- Home

- Product

- Tools

- AI Data Analyst

- Excel Formula Generator

- Excel Formula Explainer

- Google Apps Script Generator

- Excel VBA Script Explainer

- AI VBA Code Generator

- Excel VBA Code Optimizer

- Excel VBA Code Debugger

- Google Sheets Formula Generator

- Google Apps Script Explainer

- Google Sheets Formula Explainer

- Google Apps Script Optimizer

- Google Apps Script Debugger

- AI Excel Spreadsheet Generator

- AI Excel Assistant

- AI Graph Generator

- Pricing

- Home

- Blog

- Calculators

- Free EBITDA Calculator Online: Calculate Margin

Free EBITDA Calculator Online: Calculate Margin

Explore other articles

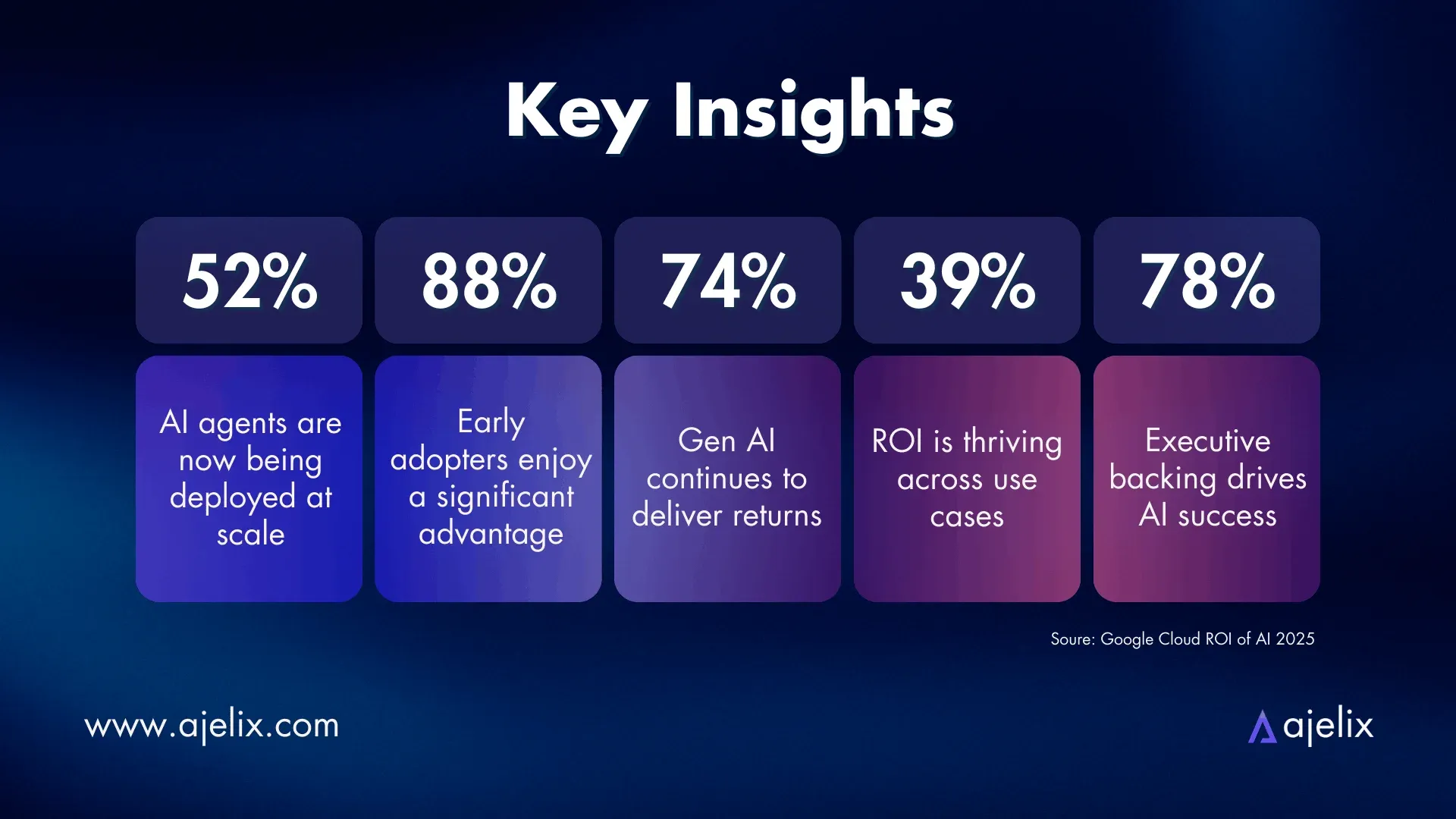

- What AI Studies Say About Agentic AI ROI & Stats (And What They Don’t)

- Google Sheets AI Agents That Autonomously Perform Tasks

- Advanced Agentic Research With AI Agents

- GLM-5 is Now Available on Ajelix AI Chat

- AI Spreadsheet Generator: Excel Templates With AI Agents

- Excel Financial Modeling With AI Agents (No Formulas Need!)

- AI Landing Page Generator: From 0 To Stunning Page With Agent

- Creating Charts In Excel with Agentic AI – It Does Everything!

- Create Report From Google Sheets Data with Agentic AI

- How To Create Powerpoint Presentation Using AI Agent (+Video)

