- Home

- Product

- Tools

- AI Data Analyst

- Excel Formula Generator

- Excel Formula Explainer

- Google Apps Script Generator

- Excel VBA Script Explainer

- AI VBA Code Generator

- Excel VBA Code Optimizer

- Excel VBA Code Debugger

- Google Sheets Formula Generator

- Google Apps Script Explainer

- Google Sheets Formula Explainer

- Google Apps Script Optimizer

- Google Apps Script Debugger

- AI Excel Spreadsheet Generator

- AI Excel Assistant

- AI Graph Generator

- Pricing

- Home

- Blog

- Calculators

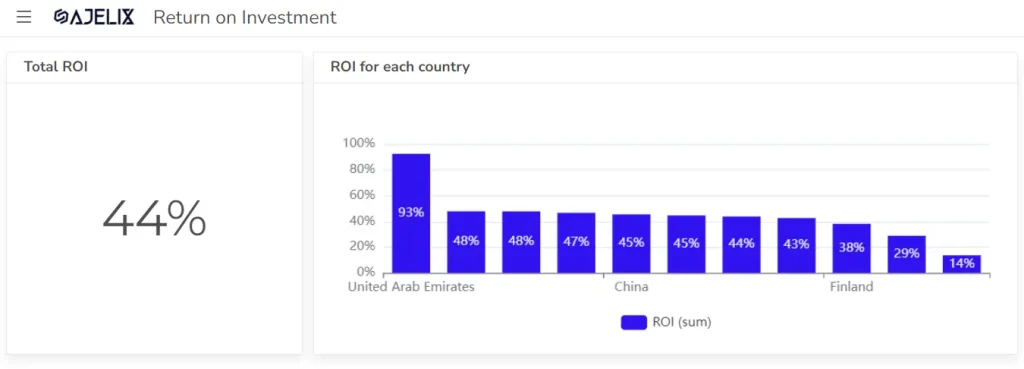

- Free ROI Calculator Online: Calculate Return On Investment

Free ROI Calculator Online: Calculate Return On Investment

Explore other articles

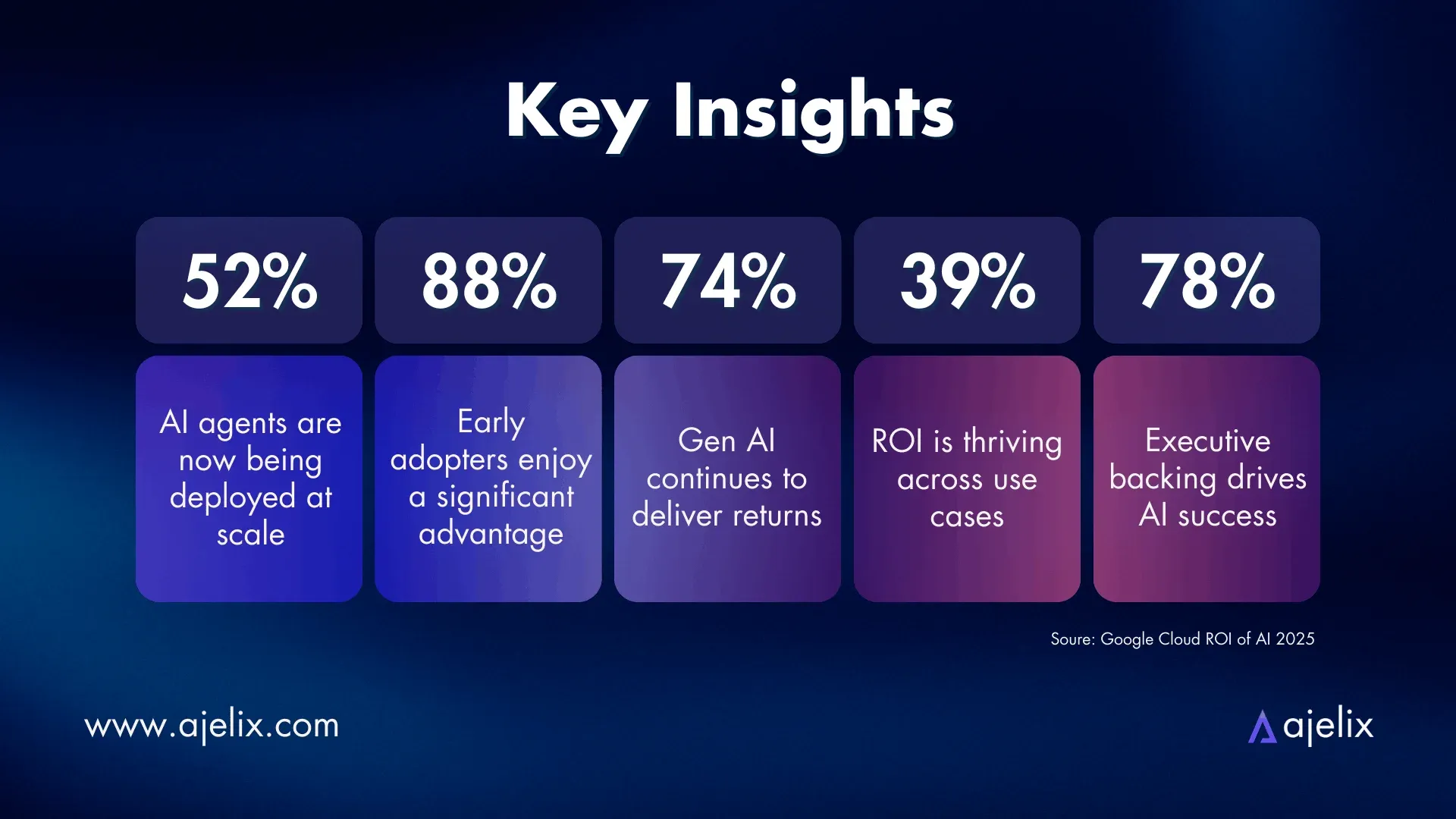

- What AI Studies Say About Agentic AI ROI & Stats (And What They Don’t)

- Google Sheets AI Agents That Autonomously Perform Tasks

- Advanced Agentic Research With AI Agents

- GLM-5 is Now Available on Ajelix AI Chat

- AI Spreadsheet Generator: Excel Templates With AI Agents

- Excel Financial Modeling With AI Agents (No Formulas Need!)

- AI Landing Page Generator: From 0 To Stunning Page With Agent

- Creating Charts In Excel with Agentic AI – It Does Everything!

- Create Report From Google Sheets Data with Agentic AI

- How To Create Powerpoint Presentation Using AI Agent (+Video)

