- Home

- Product

- Tools

- AI Data Analyst

- Excel Formula Generator

- Excel Formula Explainer

- Google Apps Script Generator

- Excel VBA Script Explainer

- AI VBA Code Generator

- Excel VBA Code Optimizer

- Excel VBA Code Debugger

- Google Sheets Formula Generator

- Google Apps Script Explainer

- Google Sheets Formula Explainer

- Google Apps Script Optimizer

- Google Apps Script Debugger

- AI Excel Spreadsheet Generator

- AI Excel Assistant

- AI Graph Generator

- Pricing

- Home

- Blog

- Calculators

- Free IRR Calculator: Calculate Internal Rate of Return

Free IRR Calculator: Calculate Internal Rate of Return

Explore other articles

- Google Sheets AI Agents That Autonomously Perform Tasks

- Advanced Agentic Research With AI Agents

- GLM-5 is Now Available on Ajelix AI Chat

- AI Spreadsheet Generator: Excel Templates With AI Agents

- Excel Financial Modeling With AI Agents (No Formulas Need!)

- AI Landing Page Generator: From 0 To Stunning Page With Agent

- Creating Charts In Excel with Agentic AI – It Does Everything!

- Create Report From Google Sheets Data with Agentic AI

- How To Create Powerpoint Presentation Using AI Agent (+Video)

- Ajelix Launches Agentic AI Chat That Executes Business Workflows, Not Just Conversation

