- Home

- Product

- Tools

- AI Data Analyst

- Excel Formula Generator

- Excel Formula Explainer

- Google Apps Script Generator

- Excel VBA Script Explainer

- AI VBA Code Generator

- Excel VBA Code Optimizer

- Excel VBA Code Debugger

- Google Sheets Formula Generator

- Google Apps Script Explainer

- Google Sheets Formula Explainer

- Google Apps Script Optimizer

- Google Apps Script Debugger

- AI Excel Spreadsheet Generator

- AI Excel Assistant

- AI Graph Generator

- Pricing

- Home

- Blog

- Calculators

- Free Present Value Calculator Online: Calculate PV

Free Present Value Calculator Online: Calculate PV

Explore other articles

- Agentic AI vs AI Agents: What’s the Difference and Why It Matters

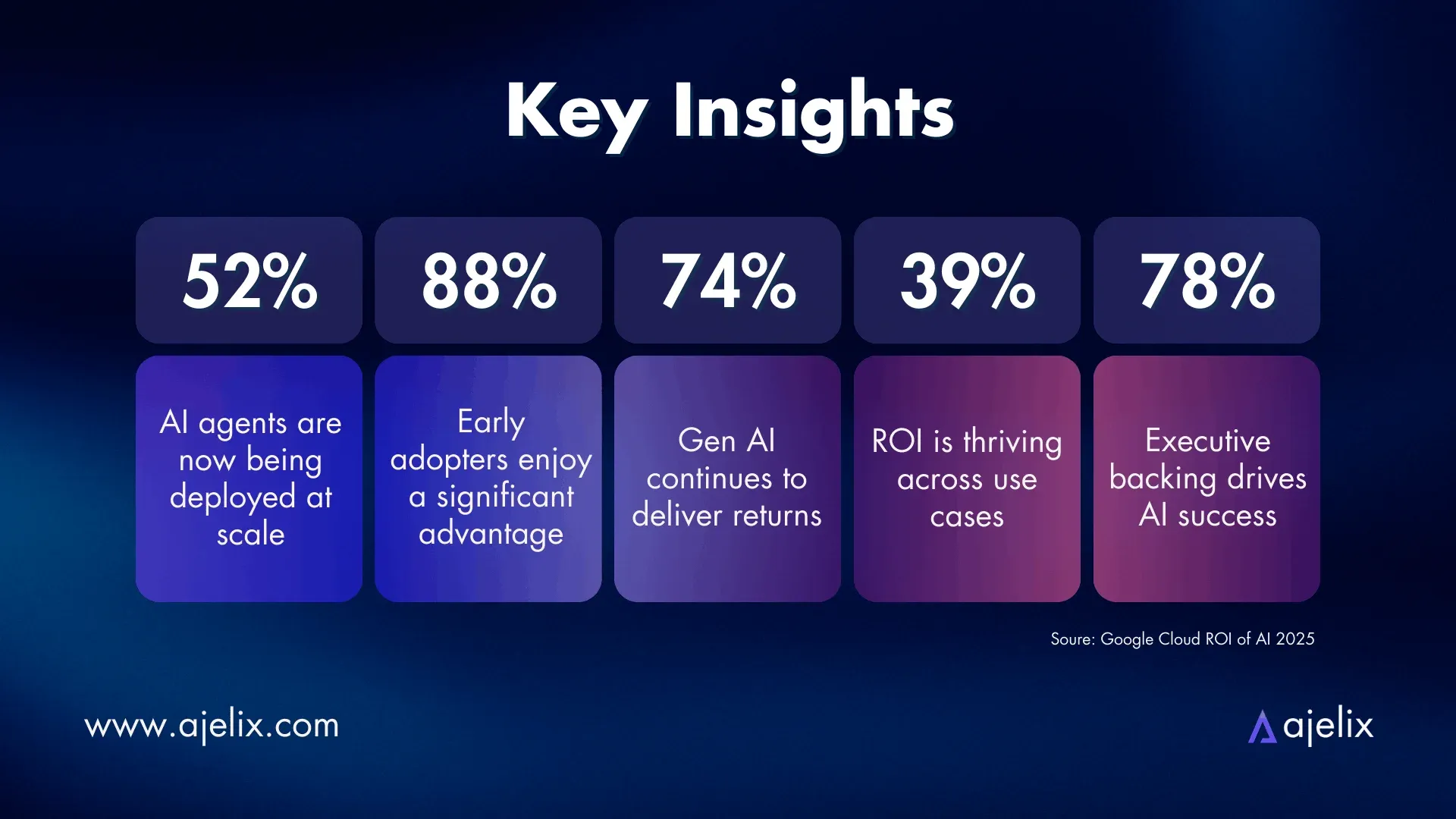

- What AI Studies Say About Agentic AI ROI & Stats (And What They Don’t)

- Google Sheets AI Agents That Autonomously Perform Tasks

- Advanced Agentic Research With AI Agents

- GLM-5 is Now Available on Ajelix AI Chat

- AI Spreadsheet Generator: Excel Templates With AI Agents

- Excel Financial Modeling With AI Agents (No Formulas Need!)