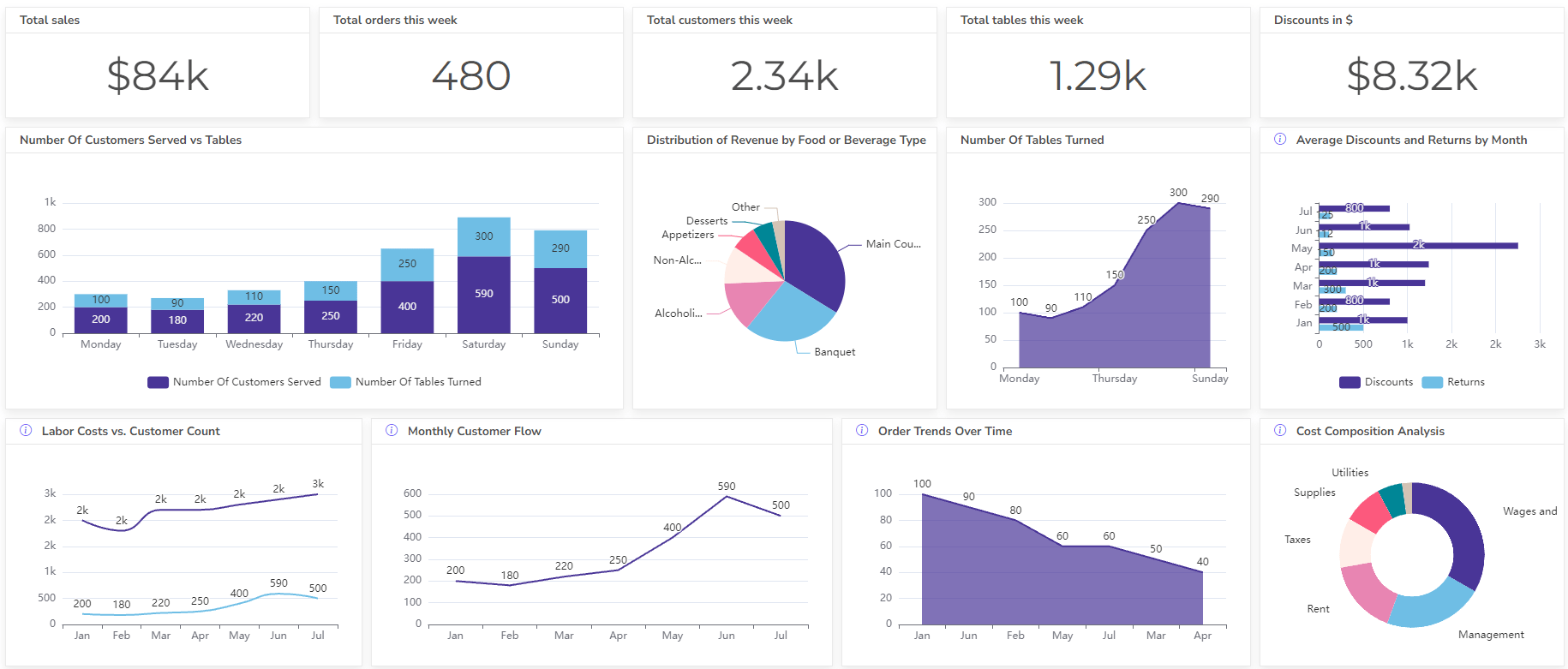

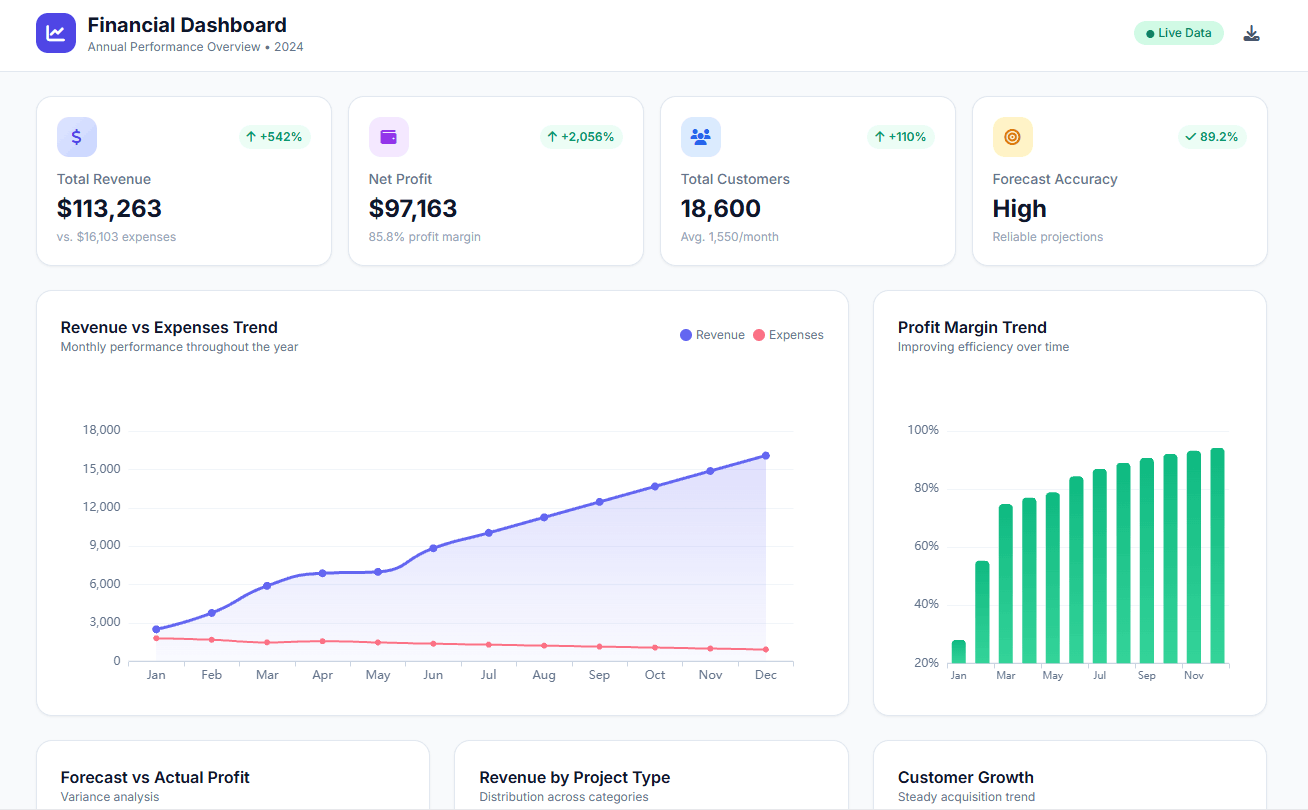

Set up dashboard & track KPIs

An ROI calculator is a tool that helps you figure out the return on investment for something. ROI is a percentage that tells you how much profit you make compared to how much you spend. So an ROI calculator helps you see if something is a good investment financially.

