- Home

- Product

- Tools

- AI Data Analyst

- Excel Formula Generator

- Excel Formula Explainer

- Google Apps Script Generator

- Excel VBA Script Explainer

- AI VBA Code Generator

- Excel VBA Code Optimizer

- Excel VBA Code Debugger

- Google Sheets Formula Generator

- Google Apps Script Explainer

- Google Sheets Formula Explainer

- Google Apps Script Optimizer

- Google Apps Script Debugger

- AI Excel Spreadsheet Generator

- AI Excel Assistant

- AI Graph Generator

- Pricing

- Home

- Blog

- Calculators

- Free Liquid Net Worth Calculator Online

Free Liquid Net Worth Calculator Online

Explore other articles

- Google Sheets AI Agents That Autonomously Perform Tasks

- Advanced Agentic Research With AI Agents

- GLM-5 is Now Available on Ajelix AI Chat

- AI Spreadsheet Generator: Excel Templates With AI Agents

- Excel Financial Modeling With AI Agents (No Formulas Need!)

- AI Landing Page Generator: From 0 To Stunning Page With Agent

- Creating Charts In Excel with Agentic AI – It Does Everything!

- Create Report From Google Sheets Data with Agentic AI

- How To Create Powerpoint Presentation Using AI Agent (+Video)

- Ajelix Launches Agentic AI Chat That Executes Business Workflows, Not Just Conversation

