- Home

- Product

- Tools

- AI Data Analyst

- Excel Formula Generator

- Excel Formula Explainer

- Google Apps Script Generator

- Excel VBA Script Explainer

- AI VBA Code Generator

- Excel VBA Code Optimizer

- Excel VBA Code Debugger

- Google Sheets Formula Generator

- Google Apps Script Explainer

- Google Sheets Formula Explainer

- Google Apps Script Optimizer

- Google Apps Script Debugger

- AI Excel Spreadsheet Generator

- AI Excel Assistant

- AI Graph Generator

- Pricing

- Home

- Blog

- Calculators

- Free Business Loan Calculator Online: Calculate Loan

Free Business Loan Calculator Online: Calculate Loan

Explore other articles

- Google Sheets AI Agents That Autonomously Perform Tasks

- Advanced Agentic Research With AI Agents

- GLM-5 is Now Available on Ajelix AI Chat

- AI Spreadsheet Generator: Excel Templates With AI Agents

- Excel Financial Modeling With AI Agents (No Formulas Need!)

- AI Landing Page Generator: From 0 To Stunning Page With Agent

- Creating Charts In Excel with Agentic AI – It Does Everything!

- Create Report From Google Sheets Data with Agentic AI

- How To Create Powerpoint Presentation Using AI Agent (+Video)

- Ajelix Launches Agentic AI Chat That Executes Business Workflows, Not Just Conversation

