- Home

- Product

- Tools

- AI Data Analyst

- Excel Formula Generator

- Excel Formula Explainer

- Google Apps Script Generator

- Excel VBA Script Explainer

- AI VBA Code Generator

- Excel VBA Code Optimizer

- Excel VBA Code Debugger

- Google Sheets Formula Generator

- Google Apps Script Explainer

- Google Sheets Formula Explainer

- Google Apps Script Optimizer

- Google Apps Script Debugger

- AI Excel Spreadsheet Generator

- AI Excel Assistant

- AI Graph Generator

- Pricing

- Home

- Blog

- Calculators

- Dividend Calculator Free Online: Calculate Investments

Dividend Calculator Free Online: Calculate Investments

Explore other articles

- Google Sheets AI Agents That Autonomously Perform Tasks

- Advanced Agentic Research With AI Agents

- GLM-5 is Now Available on Ajelix AI Chat

- AI Spreadsheet Generator: Excel Templates With AI Agents

- Excel Financial Modeling With AI Agents (No Formulas Need!)

- AI Landing Page Generator: From 0 To Stunning Page With Agent

- Creating Charts In Excel with Agentic AI – It Does Everything!

- Create Report From Google Sheets Data with Agentic AI

- How To Create Powerpoint Presentation Using AI Agent (+Video)

- Ajelix Launches Agentic AI Chat That Executes Business Workflows, Not Just Conversation

