- Home

- Product

- Tools

- AI Data Analyst

- Excel Formula Generator

- Excel Formula Explainer

- Google Apps Script Generator

- Excel VBA Script Explainer

- AI VBA Code Generator

- Excel VBA Code Optimizer

- Excel VBA Code Debugger

- Google Sheets Formula Generator

- Google Apps Script Explainer

- Google Sheets Formula Explainer

- Google Apps Script Optimizer

- Google Apps Script Debugger

- AI Excel Spreadsheet Generator

- AI Excel Assistant

- AI Graph Generator

- Pricing

- Home

- Blog

- Calculators

- Free Gross Profit Margin Calculator Online

Free Gross Profit Margin Calculator Online

Explore other articles

- Google Sheets AI Agents That Autonomously Perform Tasks

- Advanced Agentic Research With AI Agents

- GLM-5 is Now Available on Ajelix AI Chat

- AI Spreadsheet Generator: Excel Templates With AI Agents

- Excel Financial Modeling With AI Agents (No Formulas Need!)

- AI Landing Page Generator: From 0 To Stunning Page With Agent

- Creating Charts In Excel with Agentic AI – It Does Everything!

- Create Report From Google Sheets Data with Agentic AI

- How To Create Powerpoint Presentation Using AI Agent (+Video)

- Ajelix Launches Agentic AI Chat That Executes Business Workflows, Not Just Conversation