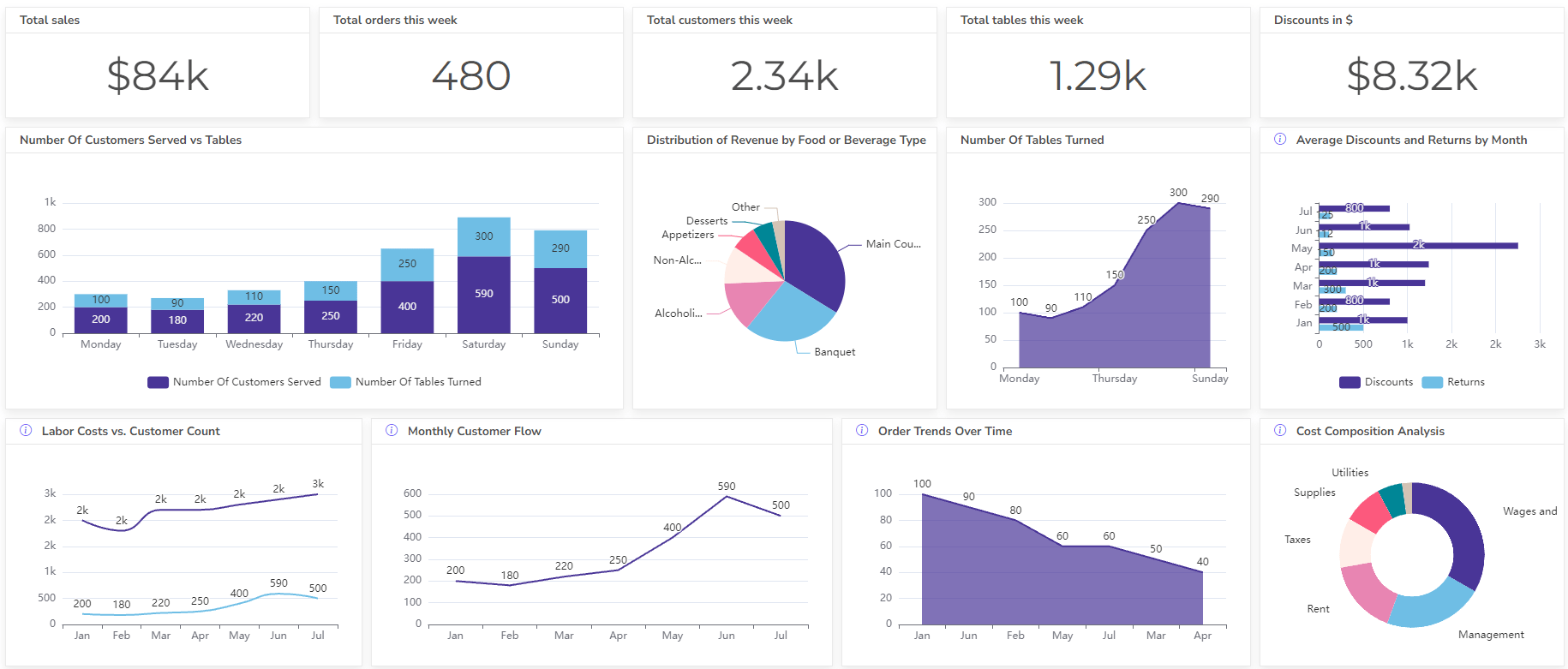

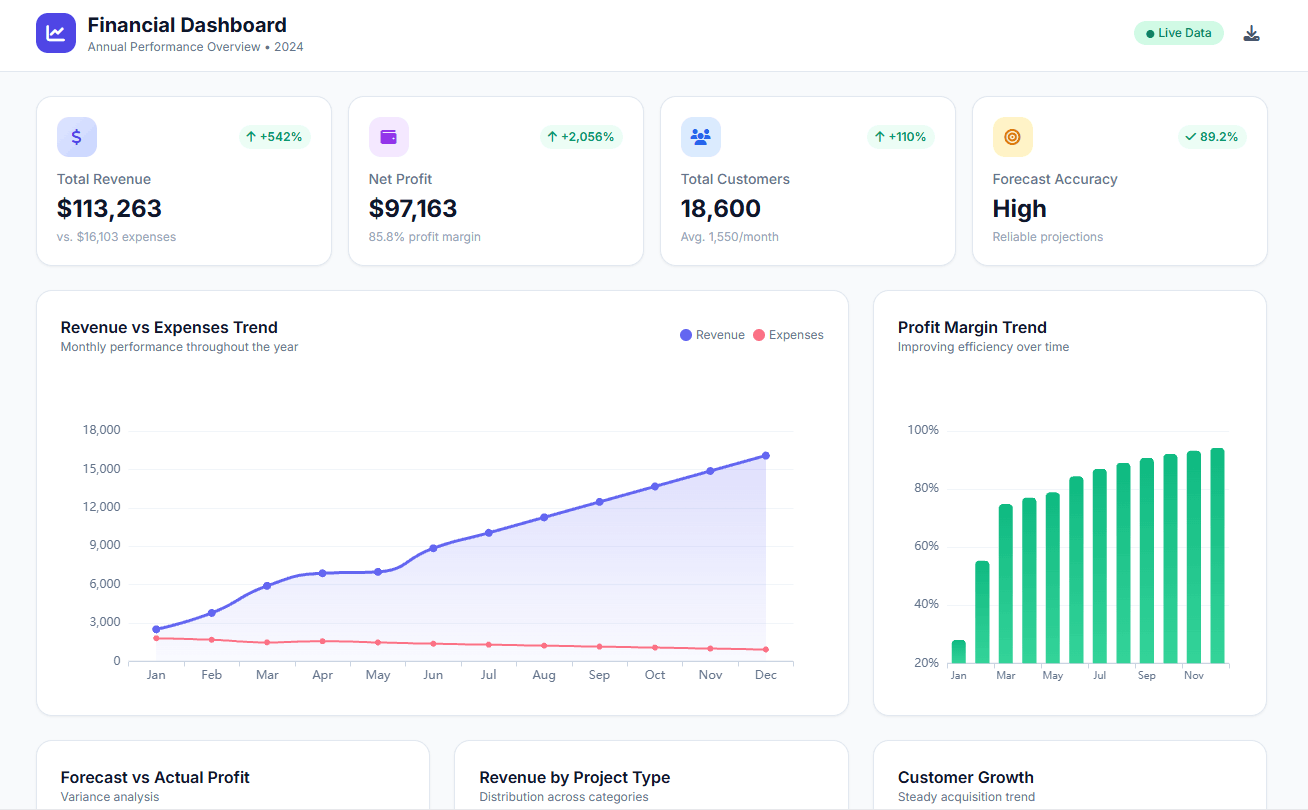

Set up dashboard & track KPIs

A liquid net worth calculator can help you measure your financial flexibility in the short term. It essentially tells you how much cash you have readily available or can convert to cash quickly in case of emergencies or unexpected needs.

Calculate Liquid Net Worth

Liquid Net Worth Formula

Liquid Net Worth = Total Liquid Assets – Total Liabilities

Where,

- Total Liquid Assets: This represents the sum of all your financial holdings that can be quickly converted to cash, typically within a business day. Examples include:

- Cash: Physical currency you have on hand.

- Checking Account: The readily available funds in your checking account.

- Savings Account: The balance in your savings account, though some savings accounts might have limitations on withdrawals.

- Marketable Securities: Stocks, bonds, and mutual funds that can be readily sold on an exchange. (Note: Selling these might result in a slight loss due to market fluctuations, so consider factoring in a buffer for a more realistic picture.)