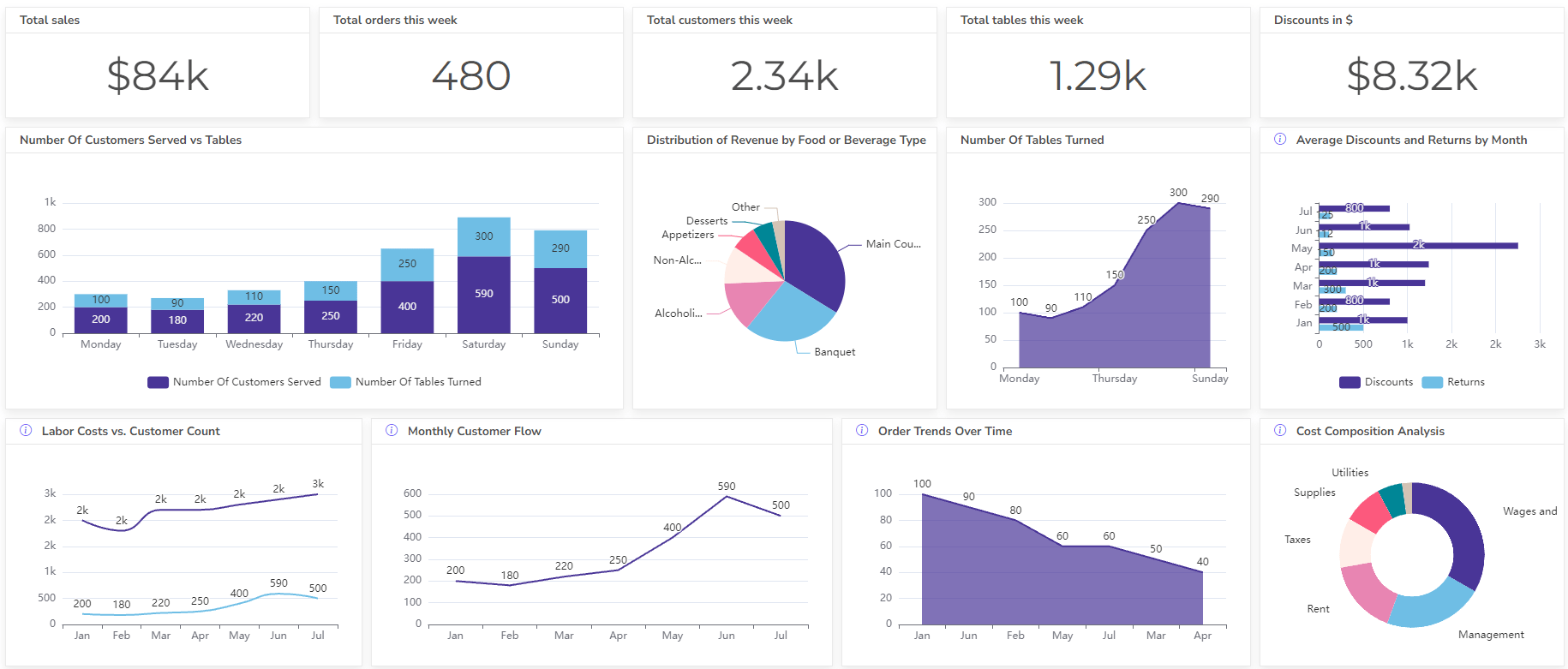

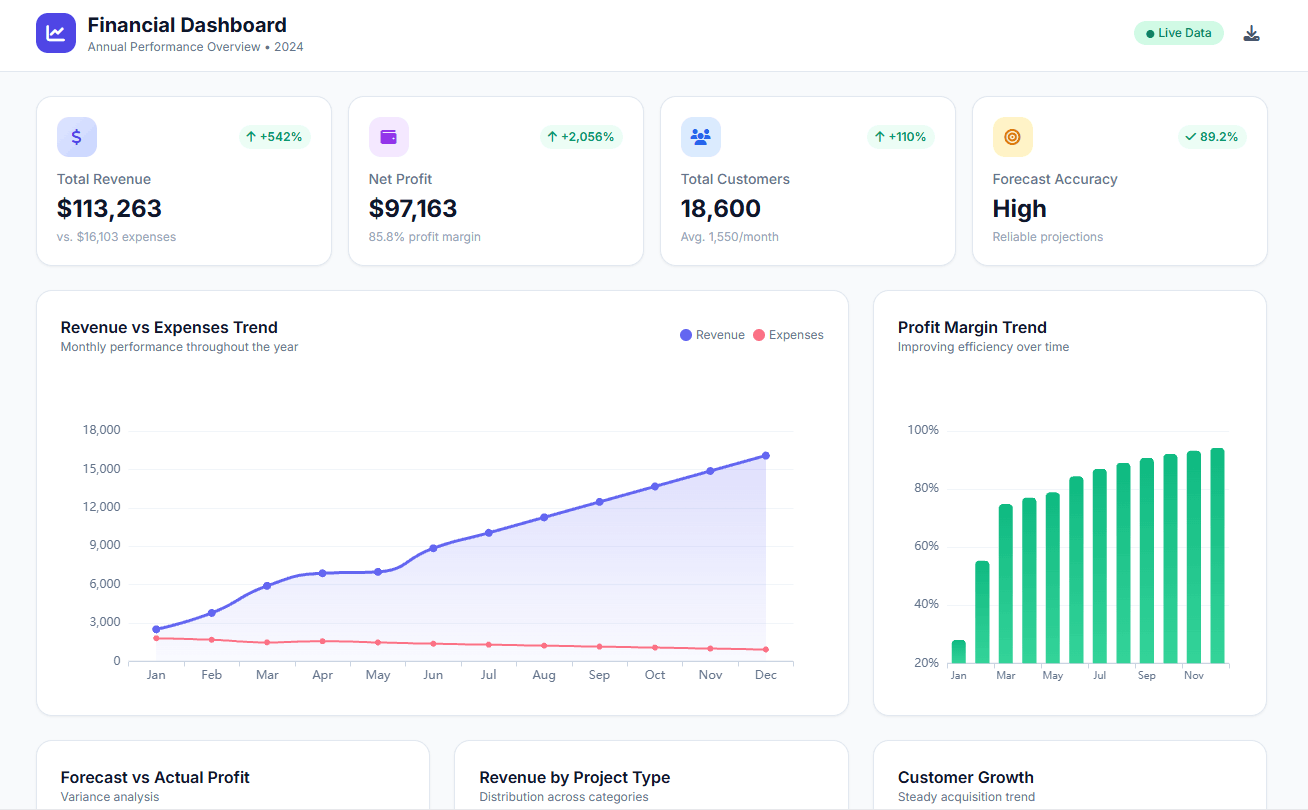

Set up dashboard & track KPIs

A dividend calculator is a financial tool that helps investors figure out how much money they’ll get from stock dividends. It typically considers factors like the number of shares owned, current stock price, and dividend amount.

Dividend Calculator

What is a dividend?

A dividend is a portion of a company's profit that is distributed to its shareholders. It's essentially a way for the company to share its financial success with the people who own pieces of the company (the shareholders).

Struggling with manual calculations & tiring setups?

Let agentic AI do the heavy lifting.