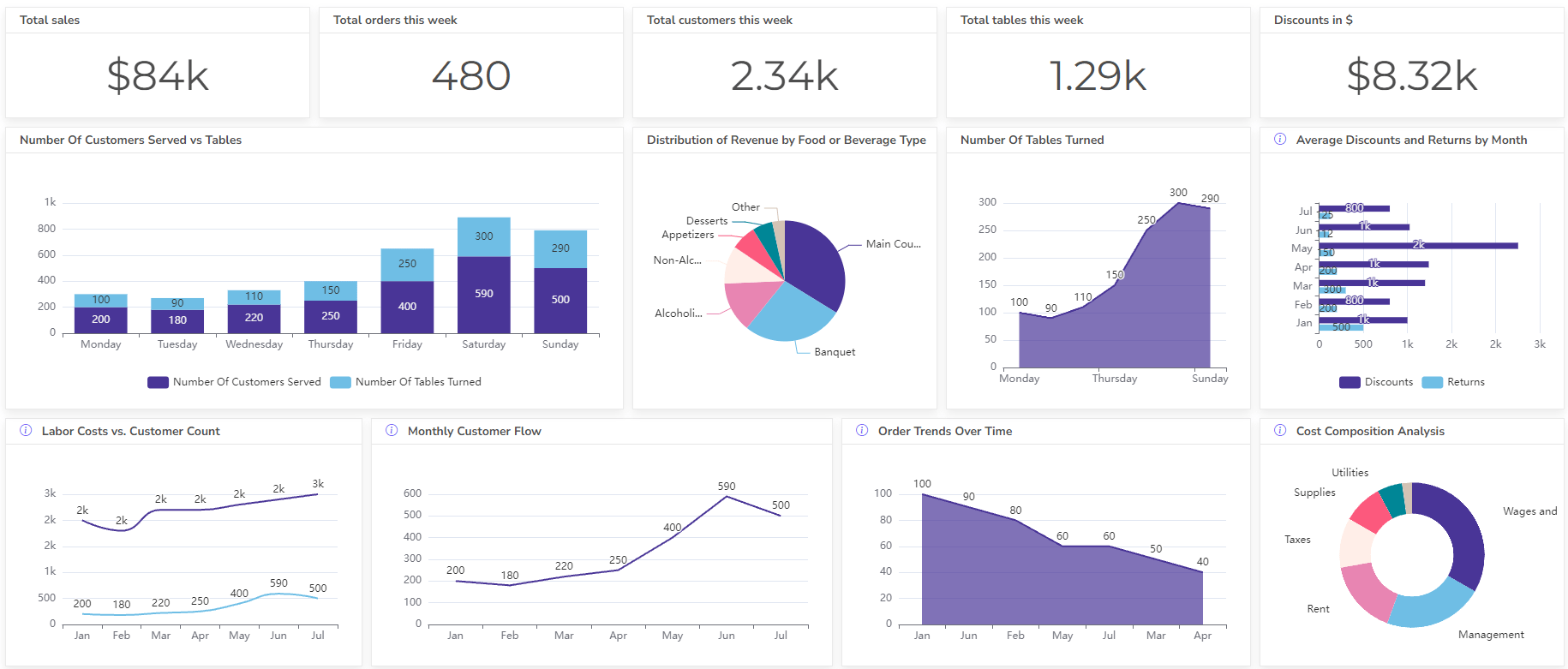

Set up dashboard & track KPIs

An IRR calculator is a tool that helps you determine the internal rate of return (IRR) for an investment. The IRR is the discount rate that makes the net present value (NPV) of all your cash flows zero. In simpler terms, it tells you the expected annualized return on your investment.

Calculate Internal Rate of Return

What is IRR?

IRR stands for Internal Rate of Return. It’s a financial metric used to estimate an investment’s profitability. It considers all your cash flows (both positive and negative) and tells you the discount rate that makes their net present value zero.

IRR Formula

IRR = (Future Value ÷ Present Value)^(1 ÷ Number of Periods) – 1

This formula represents the discount rate where the future value of the investment divided by the present value, raised to the power of 1 divided by the number of investment periods, minus 1, equals the IRR.

What is Future Value (FV)?

FV is the total cash you expect to receive at the end of your investment period. It considers any income generated by the investment with the initial investment amount you get back.

What is Present Value (PV)?

PV represents the initial cost of your investment. It’s the amount you’re putting in today to get future returns.

What is the Number of Periods?

A number of periods in the IRR formula is the total number of periods your investment will be active. This could be years, months, quarters, etc., depending on your cash flow schedule.