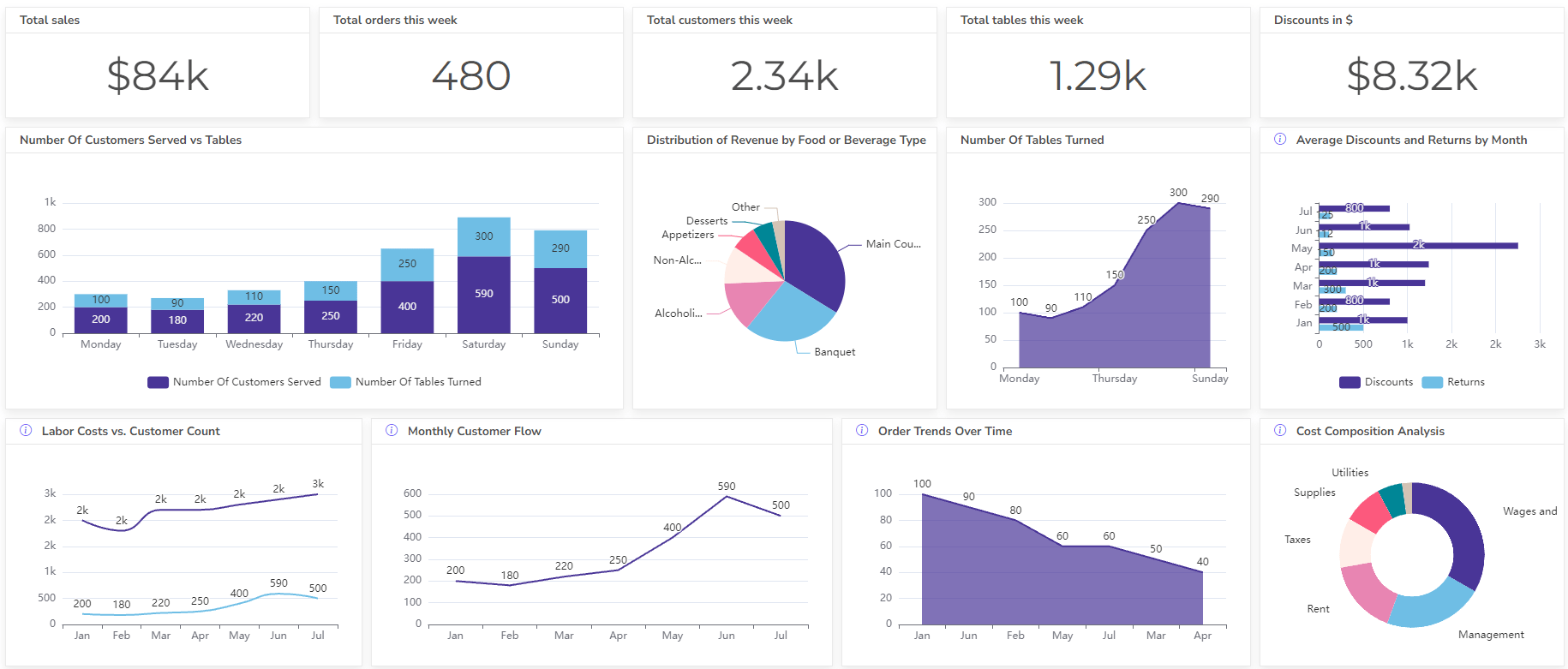

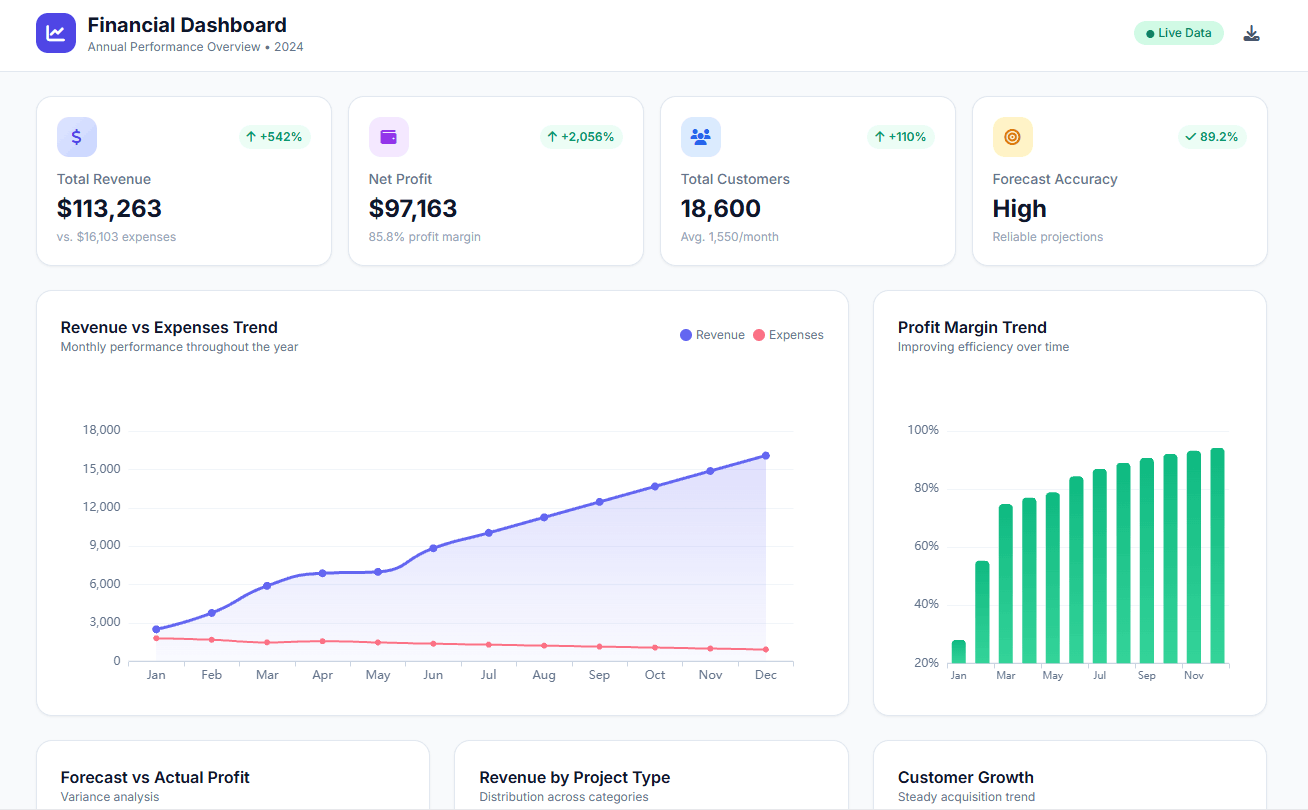

Set up dashboard & track KPIs

A business loan calculator is a tool that helps you estimate the monthly payments, total interest, and overall cost of a business loan. It considers factors like loan amount, interest rate, and loan term to give you a clearer picture of how much the loan will cost you.