- AI Landing Page Generator: From 0 To Stunning Page With Agent

- Creating Charts In Excel with Agentic AI – It Does Everything!

- Create Report From Google Sheets Data with Agentic AI

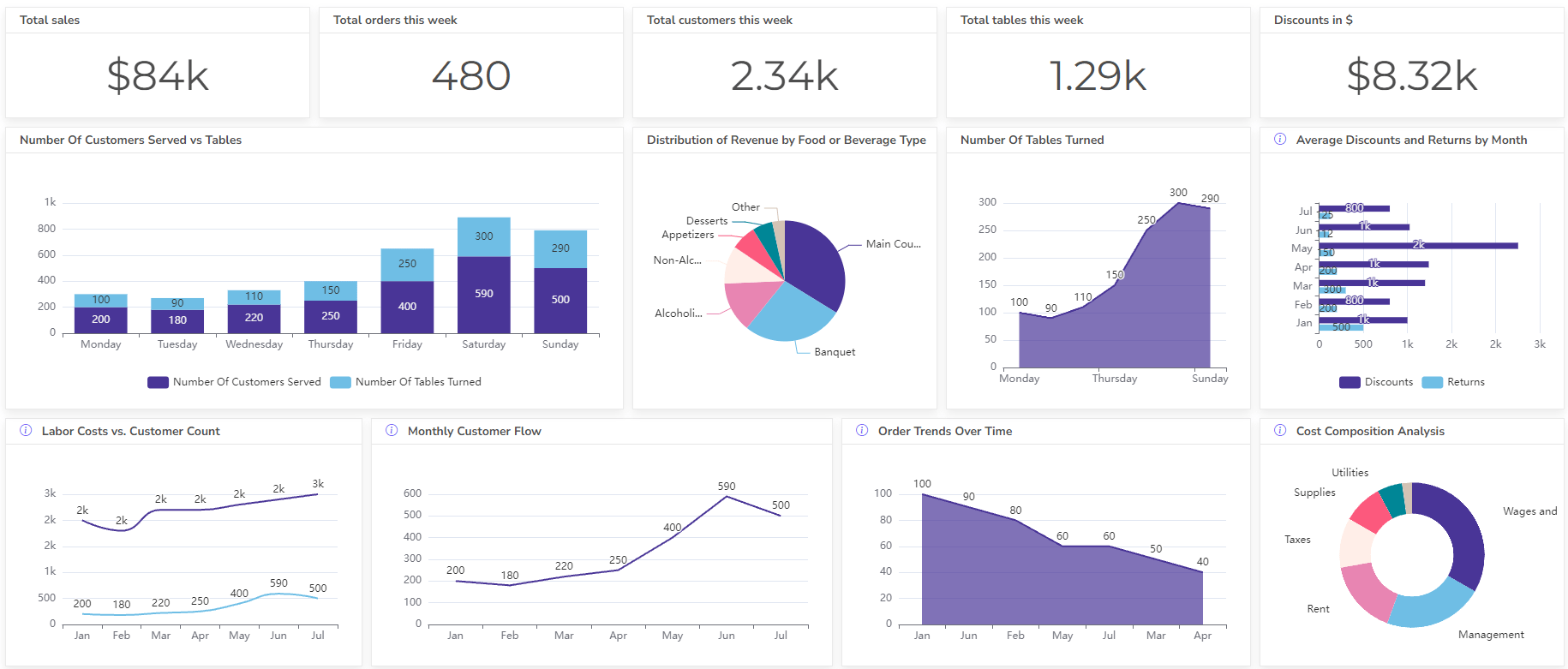

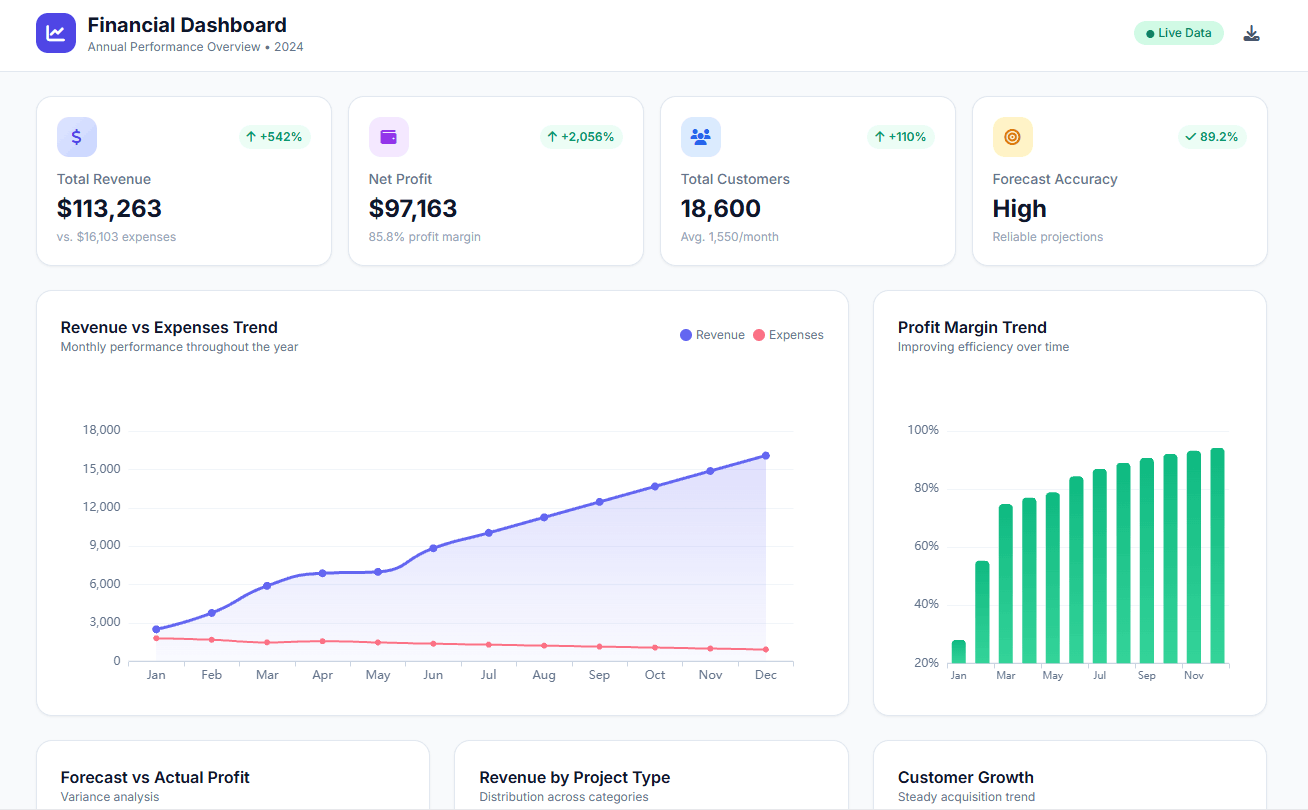

Set up dashboard & track KPIs

A present value calculator is a tool that helps you figure out how much money you’d need to invest today to reach a specific future amount, considering interest. It’s basically like a fancy savings calculator.

What is Present Value (PV)?

Present value is the current worth of a future sum of money. It considers the time value of money, meaning a dollar today is worth more than a dollar tomorrow due to potential investment gains.

Struggling with manual calculations & tiring setups?

Let agentic AI do the heavy lifting.

Start free

Fast sign up & easy setup

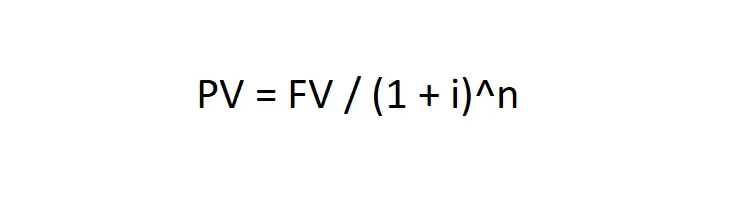

Present Value Formula (PV)

PV = FV / (1 + i)^n

where:

- PV = Present value

- FV = Future value

- i = Interest rate (in decimal form)

- n = Number of compounding periods

What is the Future Value in the PV Formula?

In the Present Value (PV) formula, the Future Value (FV) represents the amount of money you expect to have in the future. It’s the target you’re working towards, considering interest earned over time.

What is the Interest Rate (I) in the FV Formula?

In the Present Value (PV) formula, the Interest Rate (I) is the cost of borrowing money (for loans) or the return you expect on an investment. It’s expressed as a decimal (e.g., 5% interest rate = 0.05).

What is (n) in the FV formula?

In the Future Value (FV) formula, (n) represents the number of compounding periods. This refers to the number of times interest is applied to your money over the total time frame.