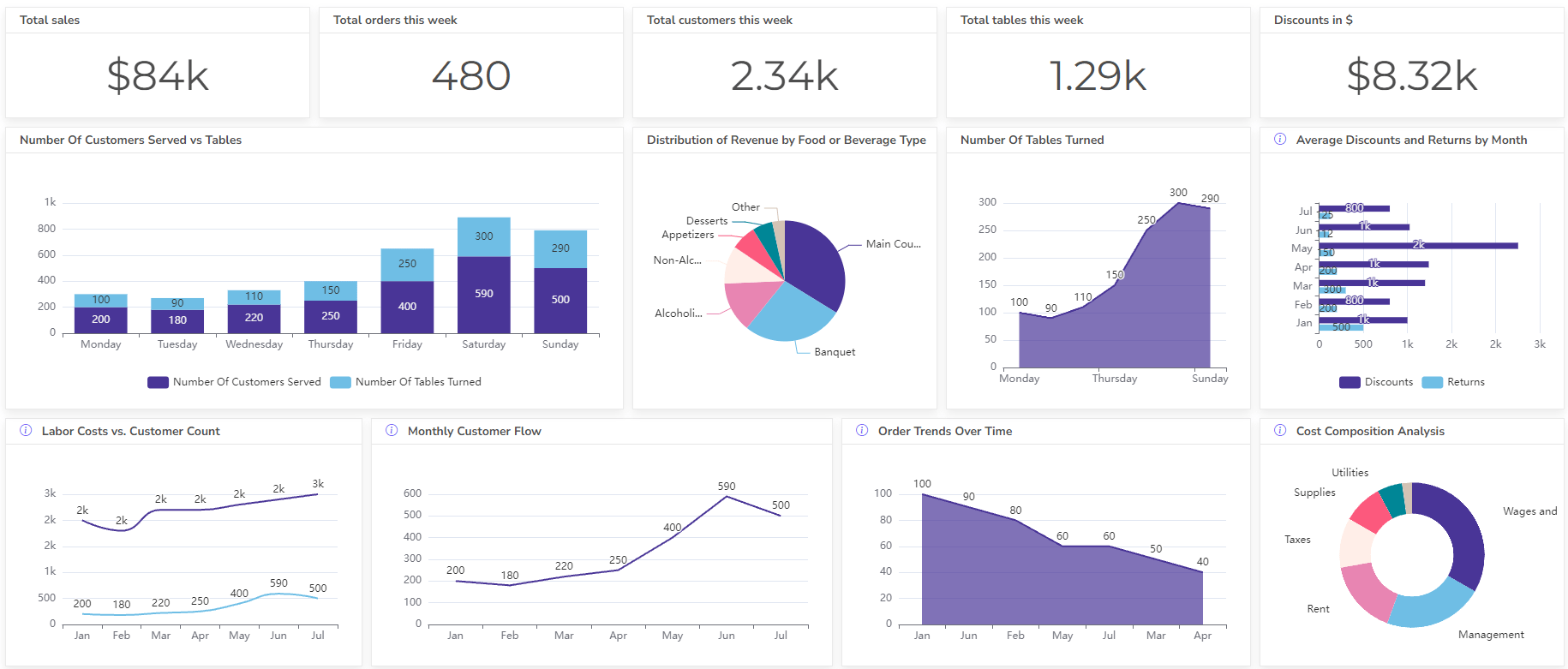

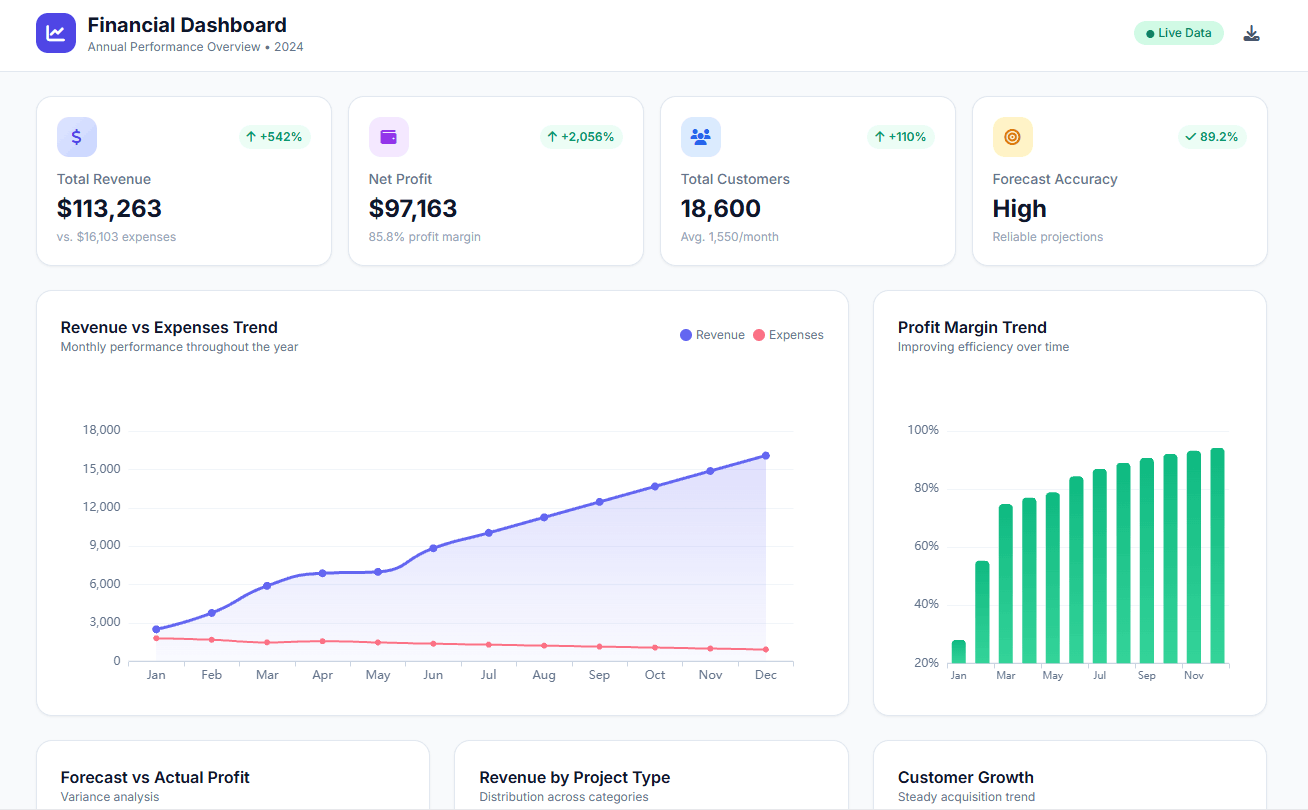

Set up dashboard & track KPIs

An EBITDA calculator is a tool that helps you calculate a company’s Earnings Before Interest, Taxes, Depreciation, and Amortization. It essentially simplifies the process of assessing a company’s core operating profit.