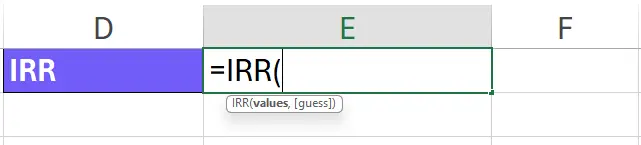

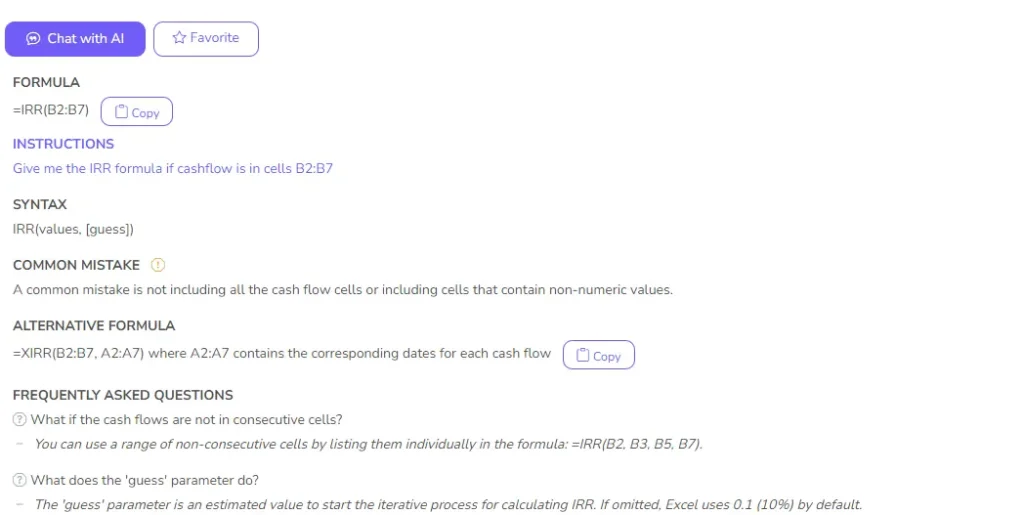

IRR Formula Excel

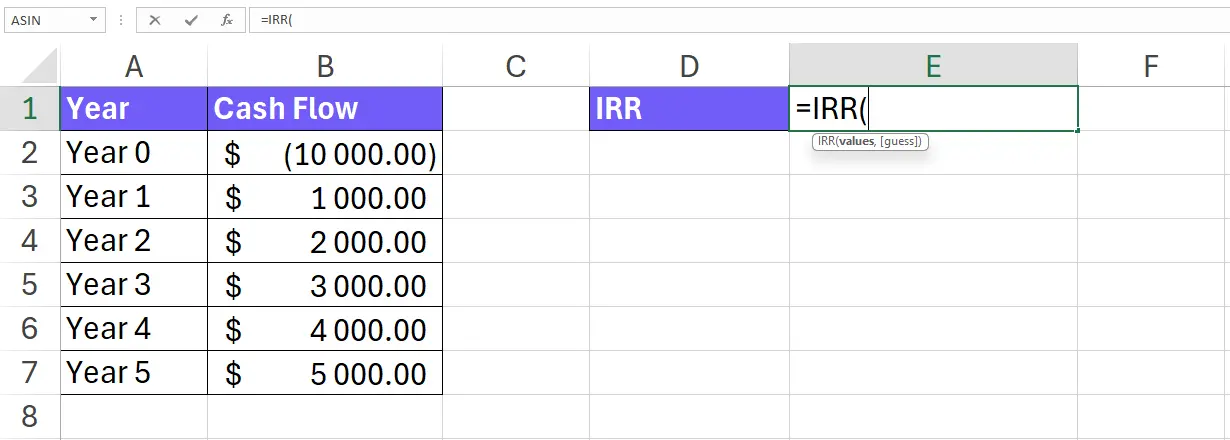

Excel provides a built-in function for calculating IRR: =IRR(values, [guess])

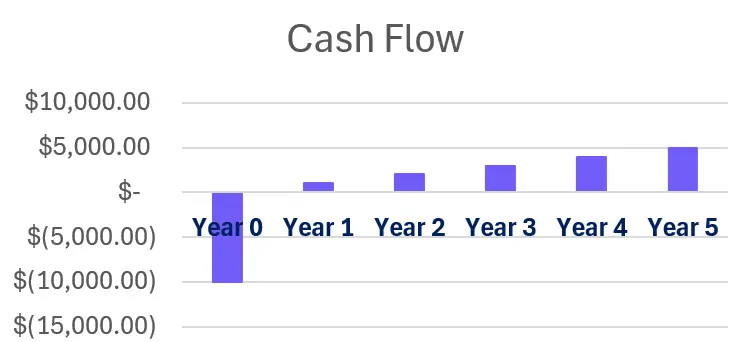

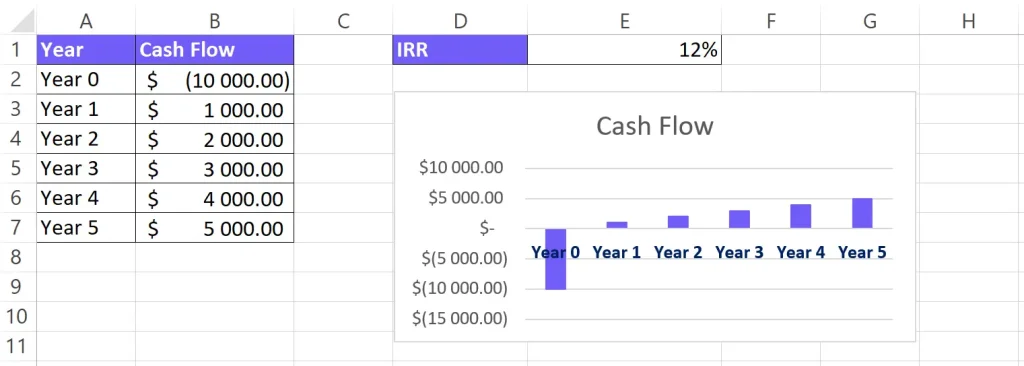

Screenshot with IRR formula in Excel, image by author

Here’s a breakdown of the function:

=IRR(: This signifies the beginning of a formula in Excel.values: This is a required argument. It refers to the range of cells containing your cash flow data. The cash flows should be listed chronologically, with the initial investment (usually negative) at the beginning.[guess]: This is an optional argument. It allows you to provide an initial guess for the IRR value. This guess can help the function converge on the solution faster, especially for complex scenarios. If omitted, Excel will use a default guess of 10%.