Calculate Return on Investment (ROI)

What is ROI?

ROI stands for Return on Investment. It’s a metric that measures how profitable an investment is. It’s like a scorecard that tells you if you’re getting more back than you put in.

Struggling with manual calculations & tiring setups?

Let agentic AI do the heavy lifting.

Start free

Fast sign up & easy setup

ROI Formula

ROI = (Net Profit / Cost of Investment) x 100%

Net Profit is the difference between the final value of the investment and the initial cost.

What is Net Profit in ROI?

Net profit represents the positive monetary outcome you receive from the investment. It can be phrased as profit, return, or net income depending on the context.

For example, if you invest in a stock that increases in value, the gain would be the difference between the selling price and the purchase price.

What is the Cost Of Investment in ROI?

The cost of investment refers to the total amount of money you put into the investment initially. This could include the purchase price, any additional fees, or ongoing costs associated with the investment.

Imagine buying a machine to improve your productivity. The investment cost would include the machine’s price and any installation fees.

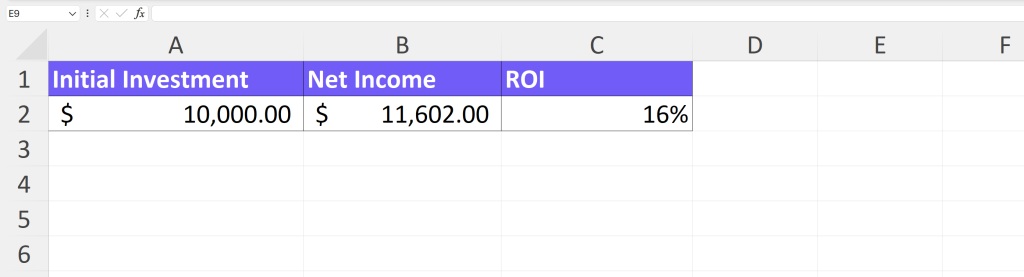

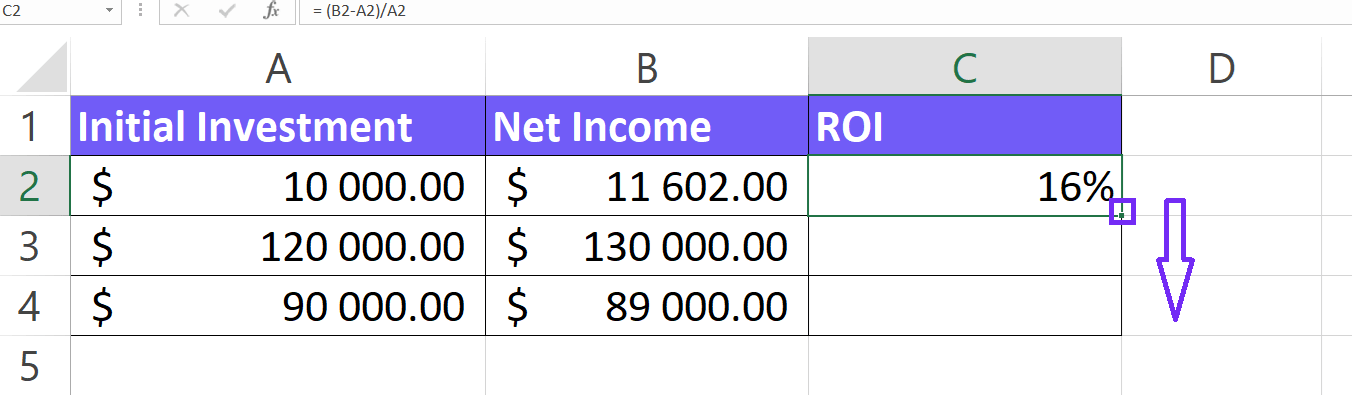

How To Calculate ROI in Excel?