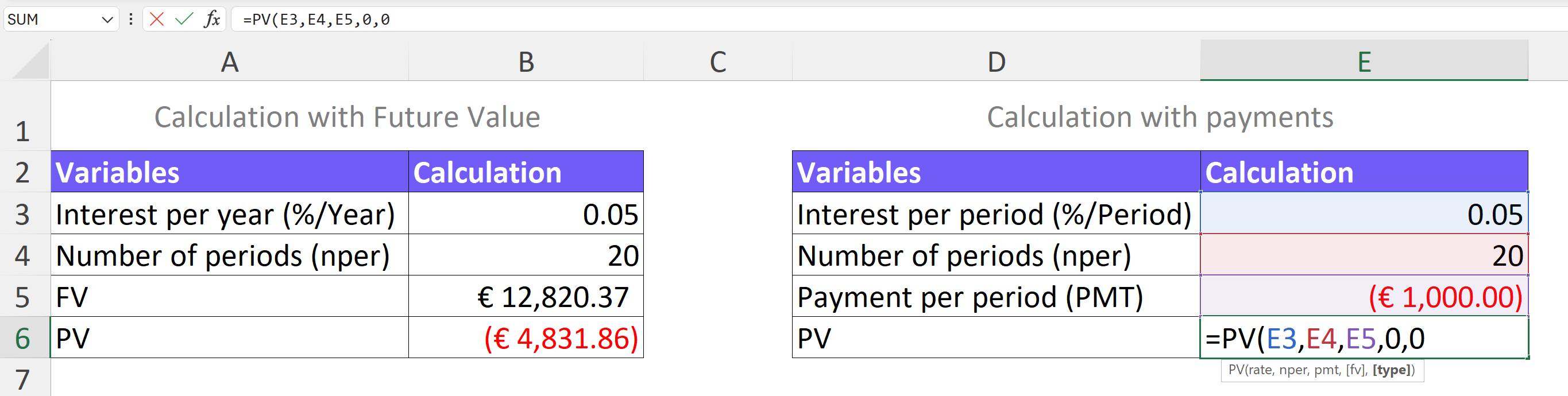

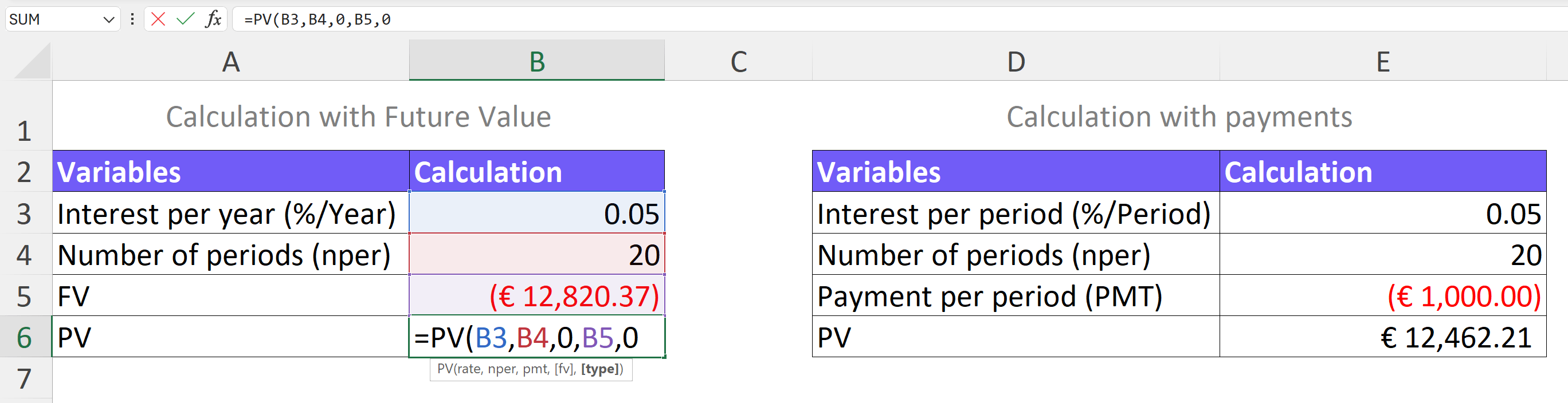

Present Value Formula in Excel

=PV(rate, nper, pmt, [fv], [type])

Here’s a breakdown of the arguments:

rate: The interest rate per period (e.g., monthly interest rate for a loan).nper: The total number of payment periods.pmt: The fixed payment amount per period (optional, can be omitted if FV is provided).fv(optional): The future value you want to achieve (e.g., total amount you’ll repay for a loan). If omitted, Excel assumes a future value of 0.type(optional): Indicates when payments are made (0 for end of period, 1 for beginning of period). If omitted, Excel assumes payments are made at the end of the period.

How To Generate Formulas With AI?