Key Points about IRR in Excel:

- Iterative Calculation: Excel uses an iterative process to find the IRR. It starts with your guess (or the default 10%) and adjusts it until the net present value of the cash flows at that rate is very close to zero (within a specific tolerance).

- #NUM! Error: If Excel can’t find a solution after 20 tries, it will return a #NUM! error. This could indicate an invalid cash flow series or a bad guess for IRR (if provided).

- IRR vs. XIRR: Excel also offers the

XIRRfunction, which is more flexible as it allows you to specify uneven cash flow timings. However,IRRremains widely used for its simplicity when cash flows occur at regular intervals.

How to Calculate IRR in Excel?

Time needed: 5 minutes

Here’s a step-by-step guide on how to calculate IRR in Excel:

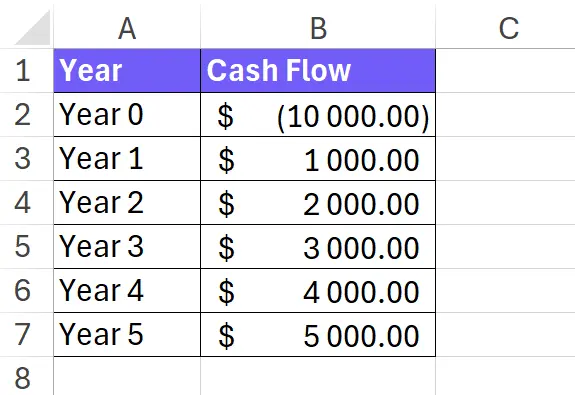

- Prepare Your Cash Flow Data

List your cash flows in a consecutive range of cells. The first cell (typically) should represent the initial investment, which is usually a negative value. Subsequent cells should represent the cash inflows or outflows for each period. Ensure your cash flows are listed chronologically, with the first period’s cash flow following the initial investment.

- Enter the IRR Formula

In an empty cell where you want the IRR result to be displayed, type the equal sign (

=) to begin the formula. Then, typeIRR(.

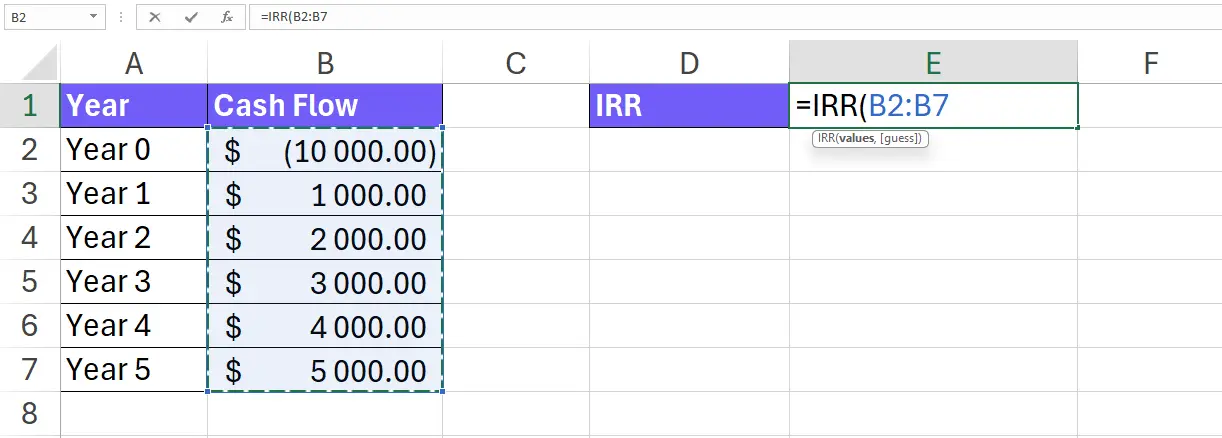

- Specify the Cash Flow Range

Inside the parentheses, enter the cell range containing your cash flow data. For example, if your cash flows are in cells B2 to B7, you would type

B2:B7.

- Add an Optional Guess

A guess for the IRR can help Excel find the solution faster, especially for complex scenarios.