Time needed: 5 minutes

Here’s a step-by-step guide on calculating ROI in Excel:

- Add Investment Data

In the first column, label a cell (e.g., A1) as “Investment Cost” or “Initial Investment.”

In the second column, label a cell (e.g., B1) as “Gain (Profit)” or “Net Income.”

In a third column (C) or a separate cell, you’ll calculate the ROI. Label this cell (e.g., C1) as “ROI” or “Return on Investment.”

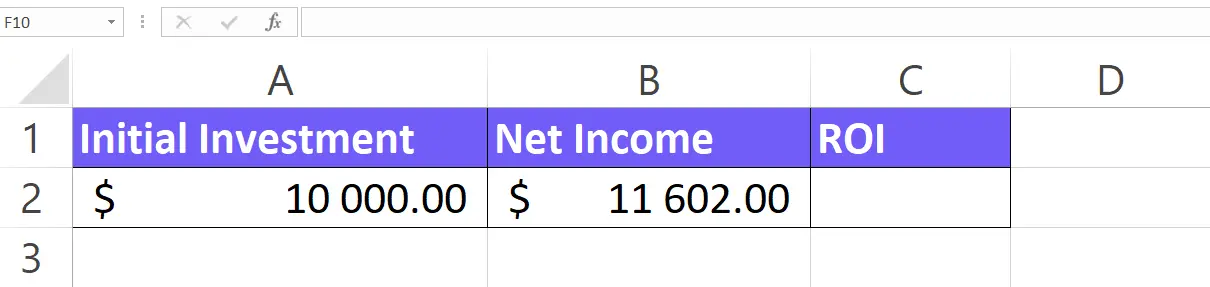

- Enter Your Investment Data

In cell A2, enter the total amount of money you invested.

In cell B2, enter the total gain or profit you received from the investment.

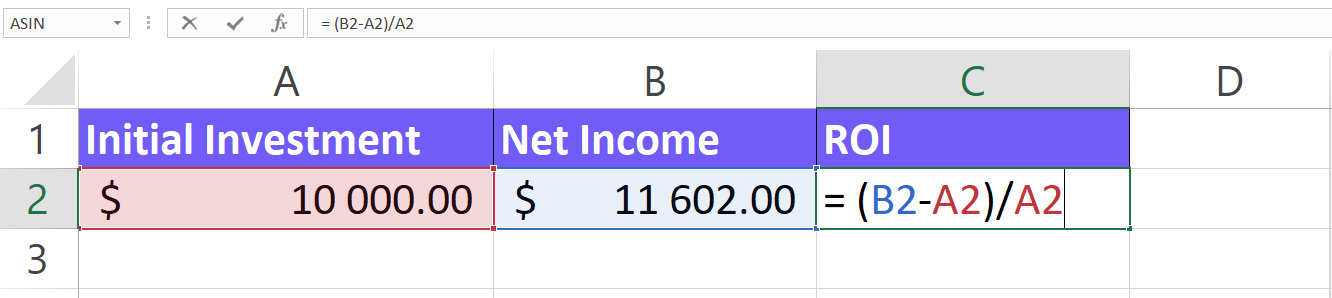

- Use the ROI Formula

In cell C2 (or your designated ROI cell), type the following formula:

= (B2- A2) / A2

This formula subtracts the investment cost (A1) from the gain (B1) and then divides the result by the investment cost (A1).