Start free

Fast sign up & easy setup

Key points about dividends:

- Distribution of profits: Dividends are paid out of a company’s earnings, though not necessarily all of them. The company’s board of directors decides how much profit will be distributed as dividends and how much will be reinvested in the business for future growth. If you're curious about potential dividend payouts, you can use a free dividend calculator or a dividend investing calculator to estimate how much you might receive.

- Cash or stock: Dividends can be paid in cash, which is the most common form, or in additional shares of the company’s stock. Many investors use a dividend investing calculator to compare how these options might affect the growth of their portfolio over time.

- Not mandatory: There’s no obligation for a company to pay dividends. Even if a company is profitable, it may choose to reinvest all its earnings back into the business. This is something to keep in mind if you’re using a monthly dividend calculator to project future income streams.

- Tax implications: Dividends are taxed differently than capital gains, which are profits from selling stocks.

What is Dividend yield?

Dividend yield is a financial ratio that shows what percentage of a company’s share price is paid out to shareholders in dividends each year. It helps you see how much income you’d receive from holding a stock, compared to its current price.

Dividend yield formula

Dividend yield = (Annual dividend per share) / (Current stock price)

For example, let's say a company has a share price of $20 and pays a dividend of $1 per year. Its dividend yield would be:

Dividend yield = ($1 annual dividend) / ($20 current stock price) = 5%In this example, a 5% dividend yield means that for every $1 you invest in this company's stock, you'd earn $0.05 annually in dividends.

Things to keep in mind about dividend yield:

- A higher yield generally means more income, since you’re getting a larger portion of the share price paid out as dividends. If you want to quickly see potential returns, a simple dividend calculator can help estimate your earnings.

- Dividend yield is just one factor. A high yield doesn’t guarantee a good investment. Check the company’s financial health and growth prospects too. Using a dividends income calculator is useful, but not a substitute for doing your own research.

- Yields change over time as share prices and payout policies shift. If you’re planning with a dividend share calculator, note that these numbers can fluctuate.

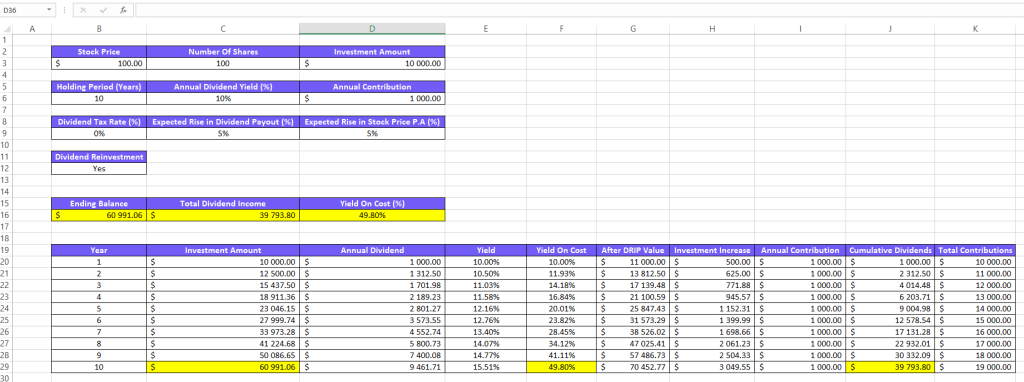

How To Calculate Dividend Income In Excel?

Want to stay on top of your dividend income? Check out this 17-step guide to calculating dividend income in Excel. If you’d rather skip the setup, just grab the ready-made Excel dividend calculator template at the end of the guide.