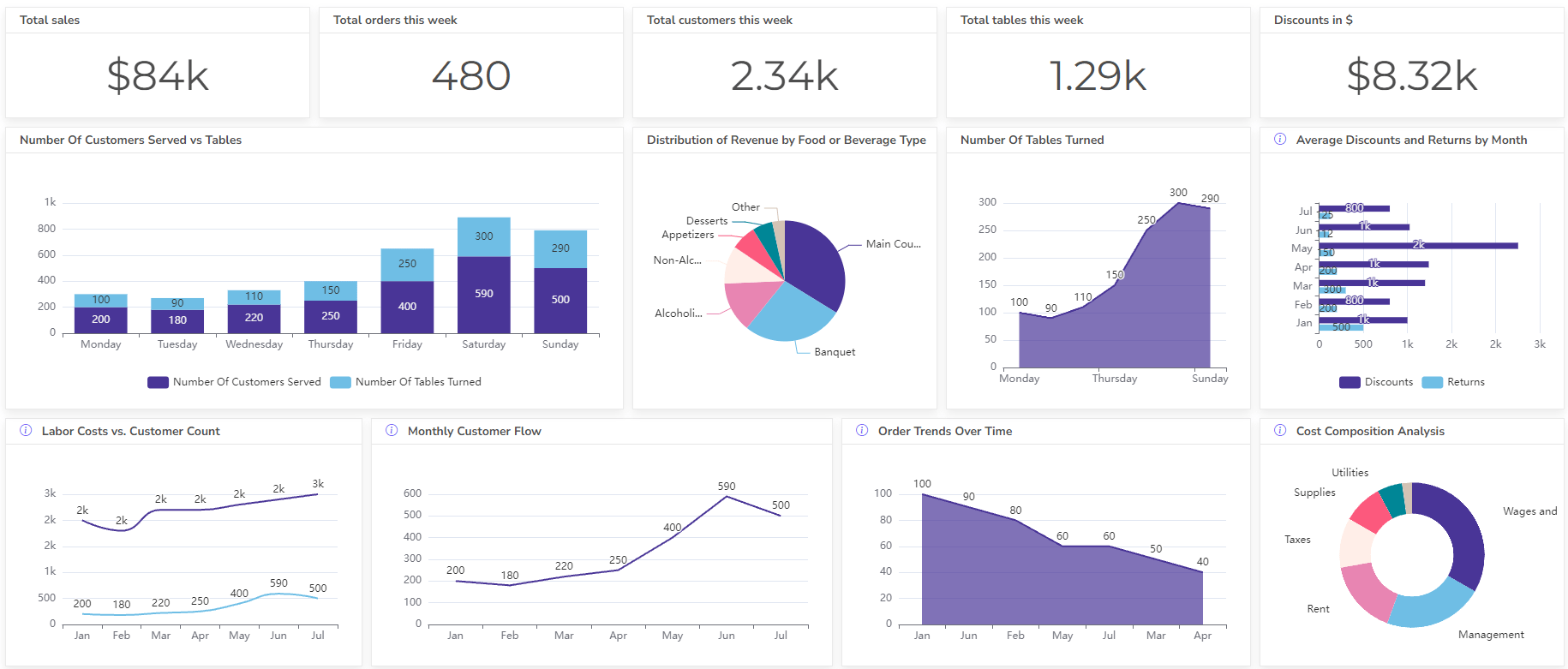

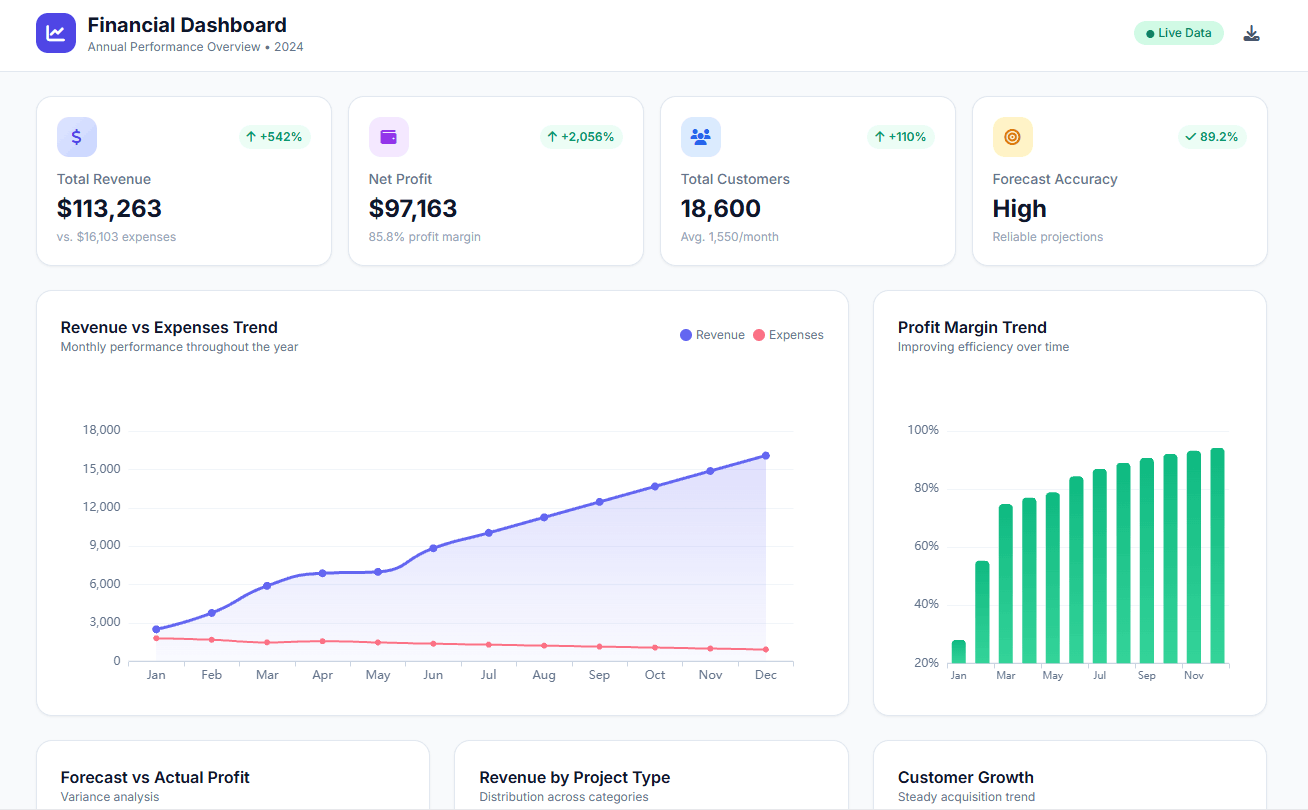

Set up dashboard & track KPIs

A gross profit margin calculator is a financial tool that tells you how much profit a company makes after covering the direct costs of producing the goods or services it sells.

Gross Profit Margin Formula

Gross Profit Margin = (Revenue – Cost of Goods Sold (COGS)) / Revenue x 100

Where:

- Revenue: The total amount from selling goods or services during a specific period.

- Cost of Goods Sold (COGS): The direct costs of producing the goods or services you sell. This includes raw materials, labor, and direct overhead.

Struggling with manual calculations & tiring setups?

Let agentic AI do the heavy lifting.

Start free

Fast sign up & easy setup

How To Calculate Gross Profit Margin?

Time needed: 5 minutes

- Find Revenue and Cost of Goods Sold

Locate these figures on the income statement for your desired period (month, quarter, or year).

- Subtract COGS from Revenue

This will give you your Gross Profit.

- Divide Gross Profit by Revenue

This will give you a decimal value.

- Multiply by 100 and express as a percentage

This is your Gross Profit Margin.

Example

Let’s say a bakery has the following figures for a month:

- Revenue: $20,000

- Cost of Goods Sold (COGS): $8,000

Now, let’s calculate the gross margin:

- Gross Profit = Revenue – COGS = $20,000 – $8,000 = $12,000

- Gross Profit Margin = ($12,000 / $20,000) x 100 = 0.6 x 100 = 60%

Therefore, the bakery’s margin is 60%. This signifies that for every dollar of revenue, the bakery keeps $0.60 as profit after covering the direct costs of producing the baked goods.

What is a good gross profit Margin rate?

There’s no single “good” gross profit margin that applies across all industries. It can vary significantly depending on the:

- Industry: Businesses that manufacture complex products with a high cost of materials might naturally have lower gross profit margins compared to service industries.

- Business Model: Some businesses, like discount retailers, might prioritize high sales volume with a lower profit per item, resulting in a lower gross profit margin.

Here’s a general guideline to keep in mind:

- 50% to 70%: This range is often considered healthy for many businesses like retailers, restaurants, manufacturers, and other producers of goods. It indicates a good balance between production costs and revenue.

- Below 50%: This could be cause for concern, especially if your industry average is higher. It might suggest inefficiencies in production or pricing strategies that must be addressed.

- Above 70%: This can be a positive sign, but ensuring you’re not sacrificing sales volume for higher profit margins is important.

the difference between gross and net profit margin

Profit margins tell you how much profit you earn from sales. Gross Profit Margin measures efficiency in converting sales to profit from the product itself. It considers only direct production costs (think ingredients for your bakery). However, a Net Profit Margin shows how much profit remains after ALL expenses (rent, salaries, taxes) are covered.

Other calculators

Setup and monitor your KPIs regularly using Ajelix BI