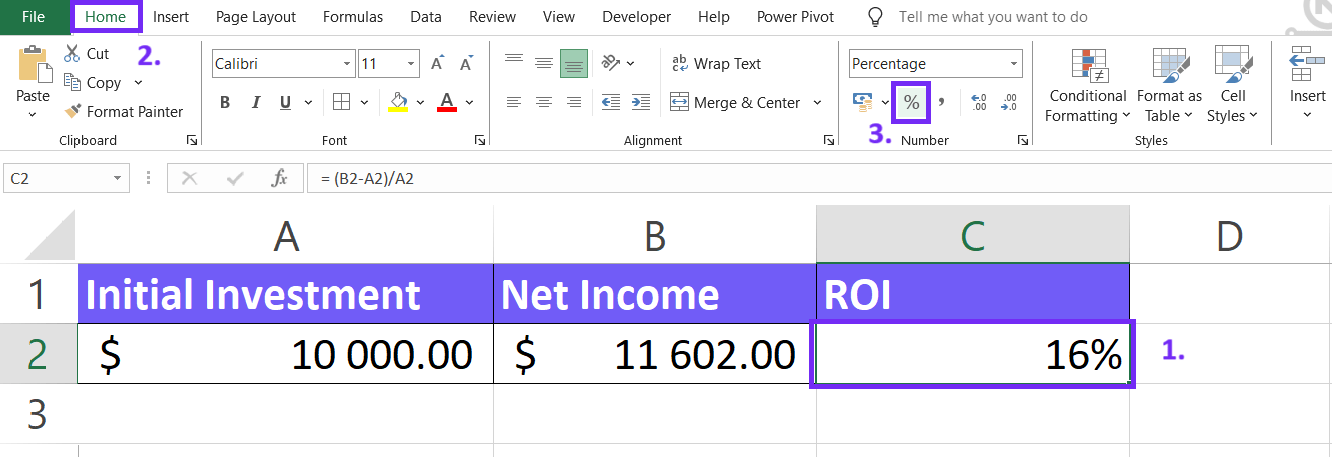

- Convert the Result to a Percentage (Optional):

The formula will initially give you a decimal value representing the ROI ratio.

Select cell C2 (or your ROI cell) to show it as a percentage. Click on the percentage style button (%) in the number formatting options at the top of the Excel window. This will convert the decimal to a percentage.

- Apply the Formula if Needed

If you have data for multiple investments, copy the formula in cell C1 (or your ROI cell) down to the corresponding rows for each investment. Excel will automatically adjust cell references (A1 and B1) based on the copied row.

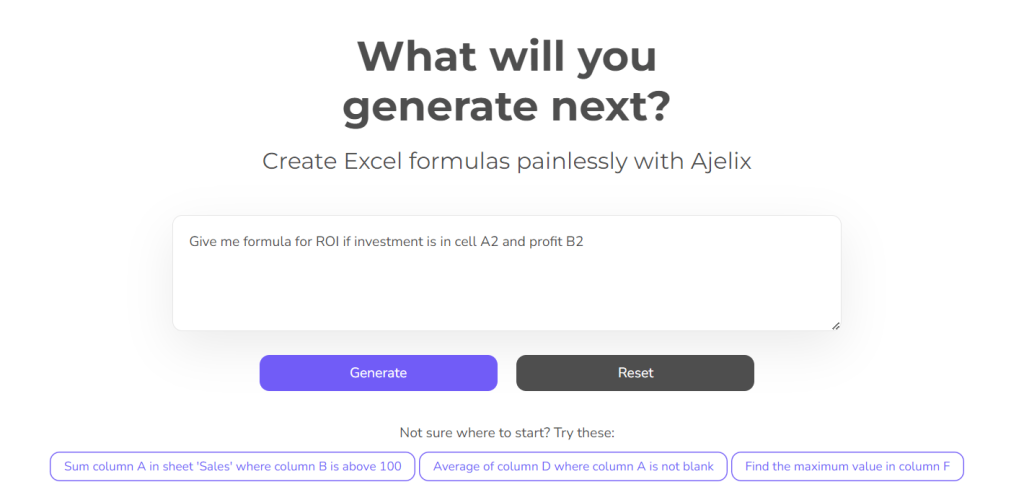

How To Generate Formulas With AI?

Forget scouring the web for the right formula – AI is here to streamline your spreadsheets. With AI-powered formula generation, you can describe what you need to calculate, and the AI will write the formula for you, eliminating errors and saving you valuable time.

Here’s a step-by-step guide to get started with this powerful new feature:

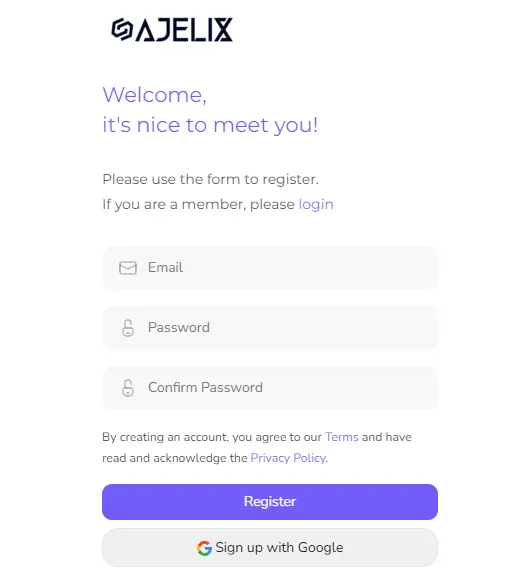

1. Create a free Ajelix account

Ajelix goes beyond formulas! It offers over 15 AI-powered tools to tackle all your spreadsheet tasks. Sign up with your email – Gmail or anything else works – and unlock a world of spreadsheet efficiency.

