- Home

- Data Visualization

- Tools

- AI Data Analyst

- Excel Formula Generator

- Excel Formula Explainer

- Google Apps Script Generator

- Excel VBA Script Explainer

- AI VBA Code Generator

- Excel VBA Code Optimizer

- Excel VBA Code Debugger

- Google Sheets Formula Generator

- Google Apps Script Explainer

- Google Sheets Formula Explainer

- Google Apps Script Optimizer

- Google Apps Script Debugger

- AI Excel Spreadsheet Generator

- AI Excel Assistant

- AI Graph Generator

- Pricing

- Resources

- Home

- Blog

- Calculators

- Free Net Profit Margin Calculator Online

Free Net Profit Margin Calculator Online

Explore other articles

- 7 Productivity Tools and AI Plugins for Excel

- Julius AI Alternatives: Top 5 Choices 2026

- No Code Analytics: Top Tools in 2026

- Automation Tools for Excel in 2026: Built-In & Third-Party

- 5 Healthcare Data Analytics Trends 2026

- Best Analytics Platform For Startups In 2026

- 15 Best AI Tools For Startups In 2026 We Tried

- 7 Best AI Tools for Excel Data Analysis (2026 Comparison)

- AI Data Intelligence For Workspace

- Conversational Analytics & AI

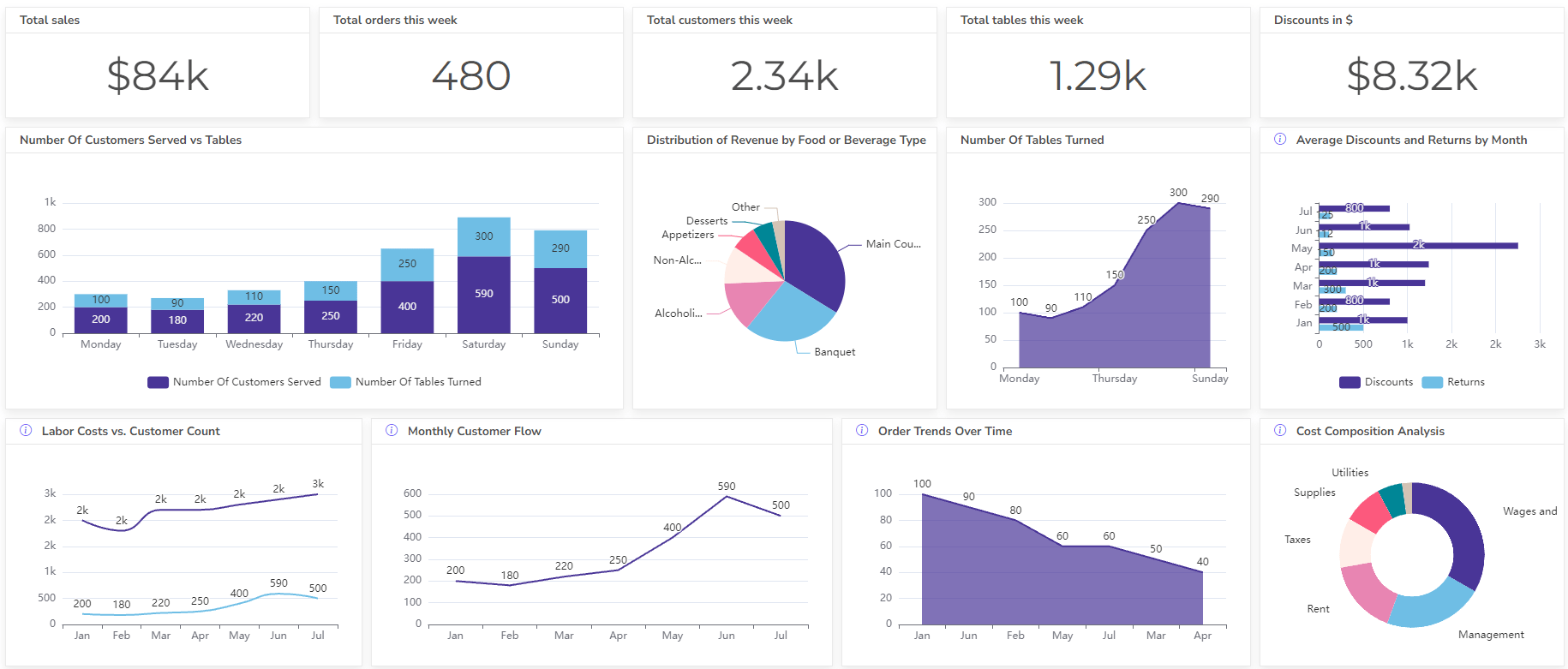

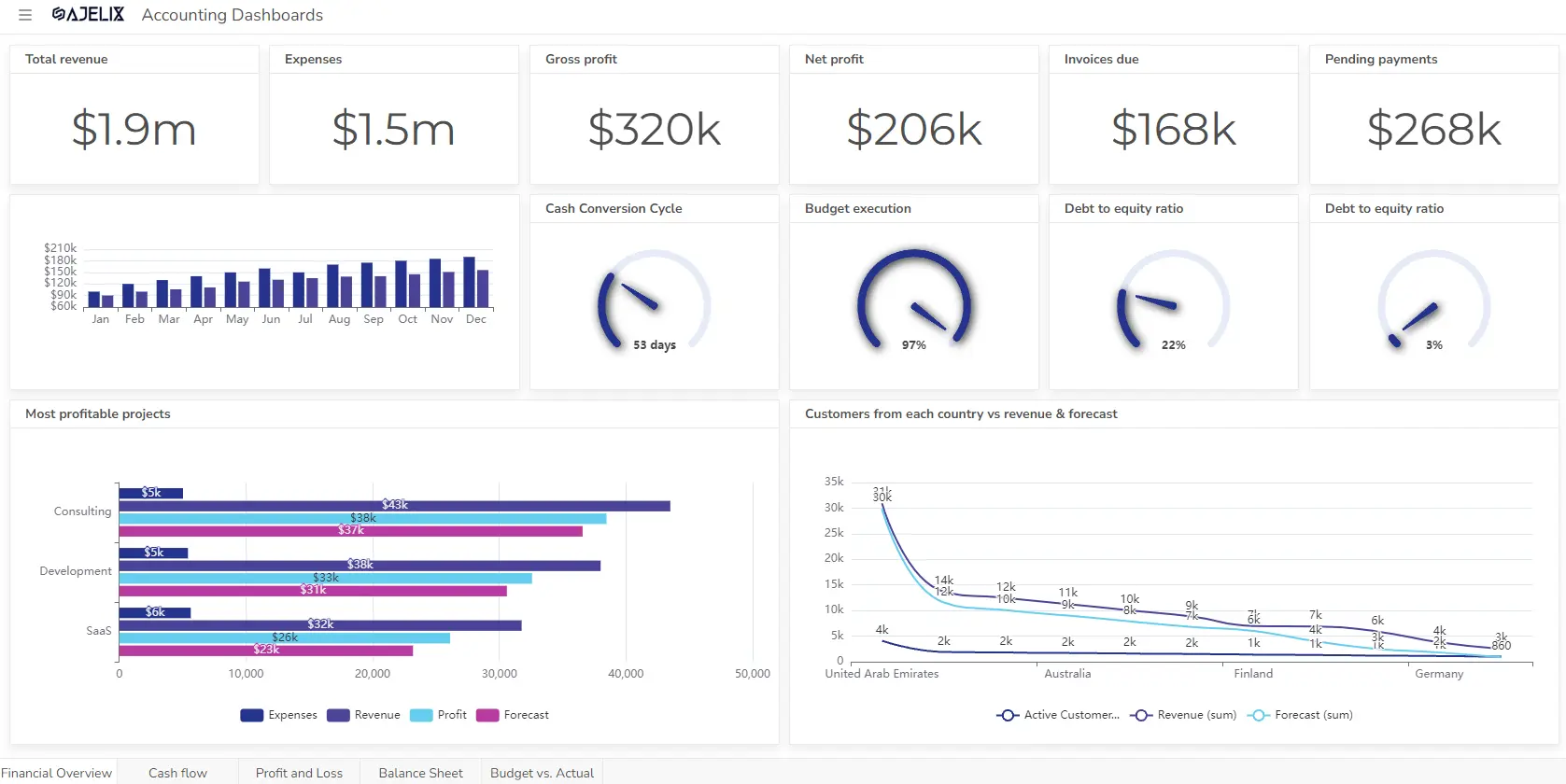

Set up dashboard & track KPIs

The Net Profit Margin Calculator is a financial tool that shows what portion of your sales revenue is left as a profit after covering all business expenses, including COGS, operating expenses, interest, and taxes.

Net Profit Margin Formula

Net Profit Margin = (Net Profit / Revenue) x 100

Where:

- Net Profit: The total profit remaining after all expenses, including COGS, operating expenses, interest, and taxes, are paid.

- Revenue: Total money earned from selling goods or services during a specific period.

Struggling with manual calculations?

Create KPIs and track your data regularly

Learn more

Fast registration and easy setup

How To Calculate Net Profit Margin?

Time needed: 5 minutes

Steps-by-step guide on how to calculate net profit margin

- Find your Net Profit and Revenue Data

Locate these figures on your income statement for the desired period (month, quarter, or year). Net profit might be labeled as “bottom line” or “net income.”

- Divide Net Profit by Revenue

This will give you a decimal value.

- Multiply by 100 and express as a percentage

This is your Net Profit Margin.

Example

For instance, let’s say a company has a Net Profit of $10,000 and a Revenue of $100,000.

- Net Profit Margin = ($10,000 / $100,000) x 100 = 10%

Therefore, the company’s Net Profit Margin is 10%. This signifies that for every revenue dollar, the company keeps $0.10 as profit after accounting for all its expenses.

Here’s a video on how to calculate this metric in Excel 👇

What is a good Margin Rate?

A higher Net Profit Margin indicates a company’s efficiency in generating profit from its sales. It’s important to note that the ideal margin rate can vary depending on the industry a company operates in.

What’s the difference between Gross and Net Profit Margin?

Both Gross Profit Margin and Net Profit Margin are key metrics used to assess a company’s profitability, but they differ in the scope of expenses considered:

| Metric | Explanation | Formula |

|---|---|---|

| Gross Profit Margin | Shows the profitability of the core business. How efficiently a company converts sales into profit from the product itself. It considers only the direct COGS. | (Revenue - Cost of Goods Sold) / Revenue x 100 |

| Net Profit Margin | Provides a more comprehensive picture of profitability. It shows what percentage of each sales dollar remains as profit after all business expenses. This includes operating expenses, interest, COGS, and taxes. | (Net Profit / Revenue) x 100 |

Why Calculate Net Margin?

- Assesses profitability: It reveals the percentage of each sales dollar that remains as profit after covering all expenses. This helps evaluate a company’s overall efficiency in generating profit from its sales.

- Benchmarking: Net Profit Margin can be compared with industry averages to assess a company’s performance relative to its competitors. A higher margin compared to the industry average suggests better profitability.

- Identifies improvement areas: Analyzing profit margin trends over time can help identify areas for improvement in cost management or sales strategies. A declining margin might indicate rising expenses or stagnant sales, prompting corrective actions.

- Investment decisions: Investors often consider Net Profit Margin when evaluating potential investments. A company with a healthy rate is generally considered more attractive.

Other calculators

Setup and monitor your KPIs regularly using Ajelix BI