You can add a comma followed by quotation marks and your estimated IRR value within the quotation marks. For instance, to use a 10% guess, you would type, "0.1".

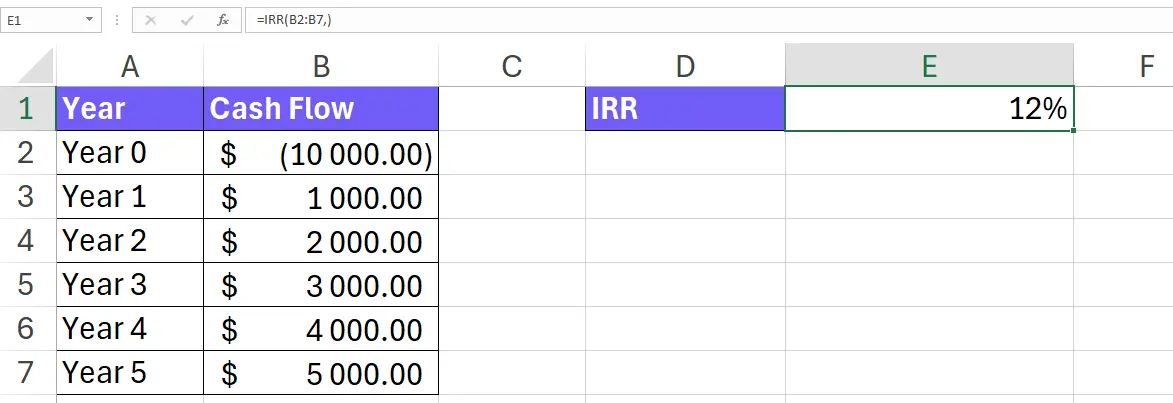

If you don’t provide a guess, Excel will use a default guess of 10%. - Complete the Formula and Press Enter

Close the parentheses

)after your cash flow range (and guess if provided). PressEnteron your keyboard.

- Visualize your cash flow

For better understanding visualize your cash flow in a chart. Select Year and Cashflow cells, go to insert, and pick from recommended charts. You can also create AI dashboards from your data using Ajelix BI. So you don’t have to share your Excel with stakeholders whenever you need to present data.

Additional Tips:

- Ensure your cash flow series includes both positive and negative values.

- If Excel returns a #NUM! error, it might indicate an invalid cash flow series or a bad guess for IRR. You can adjust your guess or review your cash flow data for errors.

- For cash flows with irregular timings, consider using the

XIRRfunction in Excel, which allows you to specify the timing of each cash flow.

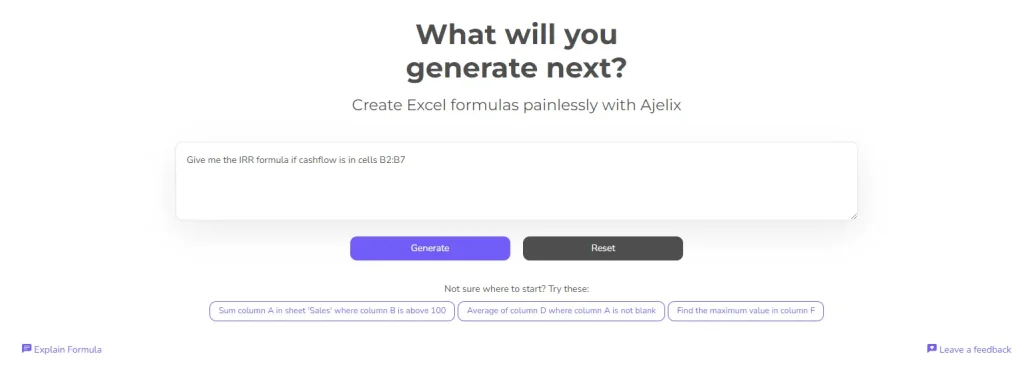

How To Generate Formulas With AI?

AI is making spreadsheet life easier by generating formulas based on your descriptions. This can help you save time and avoid errors by automating what could be complex formula building. Here’s a step-by-step guide to get started:

1. Create a free Ajelix account

Ajelix provides a suite of over 15 AI-powered tools to simplify spreadsheet tasks, including an Excel formula generator. Easy signup is available through Gmail or any email address.