Struggling with manual calculations & tiring setups?

Let agentic AI do the heavy lifting.

Start free

Fast sign up & easy setup

What is EBITDA?

EBITDA, which stands for Earnings Before Interest, Taxes, Depreciation, and Amortization, is a financial metric used to assess a company’s operating profitability. It’s essentially a way to gauge how well a company generates cash flow from its core business activities, independent of its financing choices, tax situation, and accounting decisions related to asset depreciation and intangible asset amortization.

Here’s a breakdown of why each element is excluded in EBITDA:

- Interest: This reflects the cost of borrowing money, which isn’t directly related to a company’s core operations.

- Taxes: Tax rates can vary depending on location and industry, so they don’t necessarily reflect a company’s operational efficiency.

- Depreciation: This is an accounting expense that reflects the wear and tear of tangible assets over time. It’s not a direct cash outflow, but rather an allocation of the asset’s cost.

- Amortization: Similar to depreciation, amortization spreads the cost of intangible assets (like patents or trademarks) over their useful life. Again, it’s not a cash expense.

By removing these items, EBITDA aims to provide a more standardized measure of a company’s ability to generate cash flow from its core operations. This can be useful for comparing companies across different industries or with varying capital structures (debt vs equity financing).

EBITDA Formula

There are two main ways to calculate EBITDA, also known as Earnings Before Interest, Taxes, Depreciation, and Amortization:

- Starting from Net Income:

This method involves adding back non-cash expenses to net income. The formula is:

- EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

Here, net income is a figure you’ll find on the income statement, while interest, taxes, depreciation, and amortization are typically listed separately.

- Starting from Operating Income:

This method focuses on a company’s core operating performance. The formula is:

- EBITDA = Operating Income + Depreciation + Amortization

Operating income, also known as EBIT (Earnings Before Interest and Taxes), represents a company’s profit from its core operations after accounting for expenses like cost of goods sold and operating expenses. You can find this figure on the income statement as well.

Both methods will give you the same result for EBITDA. The choice of formula may depend on what information is readily available to you.