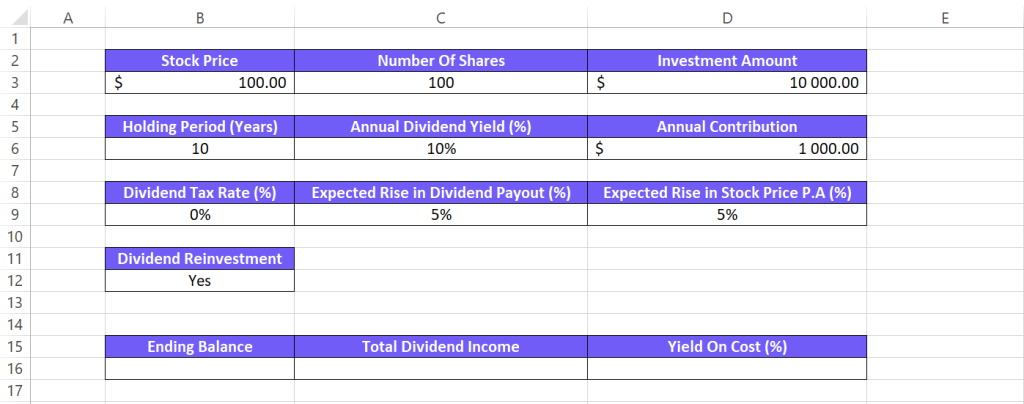

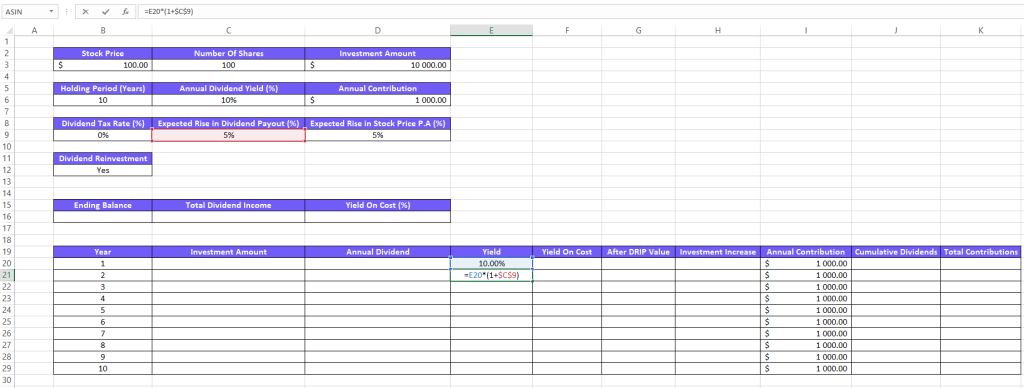

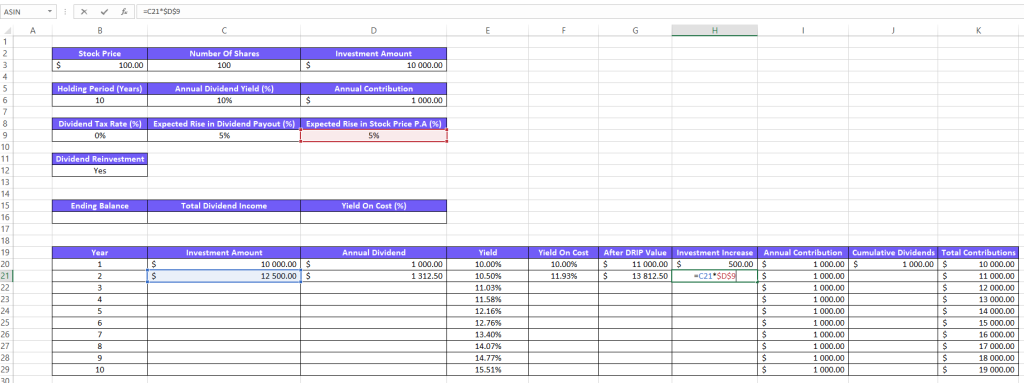

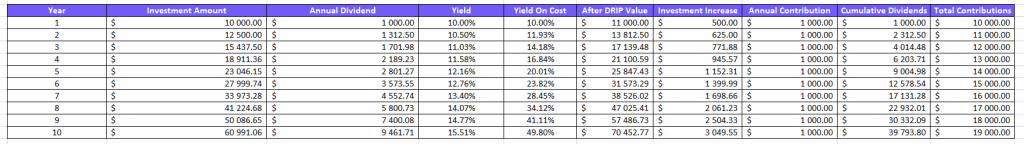

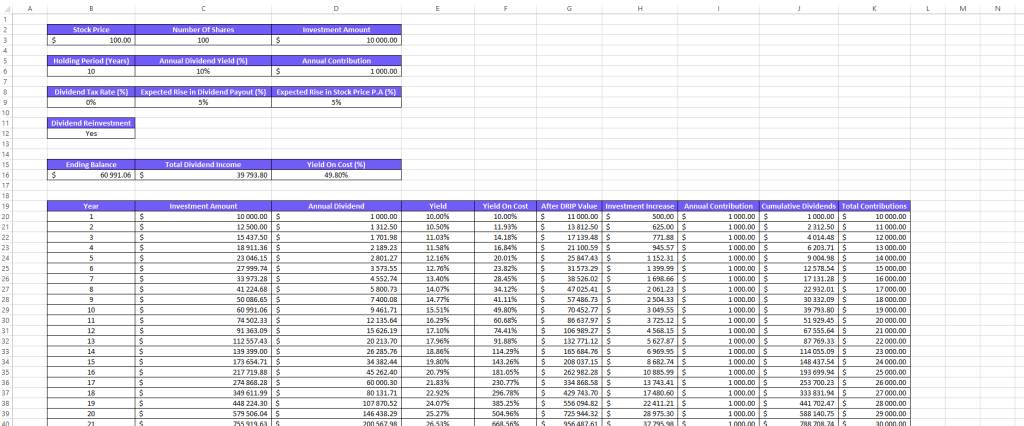

1. Create fields for variable values

Name the variable cells and input values for calculations:

- Stock price

- Number of shares

- Investment amount

- Holding period (years)

- Annual dividend yield (%)

- Annual contribution

- Dividend tax rate (%)

- Expected rise in dividend payout (%)

- Expected Rise in Stock Price P.A (%)

- Dividend reinvestment

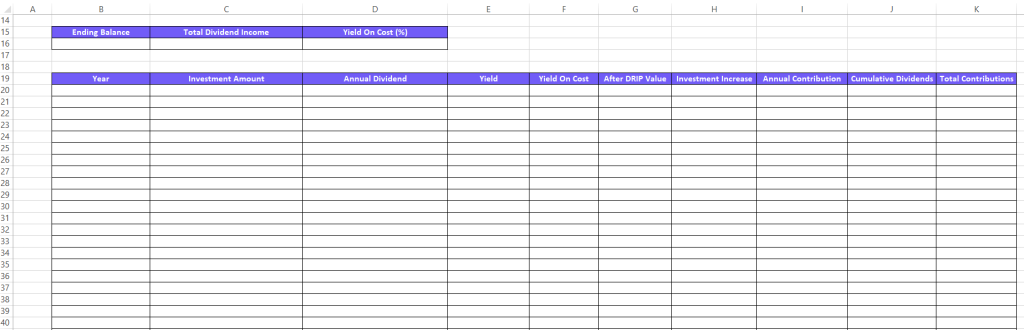

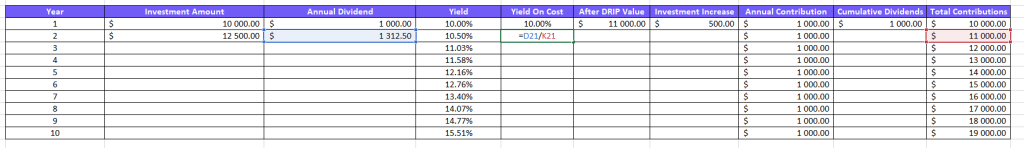

2. Create a table for calculations