Spreadsheets are about to get a whole lot easier! Forget memorizing complex formulas – AI is now here to generate them based on plain English descriptions.

This means you can spend less time wrestling with syntax and more time focusing on your data’s insights. Here’s a step-by-step guide to get started with this powerful new tool:

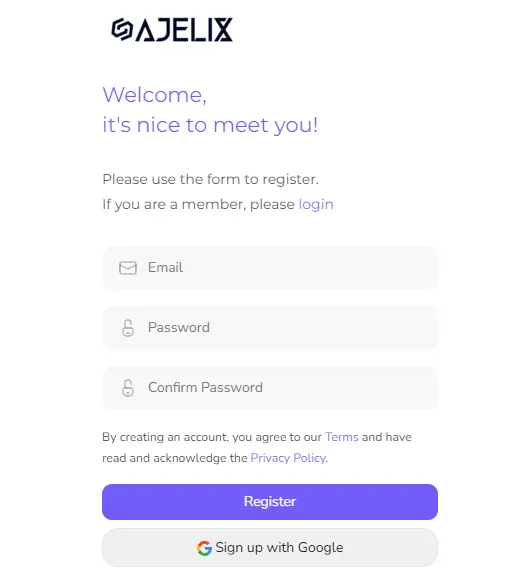

1. Create a free Ajelix account

Ajelix boasts over 15 AI-powered tools specifically designed for spreadsheet tasks, including an Excel formula generator. Signing up is a breeze – just use your Gmail account or any other email address and get started on streamlining your workflow.

Screenshot from Ajelix registration page, image by author

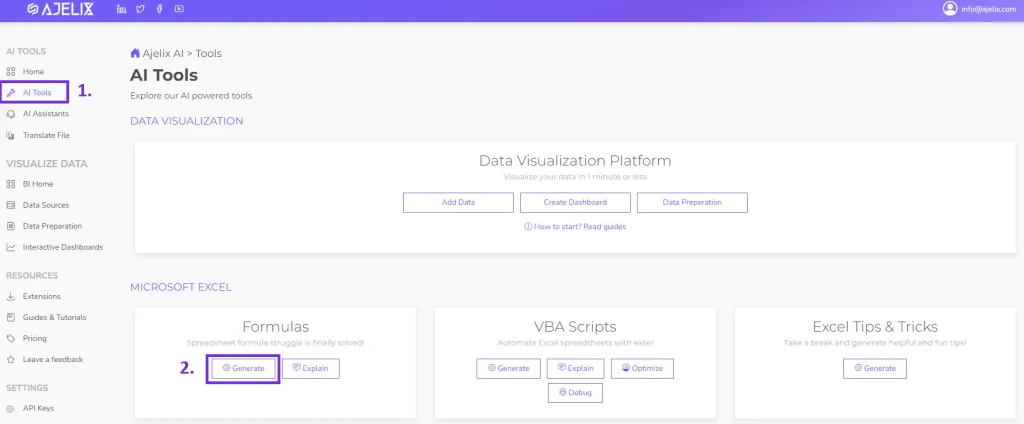

2. Locate the Formula generator tool

Once you have logged in to the portal you can find the Excel formula generator under the AI tools section.

Screenshot from Ajelix portal on how to find formula generator, image by author

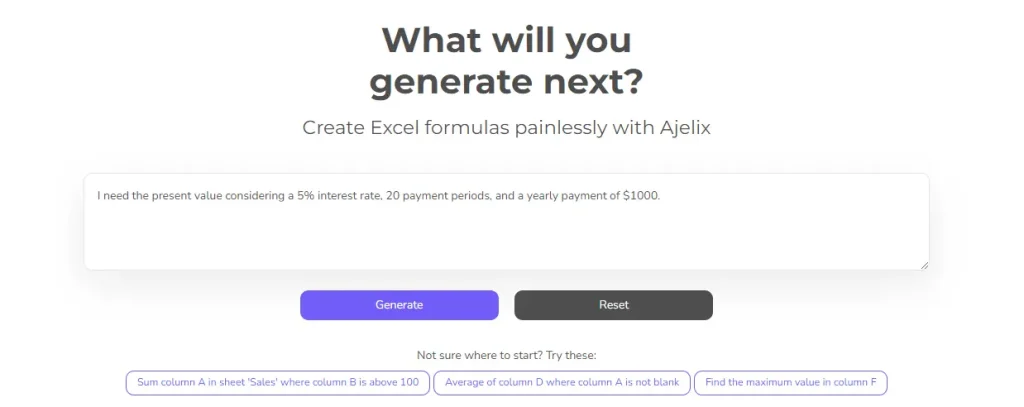

3. Write a clear and concise prompt

The accuracy of your AI-generated formula hinges on how clearly you describe your needs. For instance, instead of just saying “Get me the PV formula,” explain what you’re calculating: “I need the present value considering a 5% interest rate, 20 payment periods, and a yearly payment of $1000.”

