- Home

- Product

- Tools

- AI Data Analyst

- Excel Formula Generator

- Excel Formula Explainer

- Google Apps Script Generator

- Excel VBA Script Explainer

- AI VBA Code Generator

- Excel VBA Code Optimizer

- Excel VBA Code Debugger

- Google Sheets Formula Generator

- Google Apps Script Explainer

- Google Sheets Formula Explainer

- Google Apps Script Optimizer

- Google Apps Script Debugger

- AI Excel Spreadsheet Generator

- AI Excel Assistant

- AI Graph Generator

- Pricing

- Home

- Blog

- Calculators

- Customer Retention Rate Calculator (Free & Online)

Customer Retention Rate Calculator (Free & Online)

Explore other articles

- Google Sheets AI Agents That Autonomously Perform Tasks

- Advanced Agentic Research With AI Agents

- GLM-5 is Now Available on Ajelix AI Chat

- AI Spreadsheet Generator: Excel Templates With AI Agents

- Excel Financial Modeling With AI Agents (No Formulas Need!)

- AI Landing Page Generator: From 0 To Stunning Page With Agent

- Creating Charts In Excel with Agentic AI – It Does Everything!

- Create Report From Google Sheets Data with Agentic AI

- How To Create Powerpoint Presentation Using AI Agent (+Video)

- Ajelix Launches Agentic AI Chat That Executes Business Workflows, Not Just Conversation