- Total Liabilities: This represents the total amount of your outstanding debts. This includes:

- Credit Card Debt: The unpaid balance on your credit cards. If you have too much credit card debt though, you may face financial hardship, forcing you to take should you file for bankruptcy calculator.

- Personal Loans: Any outstanding personal loans you have taken.

- Short-term Financing: Debts like car loans that need to be repaid within a short period.

You get liquid net worth by subtracting your total liabilities from your total liquid assets. This number reflects your immediate financial cushion and ability to handle short-term emergencies or unexpected expenses.

Struggling with manual calculations & tiring setups?

Let agentic AI do the heavy lifting.

Start free

Fast sign up & easy setup

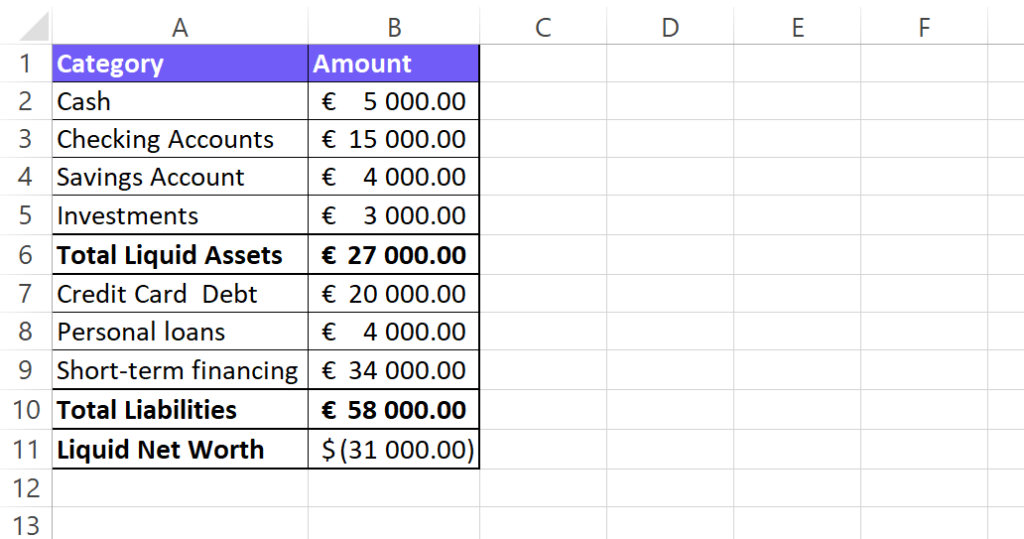

How To Calculate Liquid Net Worth? In Excel

Time needed: 5 minutes

Calculating your liquid net worth is a straightforward process that helps you understand your immediate financial flexibility. Here’s a step-by-step guide on how to calculate your Liquid Net Worth in Excel:

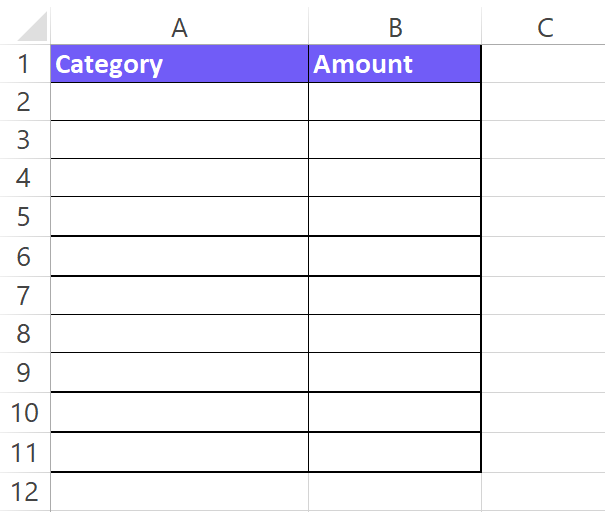

- Set Up the Spreadsheet

Open a new Excel spreadsheet. Label the first column “Category“. This will describe your assets and liabilities. In the second column, label it “Amount“. This will hold the numerical value of each item.