Name table headers for calculations with the following values:

- Year

- Investment Amount

- Annual Dividend

- Yield

- Yield on cost

- After DRIP value

- Investment increase

- Annual contribution

- Cumulative dividends

- Total contributions

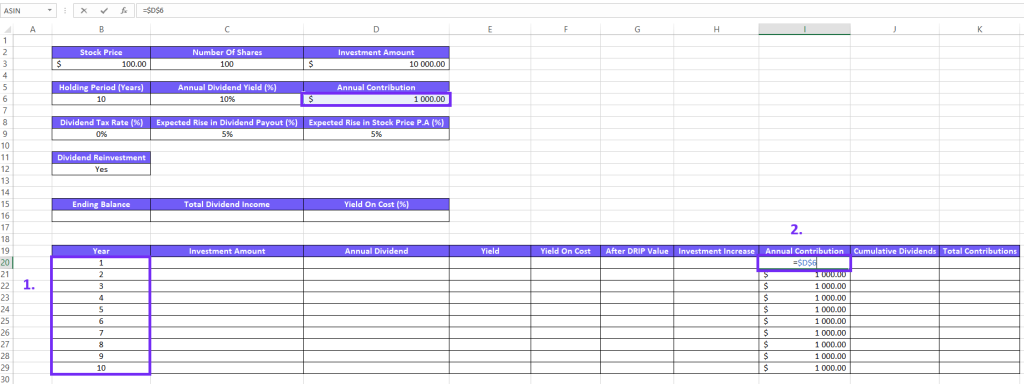

3. Fill out the Year and Annual contributions columns

Fill out the first column "Year" with values depending on how many years you want to calculate dividends. For Annual contributions simply type =D6 (a variable field that contains annual contributions value), and press F4 to freeze this cell so you can drag down and fill out the table. Annual contributions usually don't change over the years, if they do, manually insert values.