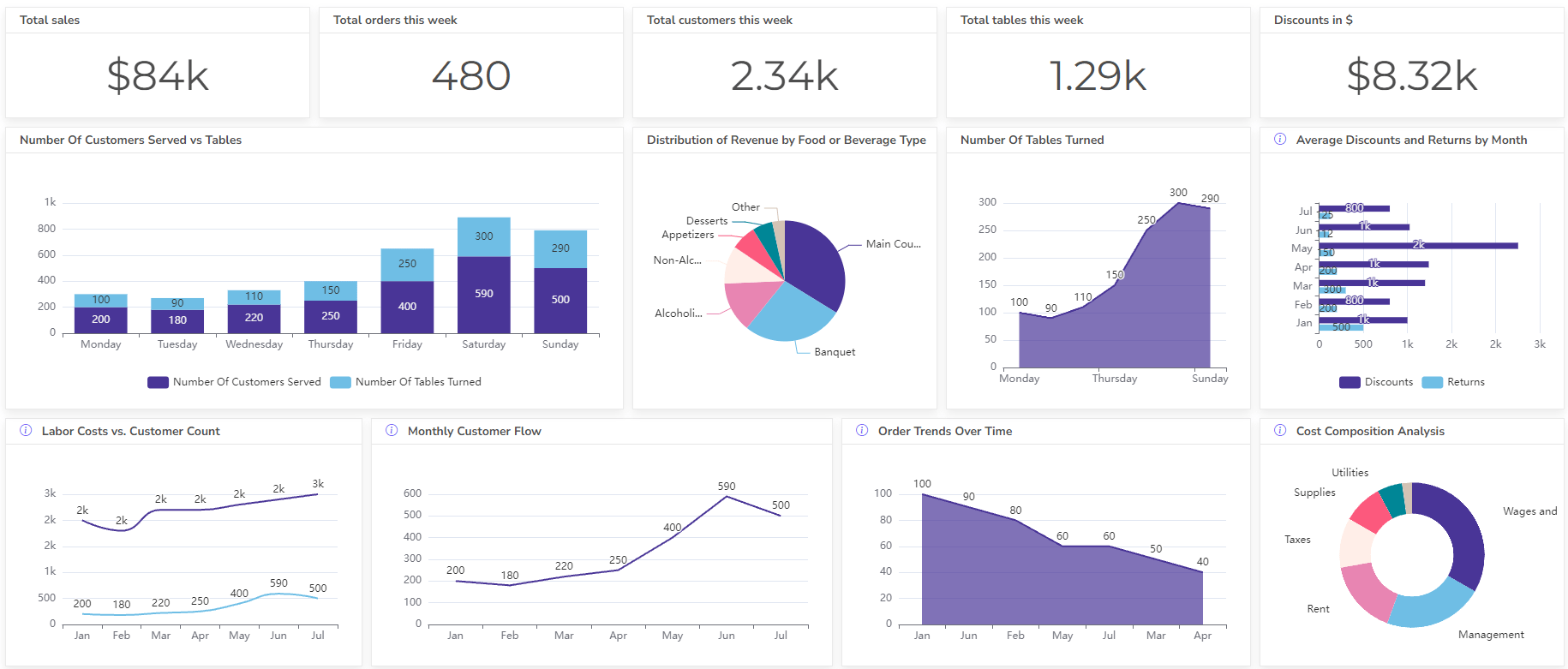

Set up dashboard & track KPIs

The customer retention rate calculator can help you determine what percentage of your customers stay with you over a specific period. A high retention rate indicates a strong customer base and a healthy business.

Calculate Customer Retention Rate

Customer Retention Rate Formula

Customer Retention Rate (CRR) = (Number of Customers at End of Period – Number of New Customers Acquired During Period) / Number of Customers at Start of Period

You might also want to use the customer acquisition cost calculator.

Where:

- Number of Customers at End of Period: The total number of customers you have at the end of the chosen period (month, quarter, year, etc.)

- Number of New Customers Acquired During Period: The total number of new customers you acquired during the specific period.

- Number of Customers at Start of Period: The total number of customers you had at the beginning of the chosen period.

How To Calculate Customer Retention?

Time needed: 5 minutes

Here’s a step-by-step guide on how to calculate your customer retention rate

- Define the timeframe

Decide on the specific period for which you want to calculate the retention rate. This timeframe should align with your business cycle. Common options include months, quarters, or years.

- Gather customer data

You’ll need three pieces of data from your customer relationship management (CRM) system or other relevant sources for the chosen timeframe: Existing customers, new customers acquired, and the number of customers at the end of the period.

- Apply the formula

Once you have collected the data, use the following formula to calculate the CRR: Customer Retention Rate (CRR) = (Customers at End of Period – New Customers Acquired) / Number of Customers at Start of Period x 100%

- Interpret the results

The resulting percentage represents your customer retention rate for the chosen timeframe. A higher retention rate indicates a stronger customer base and a healthier business. Generally, you want to see a positive CRR, but what constitutes a “good” retention rate can vary depending on your industry.

Watch a video on how customer retention rate calculator to calculate this metric 👇

Example:

Let’s say you run a subscription service and want to calculate the CRR for the last month. Here’s what the process might look like:

- Timeframe: You define the timeframe as the previous month (March 2024).

- Customer Data:

- Starting Customers (S) = 100 (number of customers on March 1st)

- New Customers (N) = 20 (customers who subscribed in March)

- Ending Customers (E) = 110 (total customers at the end of March)

- Formula: CRR = ((110 – 20) / 100) x 100% = 90%

- Interpretation: Your CRR for March is 90%. This means that 90% of your customers from the beginning of the month remained subscribed by the end.

Additional Tips:

- You can calculate retention rates for different customer segments, product categories, or marketing channels to gain deeper insights into which areas perform better in terms of retention.

- Track your CRR over time to identify trends and measure the effectiveness of your customer retention strategies.

- Remember that a healthy retention rate can vary depending on your specific industry. However, a higher retention rate is generally preferable as it signifies a more sustainable customer base.

For more detailed analysis, you can use an AI analyst to chat about your data and extract advanced analytics, charts, and metrics simply using plain language.

Why Customer Retention Rate Matters

Measuring your customer retention rate (CRR) isn’t just a vanity metric. It’s a goldmine of insights that can boost your bottom line. Here’s how:

- Save Big, Earn More: It’s far cheaper to retain existing customers than acquire new ones. Plus, loyal customers tend to spend more, increasing your revenue stream. You can calculate the break-even point here.

- CLV: It’s All About Lifetime Value: CRR helps estimate how long customers stick around. This knowledge lets you maximize the revenue each customer brings in over their lifetime.

- Learn Why Customers Leave (and Stay): A dip in CRR might signal issues. Analyze it alongside other metrics to identify what’s causing churn and improve customer satisfaction.

- Beat the Competition: Loyal customers are your biggest advocates. A high CRR translates to a competitive edge, attracting new business through positive word-of-mouth.

- Data-Driven Decisions: CRR data empowers smarter choices across your business. From marketing campaigns to product development, you can allocate resources where they have the most impact.

Other calculators

Setup and monitor your KPIs regularly using Ajelix BI