The more details you provide, the better your AI assistant can understand and deliver the perfect formula.

Screenshot from Ajelix formula generator with PV prompt, image by author

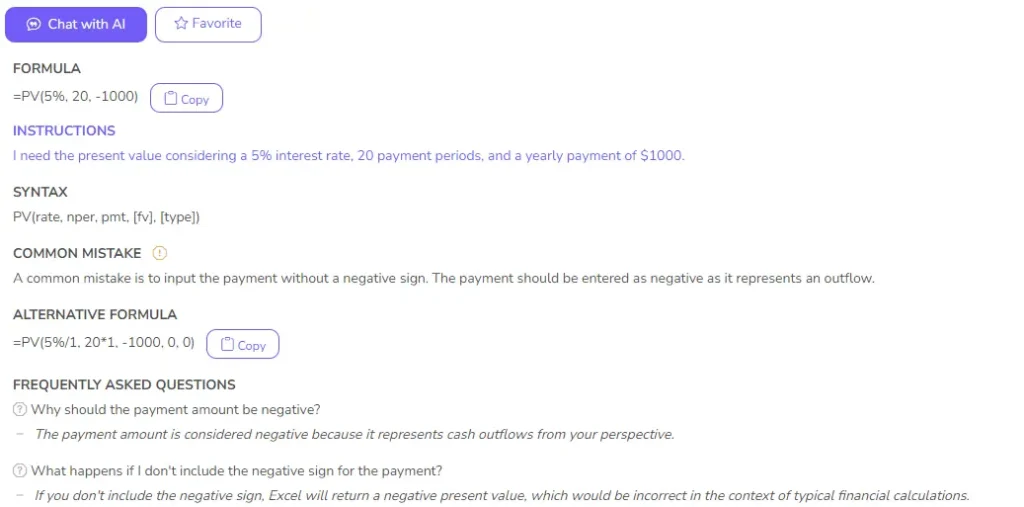

4. Get your formula

Consider using the Excel or Google Sheets add-on for even smoother formula insertion. Here’s an example: we asked for the present value (PV) with a 5% interest rate, 20 payments, and a yearly payment of $1000. The AI delivered the correct formula, but a helpful FAQ mentioned subtracting the initial investment for a more accurate result.

Screenshot from Ajelix with PV formula result, image by author

Ready to give it a go?

Test AI tools with freemium plan and only upgrade if formula generator can help you!

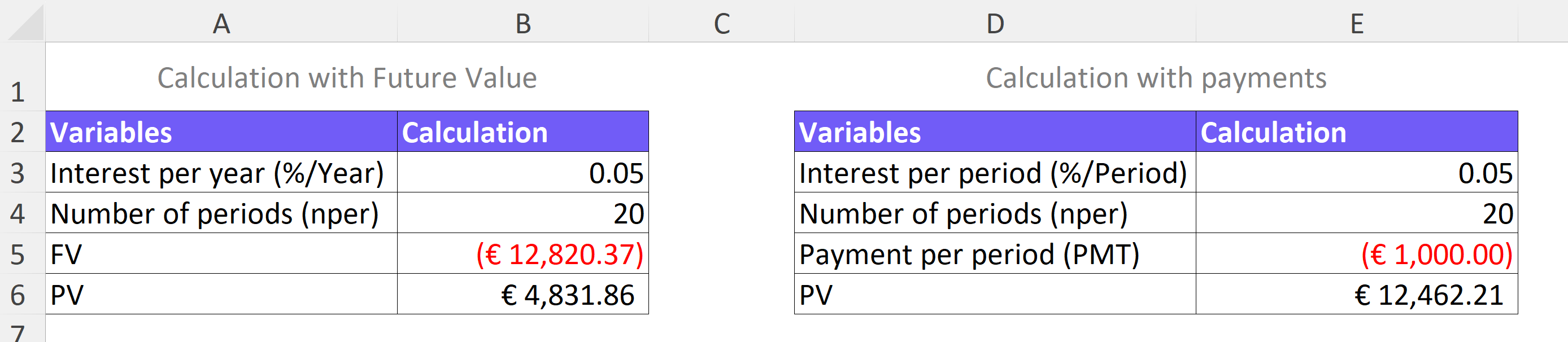

How To Calculate Present Value in Excel (PV)?