4. Calculate the yield for each year

For the first year type the same yield you have in variables. For the next years calculate the expected rise in dividend payout, type formula =Annual Dividend Yield (%) *(1+Expected Rise in Dividend Payout (%))

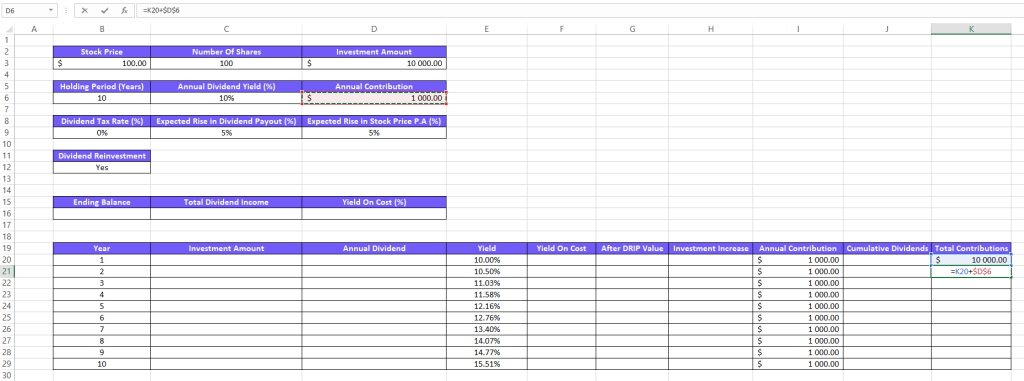

5. Fill out the total contributions column

In the first row type the investment amount, in our example it's $10,000. For the next rows type formula: = Investment Amount + Annual Contribution

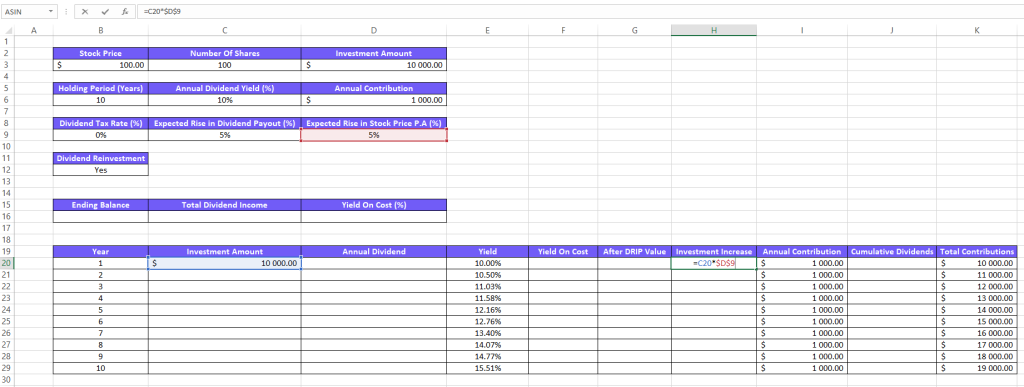

6. Calculate Investment increase

Fill out the first row for the "Investment amount" column, which in our example is $10'000. Then for the "Investment increase" column type formula =Investment Amount + Expected Rise in Stock Price P.A (%).

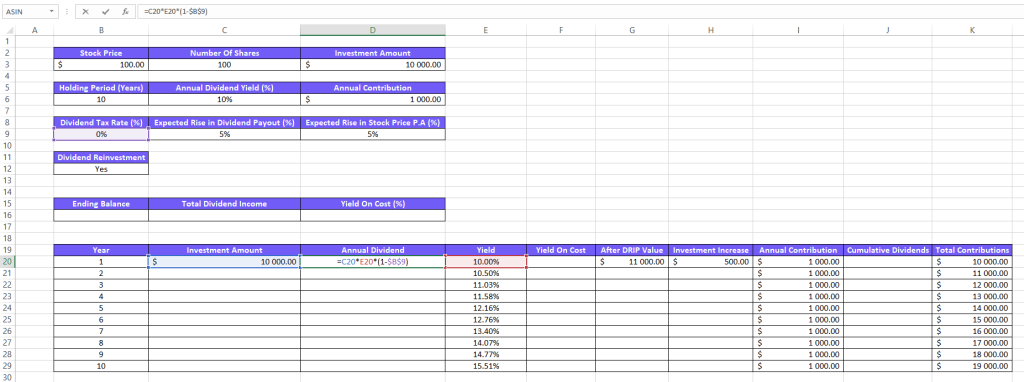

7. Calculate Annual Dividend

To calculate "Annual Dividend" use the formula =Investment Amount * Yield * (1-Dividend Tax Rate (%))