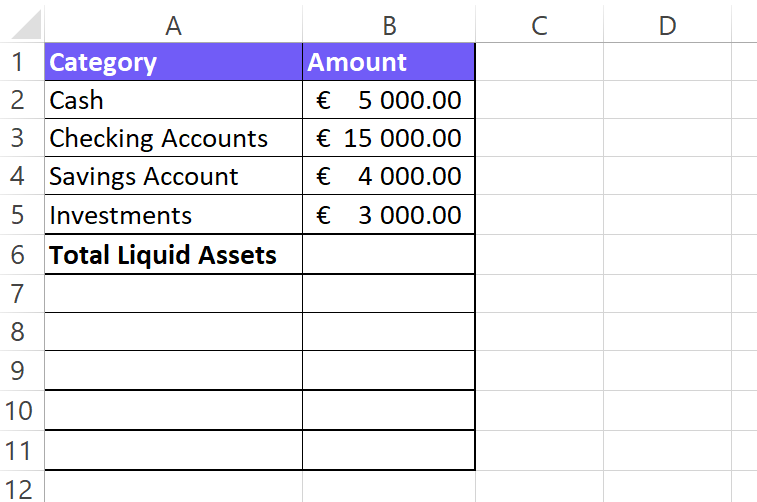

- List Your Liquid Assets

In the “Category” column, list all your liquid assets. Liquid assets are those that can be easily converted to cash quickly, typically within a short period (e.g., a few days). Examples include: Checking account balance, Savings account balance, Emergency fund, Money market accounts

Certificates of Deposit (CDs) maturing within a year (since longer terms might have penalties for early withdrawal)

In the corresponding “Amount” column, enter each liquid asset’s current balance or value.

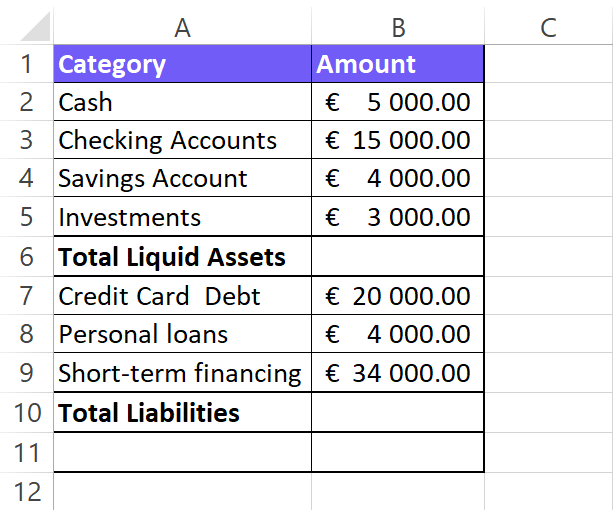

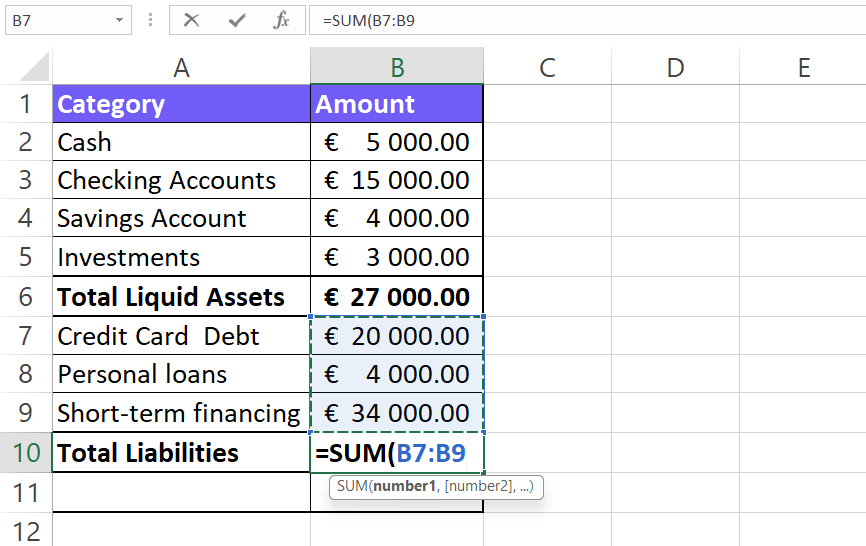

- Add up your liabilities

Move down to a new section in your spreadsheet and label it “Liabilities“.

In the “Description” column, list all your current debts or obligations. Examples include Credit card debt, Short-term loans, and Accounts payable (for businesses).

In the “Amount” column, enter the current outstanding balance for each liability.

- Calculate Totals

Use the SUM function in Excel to automatically calculate the total amount of your liquid assets and liabilities. Here’s how:

For Liquid Assets: In an empty cell below your list, type =SUM(. Click on the first cell containing the amount of your first liquid asset. Drag down to select all the cells containing your liquid asset amounts. Close the parenthesis “)” and press Enter. This will display the total value of your liquid assets. Repeat the same process for your liabilities, using a separate cell to house the SUM formula for the total liabilities amount.