Loan Calculator

Struggling with manual calculations & tiring setups?

Let agentic AI do the heavy lifting.

Start free

Fast sign up & easy setup

Business Loan Formula

There are two main formulas used for business loan calculations, the first is total interest, and the second is monthly loan payment. Here are the formulas for calculations:

1. Total Interest

This is a simple formula to calculate the total interest paid over the loan term.

I = P * r * t

- I = Total interest paid

- P = Loan amount

- r = Interest rate (as a decimal, yearly)

- t = Loan term (in years)

2. Monthly Loan Payment (EMI)

This formula calculates the fixed monthly payment you’ll make to repay the loan with interest.

EMI = P * [ r(1 + r)^n ] / [ (1 + r)^n – 1 ]

- EMI = Monthly loan payment

- P = Loan amount

- r = Interest rate (as a decimal, divided by the number of payments per year)

- n = Total number of payments (loan term in months)

How To Calculate Business Loans in Excel?

Time needed: 5 minutes

Here’s a step-by-step guide on how to calculate a business loan in Excel:

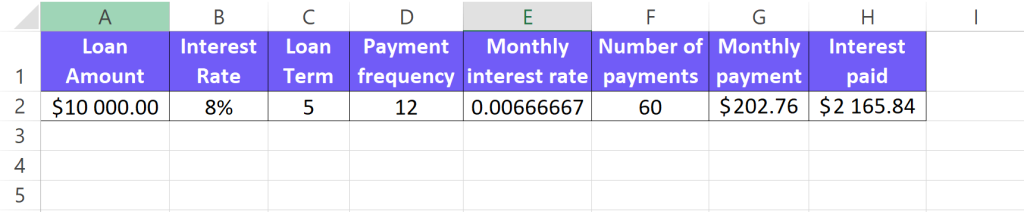

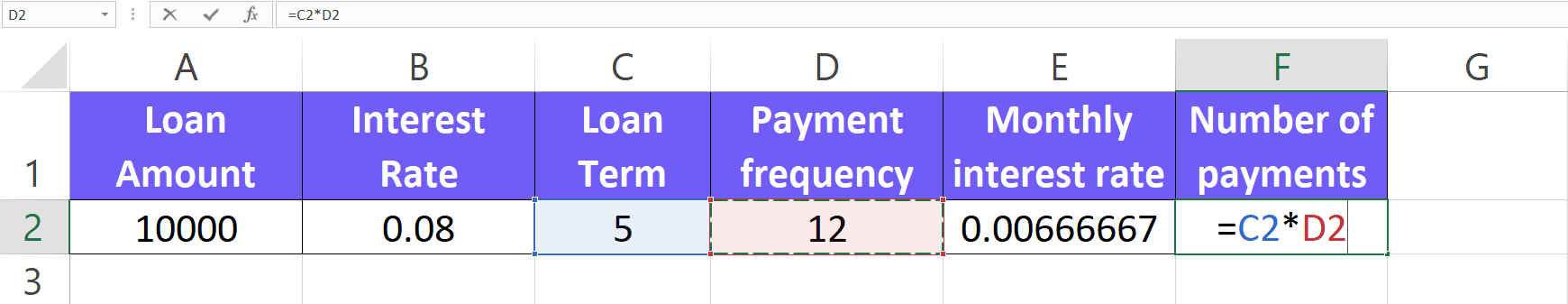

- Set up your worksheet

Label cells for Loan Amount, Interest Rate, Loan Term (in Years), and Payment Frequency (e.g., Monthly).