8. Calculate Yield On Cost

The next step to calculate dividend income is to get "Yield On Cost" values. To do that use this formula =Annual Dividend / Total Contributions

9. Fill out the Cumulative Dividends for 1 year

For the first year "Cumulative Dividends" will be the same as "Annual Dividend". Type =Annual Dividend 1 Year.

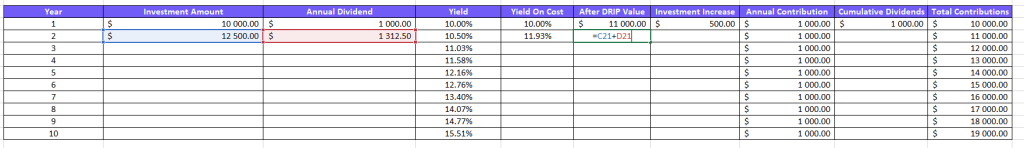

10. Calculate the Investment amount for the 2-year

Once you have calculated values for the 1 year, you can start filling out values for the second year. To get the Investment Amount for 2 years type this formula = After DRIP Value (previous year) + Investment Increase (previous year) + Annual Contribution

11. Fill out the Annual Dividend value for the 2-year

Once you have calculated the "Investment Amount" you can type the formula to get a 2-year "Annual Dividend" or you can drag down the formula from the previous year's calculation. Here's the formula =Investment Amount (2-year) * Yield (2-year) * (1-Dividend Tax Rate (%)).

12. Get Yield On Cost for the 2-year

To get the value for 2-year you can drag and fill the formula down from the previous year or use this formula =Annual Dividend (2-year) + Total Contributions (2-year).

13. Calculate the Drip Value for a 2-year

Again to get this value you can drag and fill the formula from the previous year or type this formula =Investment Amount (2-year) + Annual Dividend (2-year).

14. Calculate Investment Increase for 2-year

Repeat the actions from previous steps to get this value or type this formula =Investment Amount (2-year) * Expected Rise in Stock Price P.A (%).

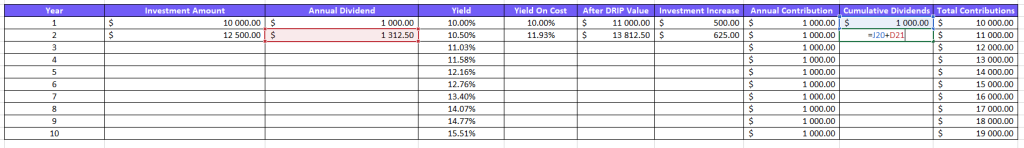

15. Calculate Cumulative Dividends 2-year

To get the value for 2-year insert this formula =Cumulative Dividends (previous year) + Annual Dividend (the same year).

16. Fill out the values for the rest of the years

Now you have values and formulas for two years and you can easily fill out formulas for the next years gradually, like we did in the previous steps.

17. Find the total results for your investment plan

Once you have filled out the table for all years, you get the Ending Balance, Total Dividend Income, and Yield on Cost.

Download the Dividend Calculator in the Excel Template

Download your dividend investment Excel template below 👇

Download Free Excel Template

When are dividends paid?

The frequency of dividend payments varies depending on the company's dividend policy. Here's a breakdown of the common payment schedules:

| Frequency | Description |

|---|---|

| Quarterly | Most frequent payout schedule, providing consistent income throughout the year. |

| Semi-Annually | Dividends are distributed twice a year, typically in June and December. |