Screenshot from Ajelix registration page, image by author

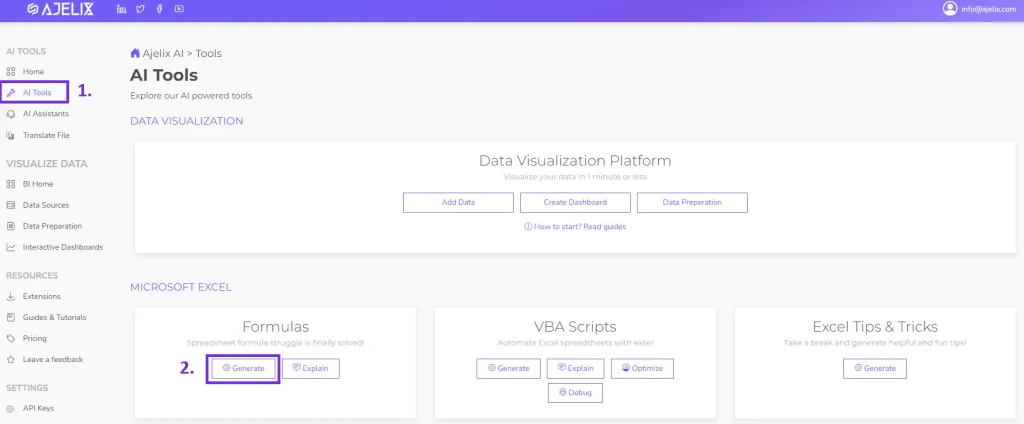

2. Locate the Formula generator tool

Within the Ajelix portal, the Excel formula generator can be accessed under the AI tools section.

Screenshot from Ajelix portal on how to find formula generator, image by author

3. Write a clear and concise prompt

The key to obtaining an accurate formula lies in providing a concise description of your desired outcome. For example, if you want to get the IRR formula, you would write: “Give me the IRR formula if cashflow is in cells B2:B7”.

Screenshot from Ajelix formula generator with IRR prompt, image by author

Here’s a rewrite of the prompt-writing tips with a more professional tone:

Crafting Effective Prompts for Accurate Formula Generation:

- Focus on the desired outcome: Move beyond generic requests like “I need a formula.” Instead, clearly define the calculation you want to achieve. For example, “Calculate the average sales amount in column B, considering only entries marked ‘Yes’ in column A (approved items).”

- Utilize cell references (if applicable): If your platform allows, specify the relevant cells or ranges by name. This provides the AI with a clearer understanding of the data involved. An example could be: “Calculate the total cost (column C) by multiplying the quantity (column A) with the corresponding price (column B).”

- Clearly articulate conditions: For formulas involving conditional logic, explain the conditions precisely. A good example: “In cell D2, display ‘Bonus’ if sales (column B2) exceed the target value (cell E1). Otherwise, return ‘No Bonus’.”

4. Get your formula

Upon providing your clear description, the AI tool will generate a ready-to-use formula applicable to your spreadsheet. For enhanced convenience, consider utilizing the Excel or Google Sheets add-on offered by the platform. This add-on can further streamline the formula writing process within your preferred spreadsheet software.

Screenshot from Ajelix with IRR formula result, image by author

Ready to give it a go?

Test AI tools with freemium plan and only upgrade if formula generator can help you!

Download IRR Excel Template

Screenshot from IRR Excel template

How does an IRR calculator work?

Online IRR calculator work similarly to the IRR function in Excel. They perform the same core calculation but handle the process behind the scenes. Here’s a breakdown of how they work:

Input:

You provide the cash flow data for your investment. This typically involves entering the initial investment amount and subsequent cash inflows or outflows for each period.

Calculation

- The calculator uses an iterative process to find the IRR. It starts with an initial guess (often 10%) and adjusts it until the net present value (NPV) of the cash flows at that rate is very close to zero.

- This iterative process is hidden from you. The calculator handles the complex calculations to arrive at the IRR.

Output

The calculator displays the IRR for your investment. This is the discount rate that makes the NPV of your cash flows zero, essentially representing the expected annualized return on your investment.