Time needed: 5 minutes

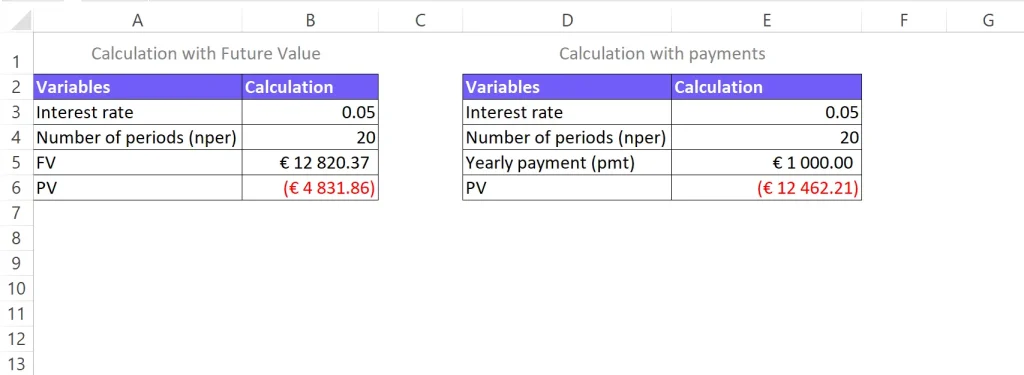

Calculating present value (PV) in Excel is straightforward using the built-in PV function. Here’s a step-by-step guide:

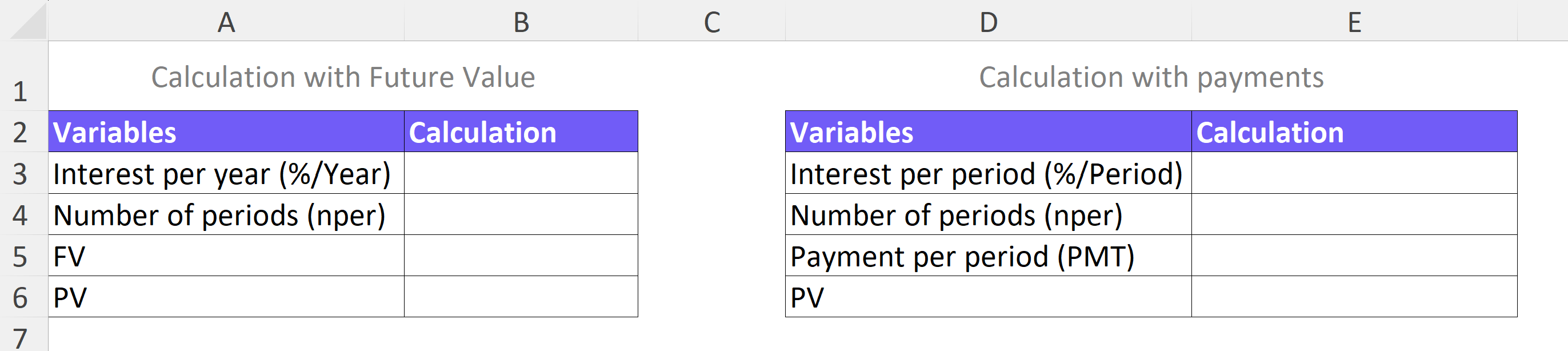

- Set Up Your Spreadsheet

Label your cells with appropriate headings for factors like “Interest Rate,” “Number of Periods,” “Payment,” “Future Value” (optional), and “Present Value.”

- Enter Your Data

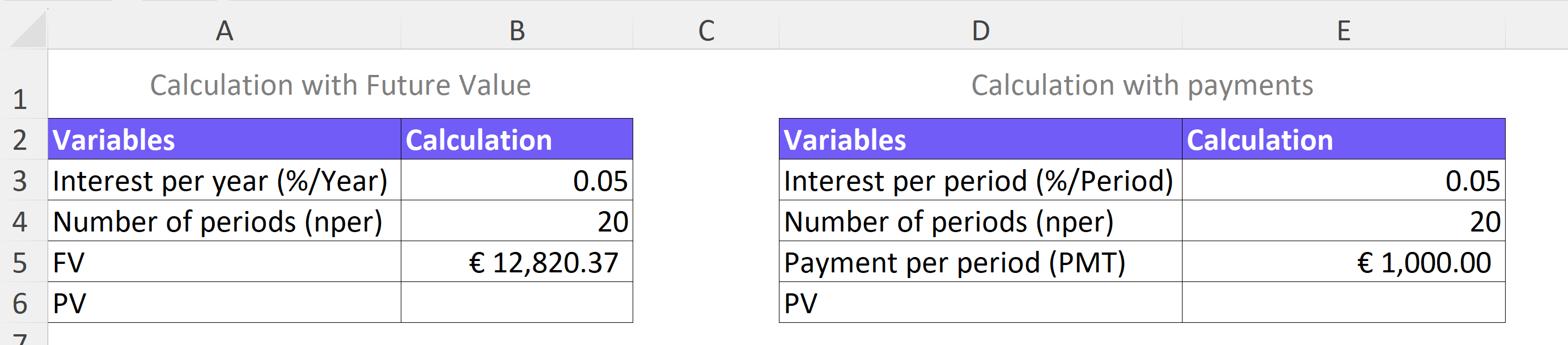

– In the corresponding cells, enter the interest rate (as a decimal, not a percentage). For example, if your interest rate is 5%, enter 0.05.