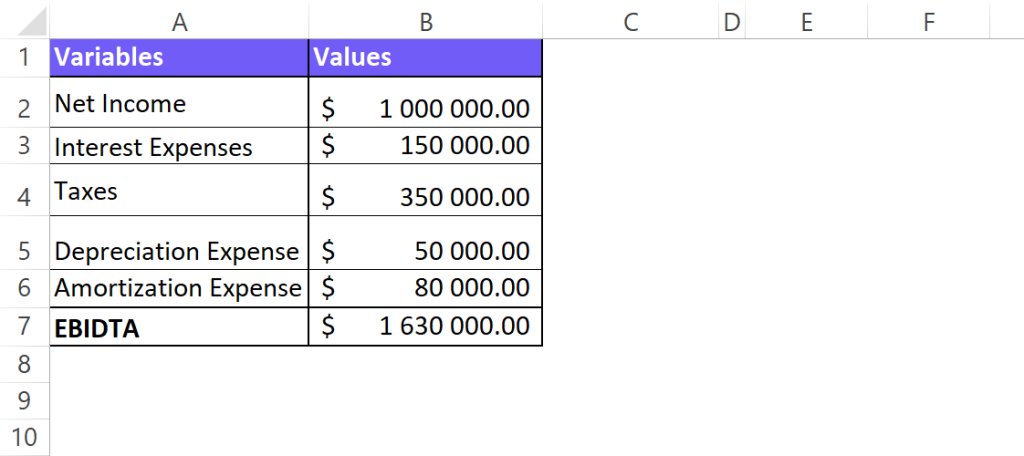

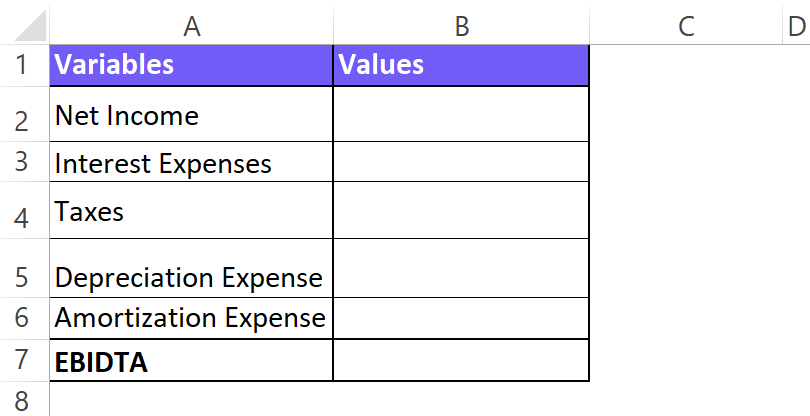

How To Calculate EBITDA? (In Excel)

Time needed: 5 minutes

Here’s how to calculate EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) in Excel:

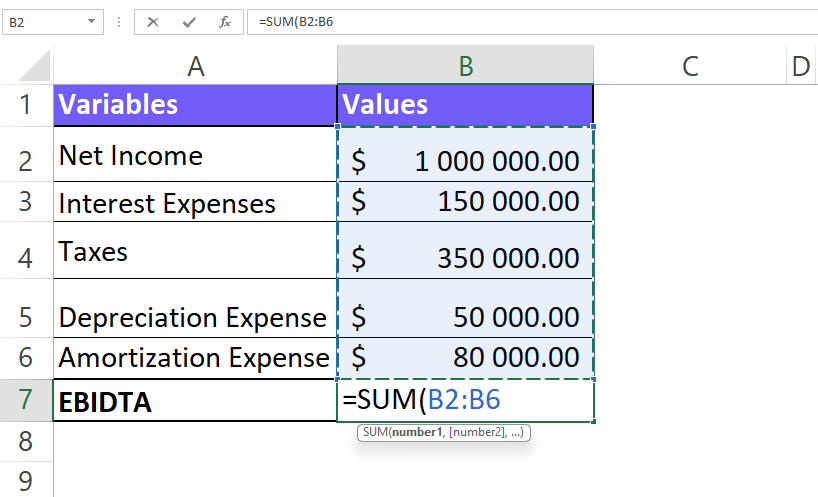

- Prepare your data

Open a new Excel workbook and create a worksheet for your calculations.

Label your columns with appropriate headers like “Description,” “Amount,” etc.

- Input your financial data

List down the relevant financial figures you’ll need for the EBITDA calculation. Here’s what you’ll typically include:

Net Income: This should be a readily available figure on the income statement.

Interest Expense: Look for this line item on the income statement. It represents the cost of borrowing money.

Taxes: This could be income tax expense or total tax expense, depending on your income statement format.

Depreciation Expense: This figure might be on the income statement or the statement of cash flows (look for depreciation and amortization expense).

Amortization Expense: Similar to depreciation, you might find this on the income statement or cash flow statement.