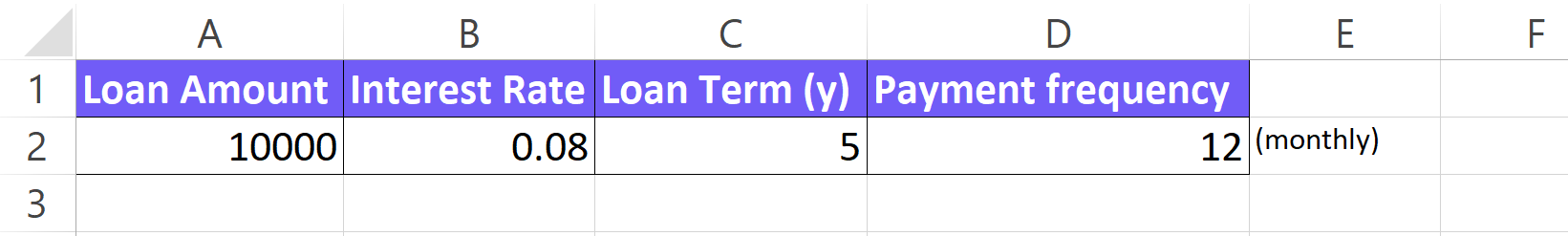

- Enter loan details

– Input the Loan Amount in a cell (e.g., A2).

– Enter the Interest Rate as a decimal (e.g., B2). For example, if the rate is 8%, enter 0.08.

– Write the Loan Term in Years (e.g., C2).

– Add payment frequency (e.g., D2), if you have monthly payments write 12, if quarterly add 4, etc.

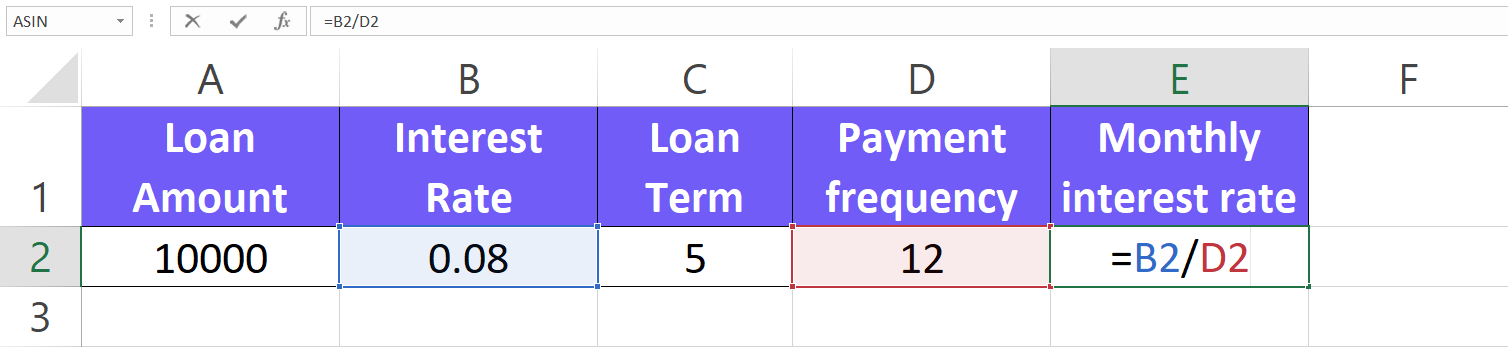

- Calculate the monthly interest rate

In another cell (e.g., E2), enter the formula:

=B2/Payment Frequency(assuming monthly payments).

- Calculate the total number of payments

In another cell (e.g., F2), enter the formula:

=C2*Payment Frequency(e.g., multiply years by 12 for monthly payments).