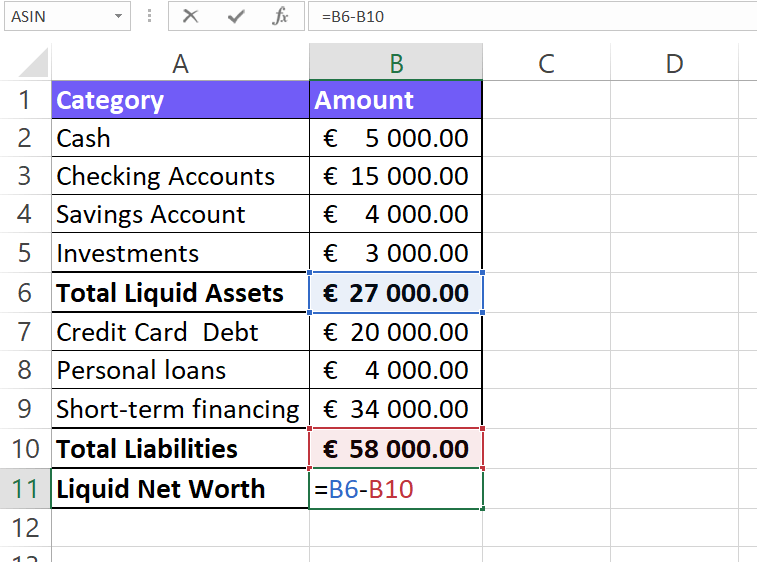

- Subtract your liabilities from your liquid assets

In a new cell, simply subtract your total liabilities from your total liquid assets. You can use the formula:

= [Total Liquid Assets cell] - [Total Liabilities cell].

This final number represents your Liquid Net Worth, which reflects your immediate financial flexibility.

Additional Tips:

- You can format your spreadsheet for better readability. Apply currency formatting to the “Amount” column.

- Consider adding a date at the top of your spreadsheet to track your liquid net worth over time. You can create a new sheet for each month or quarter and repeat the process to monitor changes.

- Remember to update your spreadsheet regularly as your assets and liabilities change.

Example

For example, let’s say you have $10,000 in cash, $20,000 in your savings account, and $5,000 in a checking account. Your total liquid assets would be $35,000. If you also have $10,000 in credit card debt, your liquid net worth would be $25,000 ($35,000 – $10,000).

Tips:

- It’s a good idea to track your liquid net worth regularly. This will help you monitor your financial progress and make better financial decisions.

- When calculating the value of your marketable securities, consider including a buffer for potential market fluctuations to get a more realistic picture of your immediate convertibility to cash.

- Your liquid net worth is just one aspect of your overall financial health. It doesn’t take into account non-liquid assets like your car or house, or your retirement savings. You may also want to calculate your total net worth, which includes all of your assets and liabilities.

Download Liquid Net Worth Calculator in Excel Template

Download your Liquid Net Worth Calculator in Excel below 👇

Calculating Liquid Net. Why it matters?

Calculating your liquid net worth offers several benefits that can empower you to make informed financial decisions. Here are some key advantages:

- Gauges your financial preparedness: Liquid net worth acts as a barometer for your ability to handle immediate financial needs. A higher number indicates a stronger safety net in case of emergencies like job loss, unexpected medical bills, or car repairs.

- Improves financial decision-making: Understanding your liquid assets and liabilities lets you make informed choices about spending, saving, and debt management. You can prioritize building your emergency fund and focus on paying off high-interest debts to improve your overall financial health.

- Reduces financial stress: Knowing you have a financial buffer can significantly reduce stress and anxiety. A strong liquid net worth provides peace of mind, knowing you can handle unforeseen situations without financial hardship.

- Helps with short-term financial goals: Liquid net worth is particularly helpful when planning for short-term goals like a down payment on a car, a vacation, or home renovations. It gives you a realistic picture of the readily available funds you can use towards these goals.

- Motivates healthy financial habits: Tracking your liquid net worth over time allows you to monitor your progress. Seeing an increase in your liquid net worth can be a great motivator to stay on track with your financial goals and continue making sound financial decisions.

FAQ

It depends on your goals. Aim for at least once or twice a year. For more frequent monitoring (e.g., building emergency fund), consider quarterly or monthly calculations.

There’s no one-size-fits-all answer, but a good rule of thumb is to have 3-6 months of living expenses saved in liquid assets. This provides a buffer for emergencies or unexpected costs.

Focus on two areas: Increase savings and reduce high-interest debt. Boost savings by cutting expenses or increasing income. Pay down credit cards or high-interest loans to free up more cash flow for building your liquid assets.

Other calculators

Setup and monitor your KPIs regularly using Ajelix BI