Screenshot from Ajelix registration page, image by author

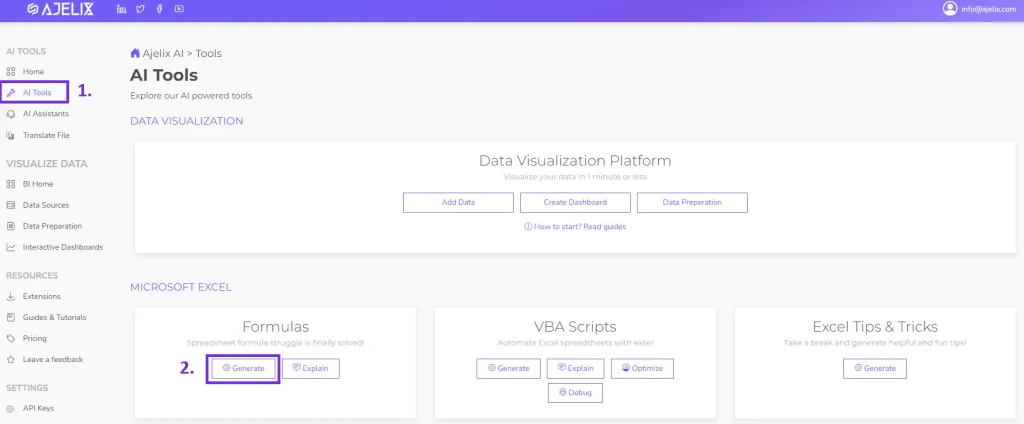

2. Locate the Formula generator tool

Once you have logged in to the portal you can find the Excel formula generator under the AI tools section.

Screenshot from Ajelix portal on how to find formula generator, image by author

3. Write a clear and concise prompt

No more hunting for the perfect formula! Just tell AI what you want to calculate, like “Give me the formula for ROI if investment is in cell A2 and profit B2” AI will translate your description into the formula, saving you time and ensuring accuracy.

Screenshot from Ajelix formula generator with ROI prompt, image by author

Here are some tips for writing your prompt:

- Focus on what you want to achieve: Ditch generic requests like “formula for calculations.” Instead, tell AI exactly what you need, like “average sales in column B for approved items (marked ‘Yes’ in column A)”.

- Talk like you would to a friend: Use natural language! Mention cell references if your platform allows (e.g., “total cost in column C by multiplying quantity in A by price in B”).

- Get specific about conditions: Need your formula to consider special cases? Explain them clearly! (e.g., “‘Bonus’ in D2 if sales (B2) exceed target (E1), otherwise ‘No Bonus'”).