Advantages of Online Calculators

- Convenience: They are readily available and accessible from any device with an internet connection.

- User-friendly Interface: Most calculators offer a simple interface for entering your cash flow data.

- No Software Installation Required: You don’t need to have Excel or any other software installed.

What is a good IRR?

There isn’t a universally “good” IRR as it depends on several factors. Here’s a table summarizing how to interpret IRR based on context:

| IRR Range | Interpretation | Considerations |

|---|---|---|

| Below Cost of Capital | Not attractive | Investment’s expected return is lower than the minimum acceptable return for similar investments |

| Cost of Capital to Industry Average | May be acceptable, but not outstanding | Return is meeting or slightly exceeding the baseline return expected for the industry |

| Above Industry Average | Attractive | Investment’s expected return is higher than the typical return for similar investments |

Additional Factors to Consider:

- Risk of Investment: Higher risk investments generally require a higher IRR to compensate for the increased risk.

- Investment Horizon: Long-term investments can potentially tolerate lower IRRs as they benefit from compounding returns over time.

- Alternatives Available: Compare the IRR to other investment options with similar risk profiles.

IRR By industry

| Industry | Average IRR |

|---|---|

| General | 14.91% |

| IT | 13.32% |

| Finance | 12.68% |

| Utility | 3.56% |

| Resource | 1.58% |

Source of table: Performance in Private Equity: Why are General Partnerships’ Owners Important? – Scientific Figure on ResearchGate.

Remember: IRR is a useful metric, but it shouldn’t be the sole factor in making investment decisions. Consider other factors like the investment’s risk profile, your overall financial goals, and alternative investment options.

What are the benefits of using IRR?

There are several benefits to using IRR (Internal Rate of Return) calculations for evaluating potential investments:

- Considers Time Value of Money: Unlike payback period methods, IRR recognizes that a dollar today is worth more than a dollar tomorrow. It factors in the time value of money by discounting future cash flows to their present value, providing a more accurate picture of an investment’s profitability.

- Compares Investments: IRR allows you to compare different investment options with varying cash flow patterns. By having a single profitability metric (IRR), you can assess which investment offers a potentially better return on your investment.

- Simple to Understand: The IRR itself is a single percentage value, making it relatively easy to understand and interpret, especially compared to more complex financial metrics. This can be helpful for making initial investment decisions.

- No Required Hurdle Rate: IRR doesn’t require you to pre-define a hurdle rate (minimum acceptable return). Instead, it calculates the discount rate that makes the NPV zero, allowing you to compare the IRR to your own cost of capital or industry benchmarks.

| Benefit | Description |

|---|---|

| Considers Time Value of Money | Provides a more accurate picture of profitability by accounting for the time value of money. |

| Compares Investments | Allows for comparison of different investments with varying cash flow patterns. |

| Simple to Understand | IRR is a single percentage value, making it easy to interpret. |

| No Required Hurdle Rate | Doesn’t require pre-defining a minimum acceptable return. |

IRR limitations

- Multiple IRRs: In some cases, there can be multiple IRR values for a given cash flow series. This can make interpretation more complex.

- Ignores Cash Flow Timing: IRR doesn’t consider the specific timing of cash flows within an investment period.

- Not Risk-Adjusted: IRR doesn’t inherently account for investment risk. Higher-risk investments should generally have a higher IRR to compensate.

FAQ

While IRR is common, it has limitations. Consider alternatives like Net Present Value (NPV) which gives a dollar value of profitability, or Discounted Payback Period which shows how fast you recoup your investment (though it doesn’t consider all cash flows).

A high IRR suggests an investment’s expected return is more attractive compared to a low IRR. It essentially indicates a higher potential profit after considering the time value of money.

Yes, IRR should ideally be higher than your cost of capital. This means the investment’s return is greater than the minimum acceptable return you expect for similar risk investments.

A #NUM! error in Excel’s IRR function means it couldn’t find a valid IRR after 20 tries. This could indicate – issues with your cash flow data (e.g., missing values, invalid entries) or a bad guess for the IRR (if provided).

Other calculators

Setup and monitor your KPIs regularly using Ajelix BI