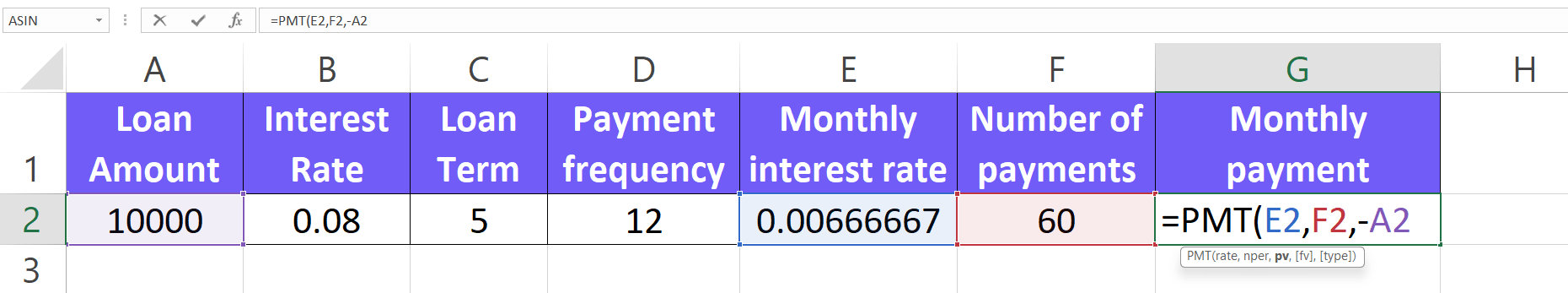

- Calculate the monthly loan payment

In another cell (e.g., G2), enter the PMT function:

=PMT(E2, F2, A2)

This formula uses:

E2: Monthly interest rate (calculated in step 3)

F2: Total number of payments (calculated in step 4)

B2: Loan amount, add a minus sign in the cell or in the function, to get a positive result

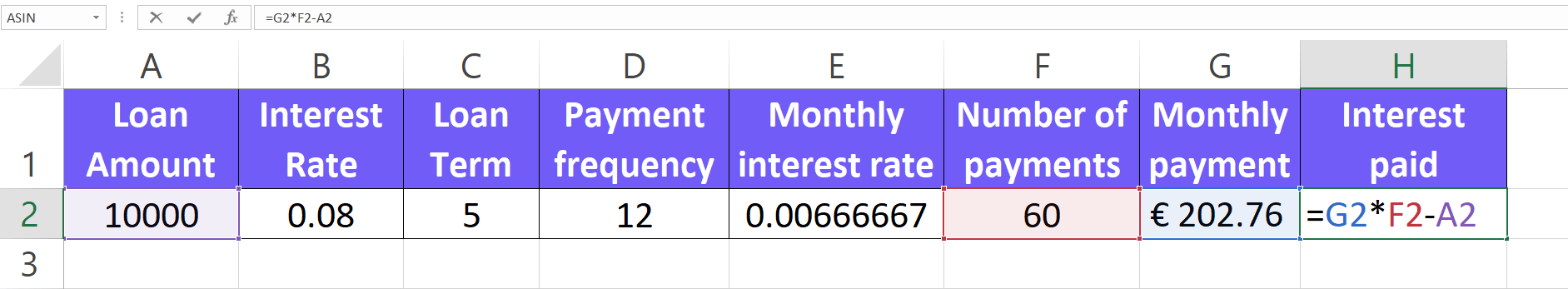

- Calculate total interest paid (optional):

In another cell (e.g., H2), enter the formula:

=G2*F2-B2

This subtracts the loan amount from the total payments to find the total interest.

