- Home

- Data Visualization

- Tools

- AI Data Analyst

- Excel Formula Generator

- Excel Formula Explainer

- Google Apps Script Generator

- Excel VBA Script Explainer

- AI VBA Code Generator

- Excel VBA Code Optimizer

- Excel VBA Code Debugger

- Google Sheets Formula Generator

- Google Apps Script Explainer

- Google Sheets Formula Explainer

- Google Apps Script Optimizer

- Google Apps Script Debugger

- AI Excel Spreadsheet Generator

- AI Excel Assistant

- AI Graph Generator

- Pricing

- Resources

- Home

- Blog

- Calculators

- Profitability Index Calculator: Free & Online

Profitability Index Calculator: Free & Online

Explore other articles

- 7 Productivity Tools and AI Plugins for Excel

- Julius AI Alternatives: Top 5 Choices 2026

- No Code Analytics: Top Tools in 2026

- Automation Tools for Excel in 2026: Built-In & Third-Party

- 5 Healthcare Data Analytics Trends 2026

- Best Analytics Platform For Startups In 2026

- 15 Best AI Tools For Startups In 2026 We Tried

- 7 Best AI Tools for Excel Data Analysis (2026 Comparison)

- AI Data Intelligence For Workspace

- Conversational Analytics & AI

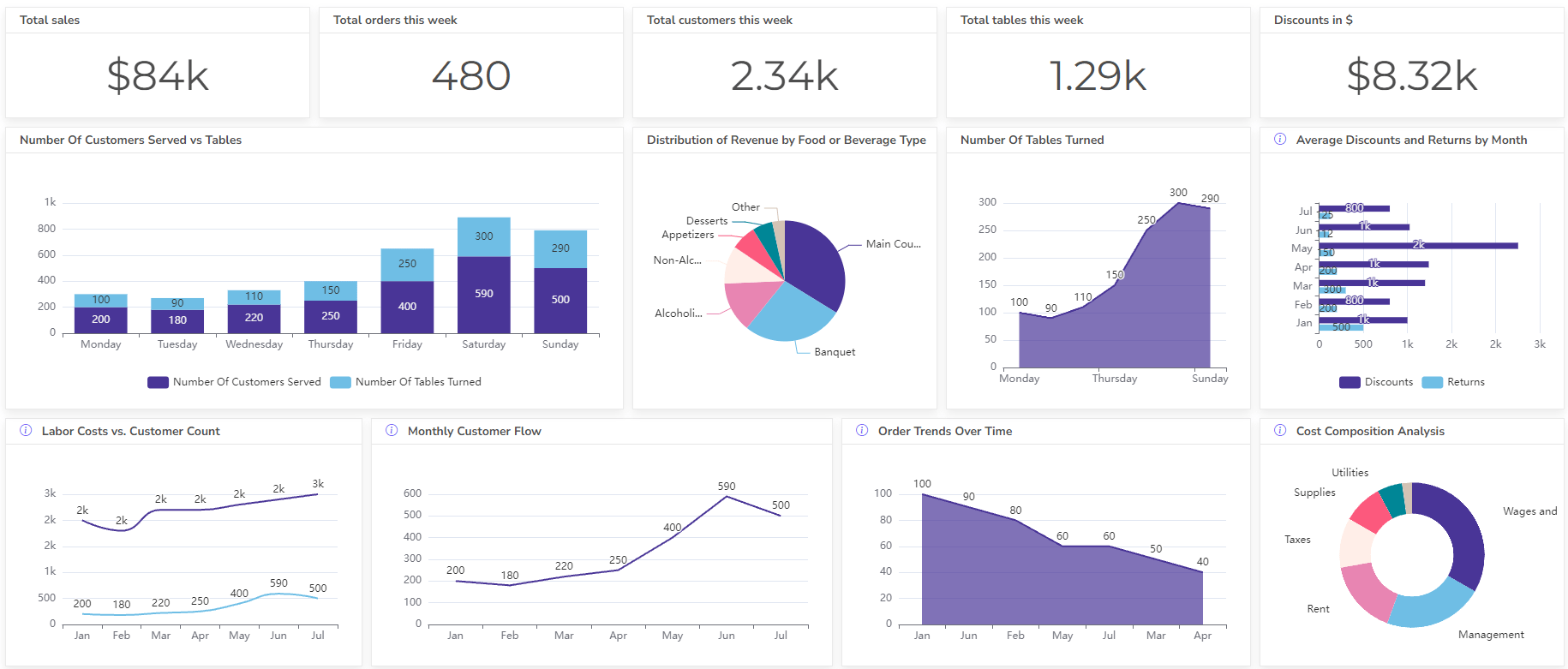

Set up dashboard & track KPIs

The profitability index calculator is a financial tool used to judge the attractiveness of an investment. It essentially compares the present value of all the future cash flows you expect to earn from an investment with the initial amount you need to put in. Profitability index, also called PI calculator for finance, is a valuable tool to evaluate projects.

Calculate Profitability Index

Profitability Index Formula

PI = Present Value of Future Cash Flows / Initial Investment

Here’s a breakdown of the formula:

- Present Value of Future Cash Flows: This represents the current worth of all the cash inflows you expect to receive from the investment over its lifetime, considering the time value of money. You might also like an article on creating a cash flow dashboard for accounting.

- Initial Investment: This is the upfront cost you need to incur to start the project.

How To Calculate Profitability Index?

Time needed: 2 minutes

The profitability index (PI calculator) helps you assess the attractiveness of an investment by comparing the present value of its future cash flows to the initial investment. Here’s how to calculate it:

- Gather Information

Future Cash Flows: Estimate the net cash inflow (revenue minus expenses) you expect to receive from the investment for each year of its lifespan.

Initial Investment: Determine the total upfront cost required to initiate the project.

Discount Rate: Choose a discount rate that reflects the risk of the investment and the time value of money. A higher risk typically requires a higher discount rate. You might also be interested in calculating your return on assets. - Calculate the Present Value of Future Cash Flows (PV)

For each year of the investment, use the discount rate to find the present value of the expected cash flow. There are a couple of ways to do this:

Discount Rate Formula: PV = Cash Flow / (1 + Discount Rate)^Year Calculate the PV for each year’s cash flow using this formula.

Financial Calculator or Spreadsheet Function: Most financial calculators and spreadsheet programs have built-in functions to calculate present value (PV). Use these functions, entering the cash flow, discount rate, and year as arguments. - Sum the Present Values

Add up the present values you calculated for each year’s cash flow to get the total present value of all future cash flows from the investment.

- Calculate the Profitability Index (PI)

For calculating the profitability index, use this formula: PI = Total Present Value of Future Cash Flows / Initial Investment

- Interpret the PI

Aim for a score bigger than 1 as that indicates a profitable investment. 1 will indicate a break-even point, and anything below means you will lose money.

Watch a video on how to calculate this metric 👇

What is A Good Index From Profitability Index Calculator?

| Score | Explanation |

|---|---|

| PI > 1 | Indicates a profitable investment. The present value of your future cash flows is greater than the initial investment, signifying that the project is expected to generate a return. |

| PI = 1 | Implies you’ll break even on the investment. The present value of your future cash flows exactly matches the initial investment. |

| PI < 1 | This suggests a disadvantageous investment. The present value of your future cash flows is less than the initial investment, indicating a potential loss |

Calculating the PI usually involves using a discount rate to find the present value of future cash flows. This discount rate reflects the risk and time value of money.

Other calculators

Setup and monitor your KPIs regularly using Ajelix BI