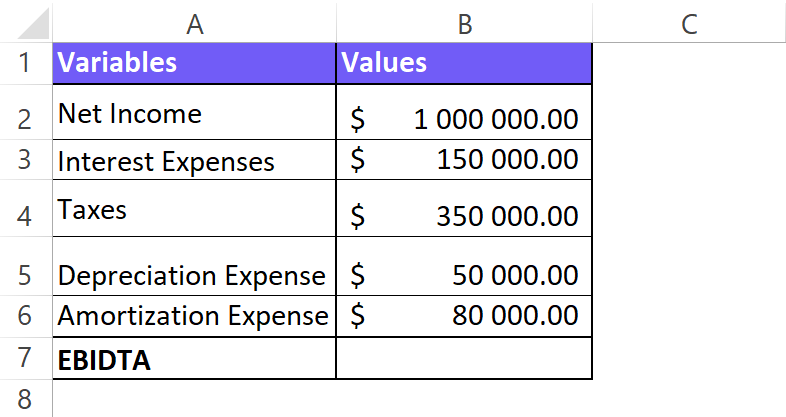

- Apply the EBITDA formula

There are two ways to calculate EBITDA in Excel, depending on the information you have available. This example will showcase calculations starting from Net Income. In a blank cell, enter the following formula, replacing the cell references with the actual locations of your data: = Net Income + Interest Expense + Taxes + Depreciation Expense + Amortization Expense

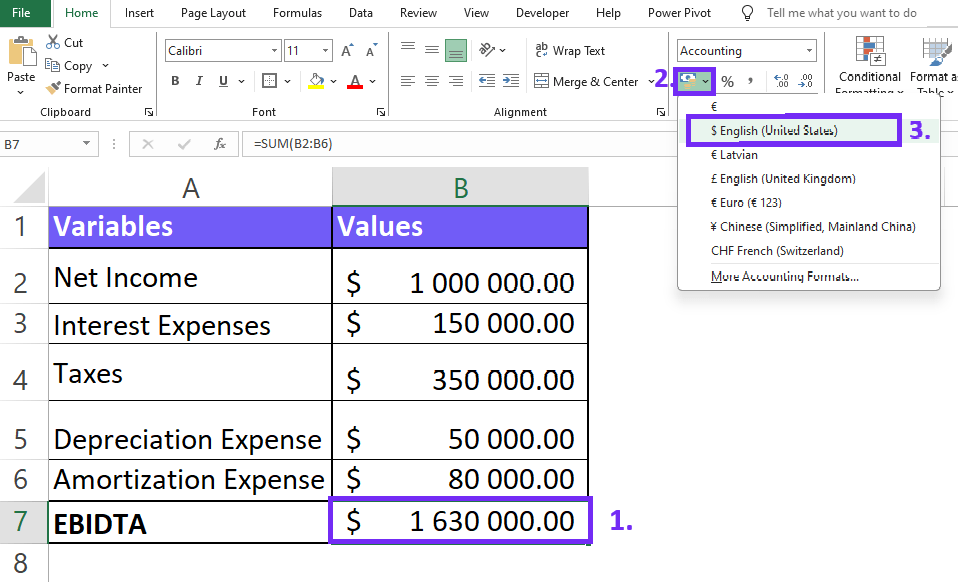

- Calculate the EBITDA

Press Enter after entering the formula. Excel will calculate the EBITDA based on the provided figures.

- Format the cell

You can format the cell containing the EBITDA value to display it as currency. Go to the Excel home toolbar, find “Number” settings, and choose the appropriate currency format.

Download EBITDA Calculator In Excel Template

Get your Excel EBITDA Calculator below 👇

FAQ

EBITDA tells you about a company’s core operating profitability, excluding the impact of financing choices, taxes, and asset depreciation. It shows how well a company generates cash flow from its main business activities.

There’s no one-size-fits-all answer for a “good” EBITDA margin. It depends on the industry. However, a margin above 10% is generally considered positive.

To effectively compare EBITDA between companies, focus on those within the same industry, as profitability can vary greatly across sectors. It’s also helpful to look at EBITDA margin, which divides EBITDA by revenue, to account for company size.

EBITDA skips factors like financing costs (interest) and taxes, so it can overstate a company’s cash flow capabilities. It also doesn’t reflect cash needed for new equipment (capital expenditures).

Other calculators

Setup and monitor your KPIs regularly using Ajelix BI