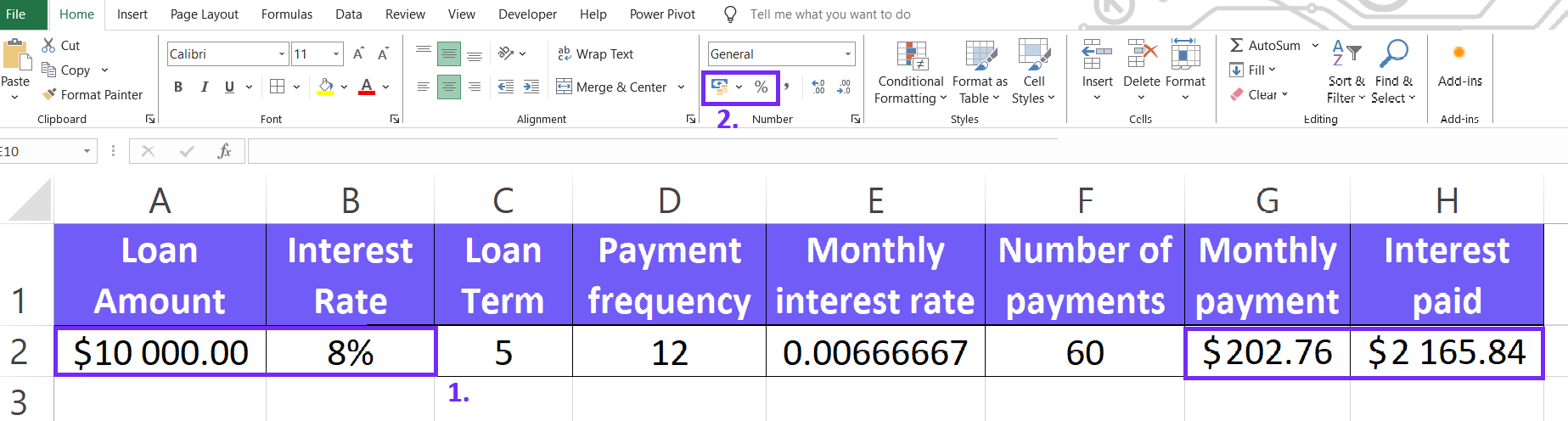

- Format cells

You can format the cells for currency and percentages as needed.

How To Generate Business Loan Formulas With AI?

AI is revolutionizing spreadsheets by creating formulas you need, simply by describing what you want to calculate. Now you can ditch complex formulas and focus on your business. For example, calculate loan payments for your next big project with ease.

Here’s a step-by-step guide to get started with AI formula generation:

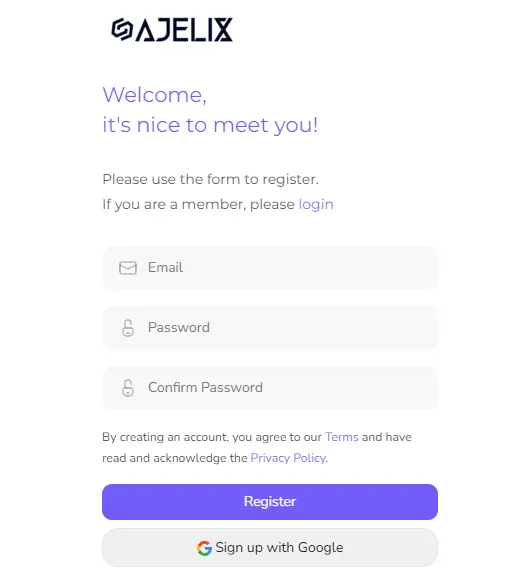

1. Create a free Ajelix account

Ajelix makes spreadsheets a breeze! Get access to over 17 AI tools for various tasks, like an Excel formula generator. Sign up seamlessly using your Gmail or any email account.

Screenshot from Ajelix registration page, image by author

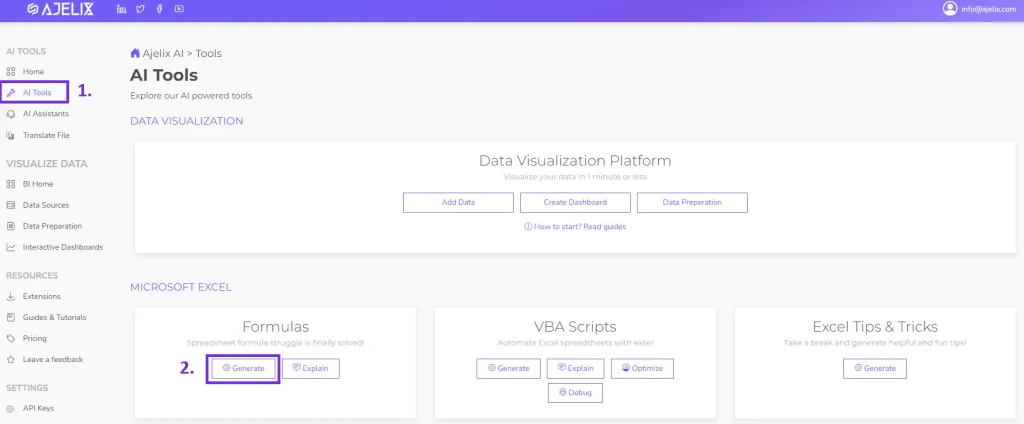

2. Locate the Formula generator tool

Once you have logged in to the portal you can find the Excel formula generator under the AI tools section.