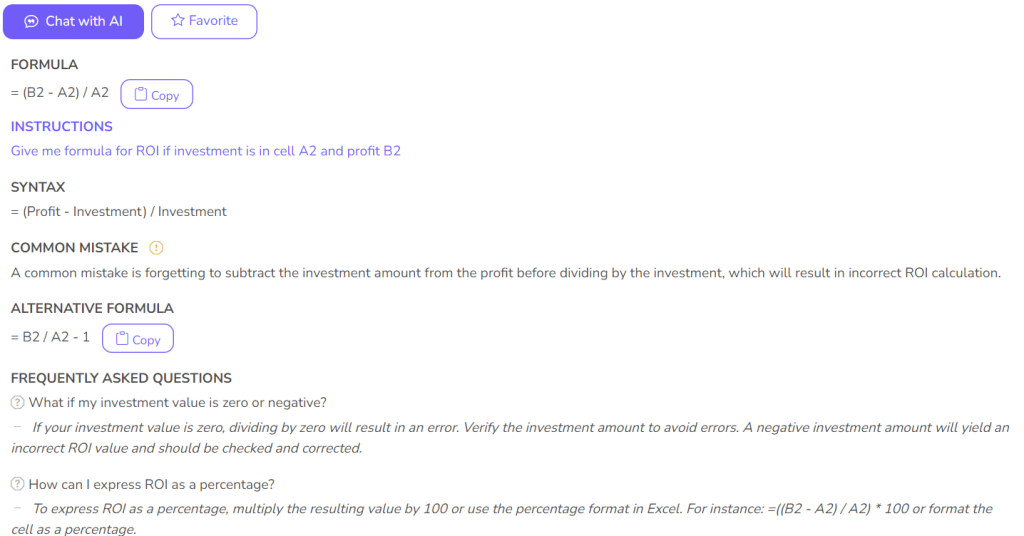

4. Get your formula

Once you have the prompt AI will give you a ready-to-use formula to copy in your spreadsheet. You can also use Excel or Google Sheets add-on for easier formula writing. In the answer below you can see that AI gave the correct formula.

Screenshot from Ajelix with ROI formula result, image by author

Ready to give it a go?

Test AI tools with freemium plan and only upgrade if formula generator can help you!

Download the ROI Calculator Excel Template

Download your free ROI Excel template below 👇

How Does An ROI Calculator Work?

ROI calculators help you determine the Return on Investment, a metric that shows how much profit you earn relative to the initial cost of an investment. These tools usually asks to input:

- Initial investment cost: The upfront cost you incur for the investment.

- Expected return: The total profit or income you anticipate generating from the investment.

After you have entered the variables calculator employs a formula that divides the net profit (expected return minus initial investment cost) by the initial investment cost. By the end of the calculation, it expresses the result as a percentage by multiplying it by 100.

ROI Results Interpretation

| ROI Result | Interpretation | Example |

|---|---|---|

| Highly Negative ROI (<-20%) | Significant Loss | Investment is losing a substantial amount of money compared to the initial investment. Re-evaluate the investment or consider selling to minimize losses. |

| Negative ROI (-5% to -20%) | Loss | Investment is not generating profit, but losses may be manageable. Consider holding or selling depending on prospects and risk tolerance. |

| Low Positive ROI (0% to 5%) | Barely Profitable | Investment might be keeping pace with inflation, but not generating significant returns. Re-evaluate if your goals are met or consider exploring higher-return options. |

| Moderate Positive ROI (5% to 10%) | Good ROI | Investment is generating a decent return that likely outpaces inflation. This is a typical range for many investments. |

| High Positive ROI (10%+) | Excellent ROI | Investment is performing very well and generating significant returns. Consider reinvesting profits or using them to achieve your financial goals. |

Important Note: These are general guidelines, and what constitutes a “good” ROI can vary depending on the investment type, your risk tolerance, and investment goals. It’s always wise to do your research and consider seeking professional financial advice before making investment decisions.

What is a good ROI?

Any positive ROI is considered good because it means you’re making money on your investment.

Benefits of using an ROI calculator

- Simplified Calculations: ROI formulas can involve multiple variables. ROI calculators automate the process, saving you time and effort, and minimizing the risk of errors.

- Quick Estimates: get instant results, to compare different investment options rapidly and gauge their potential profitability.

- Informed Decisions: By providing a clear picture of potential returns, ROI calculators help you make more informed investment decisions based on your financial goals and risk tolerance.

- Easy Comparison: ROI calculators express results as a percentage, making it straightforward to compare the profitability of various investments with different initial costs and returns.

- Communication Tool (for Sales): For salespeople, ROI calculators can be a valuable tool to showcase the expected value their product or service brings to a customer, making their sales pitch more data-driven and persuasive.

FAQ

Calculate ROI whenever you want to assess the efficiency or profitability of an investment.

Yes, ROI is a broad concept. There’s ROI on investment (classic ROI), but also metrics like return on assets (ROA) or return on equity (ROE) used for financial analysis.

There’s no one-size-fits-all answer. A good ROI depends on factors like investment type, risk, and timeframe. Generally, positive ROI is good, with higher percentages (above 10%) considered strong.

Not necessarily. A negative ROI indicates a loss, but it can offer learning for future decisions. Consider it a learning experience and analyze why the investment fell short.

Two common ROI mistakes: forgetting all costs (underestimating initial investment) or using profit instead of cash flow (confusing profit with actual money movement).

Other calculators

Setup and monitor your KPIs regularly using Ajelix BI