| Annually | Less frequent approach, with payouts happening just once a year. |

| Special | One-time dividend payment outside of the regular schedule. |

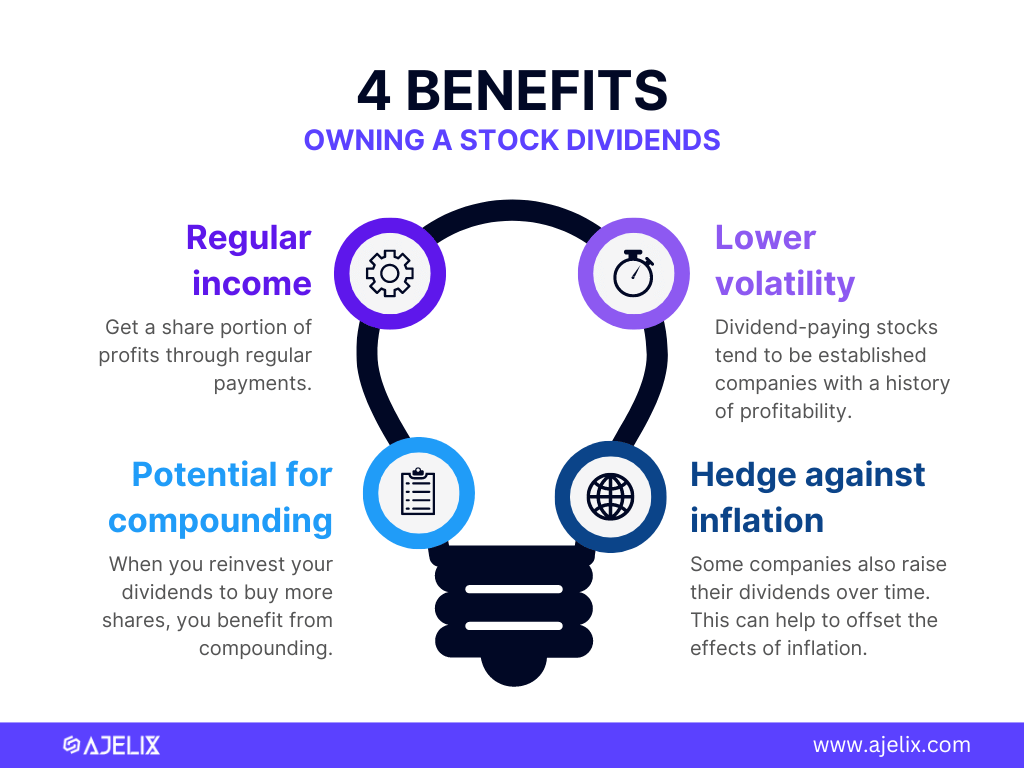

What are the Benefits of Owning a Dividend Stock?

Here are a few core benefits of investing in dividend-paying stocks.

- Companies that pay dividends share a portion of their profits through regular payments, giving investors a steady income stream. You can use this for expenses or reinvest it to buy more shares, leading to greater compounding, meaning you earn returns on both your original investment and reinvested dividends.

- Dividend-paying companies are usually larger and more stable, which can help reduce volatility in your portfolio when markets are uncertain. Many also raise dividends over time, offering a buffer against inflation.

If you want to see how dividends could impact your investments, a dividends calculator is useful for calculating stock dividend projections and handling your dividend calculation quickly.

Here are a few things you should know about dividend stocks:

- Don’t assume that every dividend stock is a good bet just because it pays out a high yield. Sometimes, a high yield is actually a red flag. It might mean the company is having trouble growing, so they’re paying out more to keep investors interested. Before you commit, always look at the company’s financial health and long-term outlook.

- Remember that dividends aren’t set in stone. Companies can cut or suspend them whenever they need to, especially if their earnings take a hit or if they need to hold onto cash for other priorities. It’s smart to keep this in mind as you build your portfolio.

FAQ

Companies pay dividends to share profits with shareholders and incentivize them to hold onto the stock. It's a way to return some of the company's earnings to investors.

Dividend policy depends on profit, growth goals, and debt. Profitable companies pay more dividends. Growing or highly indebted companies usually reinvest earnings or pay off debt instead of paying dividends.

Dividends can provide income, but they’re not guaranteed, companies can stop paying them. Falling stock prices can wipe out your gains, and dividends are taxed, which lowers your total return.

Qualified dividends get taxed at lower capital gains rates: 0%, 15%, or 20%. Ordinary dividends are taxed as regular income, which can be up to 37%.

Companies typically pay dividends quarterly, meaning four times a year. However, some companies may pay them: semi-annually (twice a year), annually (once a year), or occasionally as a special dividend (outside the regular schedule).

Disclaimer: The information on this page is for educational purposes only and should not be construed as financial advice. While we strive to provide accurate information, investing involves inherent risks. Please consult with a qualified financial advisor before making any investment decisions.

Other calculators

Setup and monitor your KPIs regularly using Ajelix BI