improvement, and make data-driven decisions.

FAQ

Variance analysis is the process of comparing budgeted amounts to actual results and investigating the differences (variances). It helps understand why performance deviated from the plan and allows for corrective action.

It depends on the context. For revenue, a positive variance is favorable (actual revenue exceeded the budget). For expenses, a positive variance is unfavorable (actual expenses exceeded the budget).

Again, it depends on the context. For revenue, a negative variance is unfavorable (actual revenue was below budget). For expenses, a negative variance is favorable (actual expenses were below budget).

The frequency depends on the business needs. Generally, reviewing it monthly is a good practice. Some businesses may need weekly or even daily reviews, especially during critical periods.

First, investigate the root cause. Gather data, talk to relevant team members, and analyze the situation. Then, develop a plan of action to address the issue, which might involve adjusting budgets, changing strategies, or implementing corrective measures.

Explore other dashboards

Ready to create your dashboard?