Screenshot from Ajelix portal on how to find formula generator, image by author

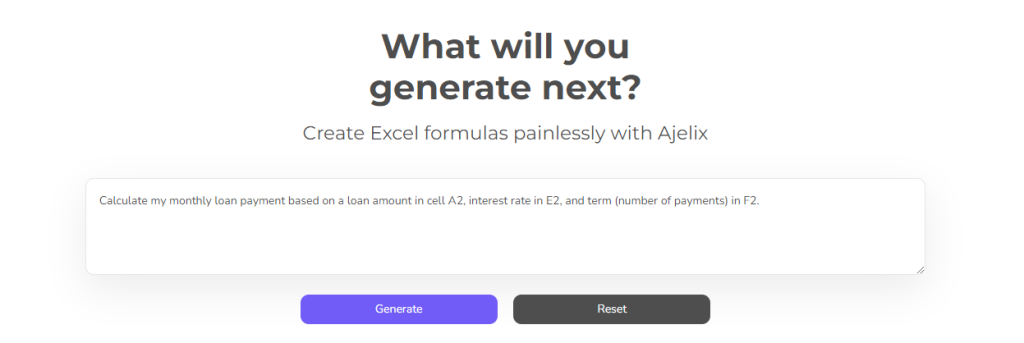

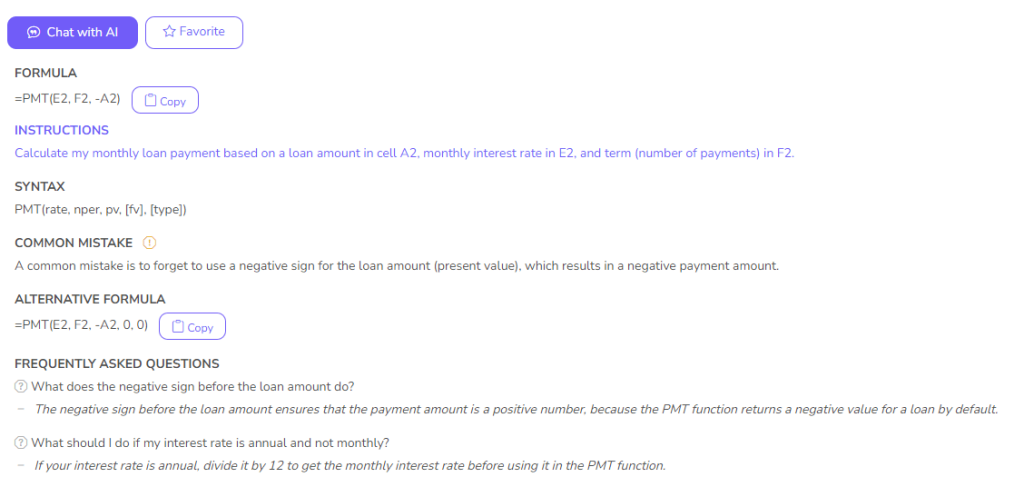

3. Write a clear and concise prompt

With AI formula builders, simply describe what you want to calculate. For example, instead of searching for a business loan formula, you could ask: “Calculate my monthly loan payment based on a loan amount in cell A2, monthly interest rate in E2, and term (number of payments) in F2.” The AI will then generate the exact formula you need.

Screenshot from Ajelix formula generator with business loan prompt, image by author

4. Get your formula

Once you describe your goal, the AI will create a ready-to-use formula for your spreadsheet. No more hunting down complex formulas! For even faster use, consider installing an Excel or Google Sheets add-on for the AI formula generator.

Screenshot from Ajelix with business loan formula result, image by author

Ready to give it a go?

Test AI tools with freemium plan and only upgrade if formula generator can help you!

Download the Business Loan Calculator Excel Template

Download your template below 👇

What are the business loan alternatives?

There are several alternatives to a traditional business loan that can help you get the capital you need. Here are some of the most common options:

Debt Financing

- Line of Credit: A line of credit is similar to a credit card for your business. You get approved for a certain amount of money and can draw on it as needed, up to your limit.

- Invoice Factoring/Factoring: With invoice factoring, you sell your outstanding invoices to a factoring company at a discount. The factoring company then collects the payment from your customers and sends you the remaining balance.

- Merchant Cash Advance (MCA): An MCA is a cash advance based on your future sales. You repay the advance with a percentage of your daily sales.

| Financing Option | Description |

|---|---|

| Line of Credit | Similar to a credit card, draw on funds as needed. |

| Invoice Factoring | Sell invoices to a company for immediate cash. |

| Merchant Cash Advance (MCA) | Cash advance based on future sales (high fees). |

| Crowdfunding | Raise capital from a large number of people online. |

| Angel Investors | Investment from wealthy individuals for startups. |

| Venture Capital | Investment from firms for high-growth businesses. |

| Bootstrapping | Use your own money and resources to finance your business. |

Equity Financing

- Crowdfunding: Crowdfunding allows you to raise capital from a large number of people online. You offer rewards or equity in your company in exchange for their investment. This can be a good way to raise brand awareness and get funding from a passionate customer base.

- Angel Investors: Angel investors are wealthy individuals who invest in startups and early-stage businesses. They can provide not only funding but also mentorship and guidance.

- Venture Capital: Venture capitalists are firms that invest in high-growth businesses. They typically invest larger amounts of money than angel investors, but they also have stricter criteria for investment.

- Bootstrapping: Bootstrapping is using your own money and resources to finance your business. This can be a good option for businesses with a low startup cost or those that are not yet profitable.

The best alternative for your business will depend on your specific needs and circumstances. Consider factors such as how much money you need, how quickly you need it, and what you are willing to give up in exchange for funding.

How Does Business Loan Calculator Work?

Business loan calculators are essentially financial tools that use a formula to estimate key metrics of a potential loan. Here’s a breakdown of how they work:

Inputs

- Loan Amount: This is the total sum of money you intend to borrow.

- Interest Rate: This is the annual percentage rate (APR) charged by the lender on the loan amount. It represents the cost of borrowing the money.

- Loan Term: This is the duration of the loan, typically expressed in months or years.

Calculation

The calculator employs a formula that considers these inputs to determine the following:

- Monthly Payment: The estimated fixed amount you’ll pay towards the loan every month throughout the term.

- Total Interest Paid: The total amount of interest you’ll pay over the entire loan term.

- Count of Payments: This will show how many payments are until the business loan is paid back.

Benefits of Using A Business Loan Calculator

- Estimates Affordability: By providing an estimated monthly payment, the calculator helps assess if the loan fits your business budget.

- Compares Loan Options: You can experiment with different loan amounts, interest rates, and terms to see how they impact the monthly payment and total interest cost. This can be helpful when comparing loan offers from different lenders.

- Improves Financial Planning: The calculator’s output can be used for financial planning purposes, allowing you to project future cash flow with the loan payments factored in.

FAQ

If your financing needs are specific or complex, consider talking to a lender or financial advisor. They can offer expert guidance on navigating these situations. Similarly, if you’re unsure which loan type or terms best suit your business, a lender or advisor can help you evaluate your options. Finally, if you have concerns about your business creditworthiness or qualifying for a loan, consulting with a professional can provide valuable insights and support throughout the process.

A business loan calculator estimates your monthly payment and total interest based on loan amount, interest rate, and loan term. It’s a tool to see how affordable a loan might be.

Business loan calculators are a handy tool for budgeting, comparing, and planning. They can help you see if the monthly payment fits your budget for different loan options, allowing you to estimate the total cost and project your cash flow with loan payments included.

Disclaimer: The information on this page is for educational purposes only and should not be construed as financial advice. While we strive to provide accurate information, investing involves inherent risks. Please consult with a qualified financial advisor before making any investment decisions.

Other calculators

Setup and monitor your KPIs regularly using Ajelix BI