– Enter the number of periods (total number of payments).

– If you have periodic payments (e.g., monthly loan payments), enter the payment amount. Leave this blank if calculating a lump sum future value.

– You can leave the “Future Value” cell blank if you’re calculating a loan (where there is no future value). However, if you’re calculating an investment with a desired future value, enter that amount here.

- Use the PV Function To Calculate Loan

In the cell designated for “Present Value,” type the formula

=PV(rate, nper, pmt, [fv], [type]). Replace the bracketed arguments with references to your data cells:rate: Cell reference for the interest rate (e.g., B3).nper: Cell reference for the number of periods (e.g., B4).pmt: Cell reference for the payment amount (leave blank if calculating future value) (e.g., B3).[fv]: Leave blank for loans.[type]: This argument is optional and defaults to 0 (payment at the end of the period). Use 1 if payments are made at the beginning of the period.

- Calculate PV When You Know Future Value

In the cell designated for “Present Value,” type the formula

=PV(rate, nper, [pmt], fv, [type]).[pmt]: Leave blank because you already have an FV value.[fv]: Leave blank for loans, otherwise enter the cell reference for future value (optional).

- Press Enter

Excel will calculate the present value based on the provided inputs.

Watch the video below for a detailed guide on how to calculate IRR 👇

Download Present Value Calculator Excel Template

Download your template below 👇

why does the pV formula return minus Value in Excel?

The PV formula in Excel returns a negative value because it calculates the present value of a cash outflow, typically a loan or mortgage. The present value represents the current worth of a series of future payments.

Here’s a breakdown of the logic:

- When you take out a loan, you receive a sum of money upfront (future value) but owe payments over time.

- The present value represents the amount you would need to invest today to equal the future value of the loan payments considering the interest rate.

- Since you’re receiving money upfront (loan) and paying later, the present value reflects a negative outflow of cash from your perspective.

Think of it this way: the negative present value signifies the amount you’re going into debt for. It’s the negative initial investment required to cover future loan payments.

What’s the difference between future value and present value?

Financial decisions often involve understanding the value of money over time. Two important concepts that come into play are Future Value (FV) and Present Value (PV).

While they may sound similar, they serve distinct purposes. This table will compare FV and PV to help you navigate financial calculations.

| Feature | Future Value (FV) | Present Value (PV) |

|---|---|---|

| Purpose | Calculate the total value of an investment in the future | Calculate upfront investment for future cash outflows |

| Cash Flow Direction | Positive (growth) | Negative (debt) |

| Focus | The upfront amount needed to invest today to generate the same future value | The total amount you’ll receive after investing $10,000 for 5 years at 5% interest |

| Formula | FV = Initial Investment * (1 + Interest Rate)^Number of Periods | PV function (considers interest rate, number of periods, and payment amount) |

| Scenario | Growing an investment | Loan payments, mortgages |

| Example | The upfront amount you need to borrow to make $10,000 worth of loan payments over 5 years at 5% interest | Upfront amount you need to borrow to make $10,000 worth of loan payments over 5 years at 5% interest |

As you can see, Future Value and Present Value offer different perspectives on the impact of interest rates and time on your money.

What Present Value (PV) Tells You?

| Feature | Description | Example |

|---|---|---|

| Upfront Investment for Future Cash Outflows | PV represents the amount you need to invest today to equal a specific future sum, considering interest. | A loan of $10,000 with a 5% annual interest rate for 5 years. The PV might be -$8,227, representing the upfront amount you need to borrow to cover the future loan payments. |

| Affordability of Future Debt | A high PV indicates a significant upfront cost to cover future loan payments. | The PV of a loan shows it has a high present value. This can be a signal to assess if the future payments are affordable considering your current financial situation. |

| Comparative Analysis of Investments | PV allows you to compare investments based on their present value of expected future returns. | You’re considering two investments, A and B. Investment A has a higher PV of future returns compared to Investment B. This suggests Investment A might offer a greater return on your investment today. |

| Impact of Time Value of Money | PV considers the time value of money, where money received today is worth more than the same amount received in the future. | You’re offered $1,000 today or $1,000 in a year. The PV calculation would account for the potential interest you could earn on $1,000 today, highlighting that the present value of the $1,000 you receive today is higher. |

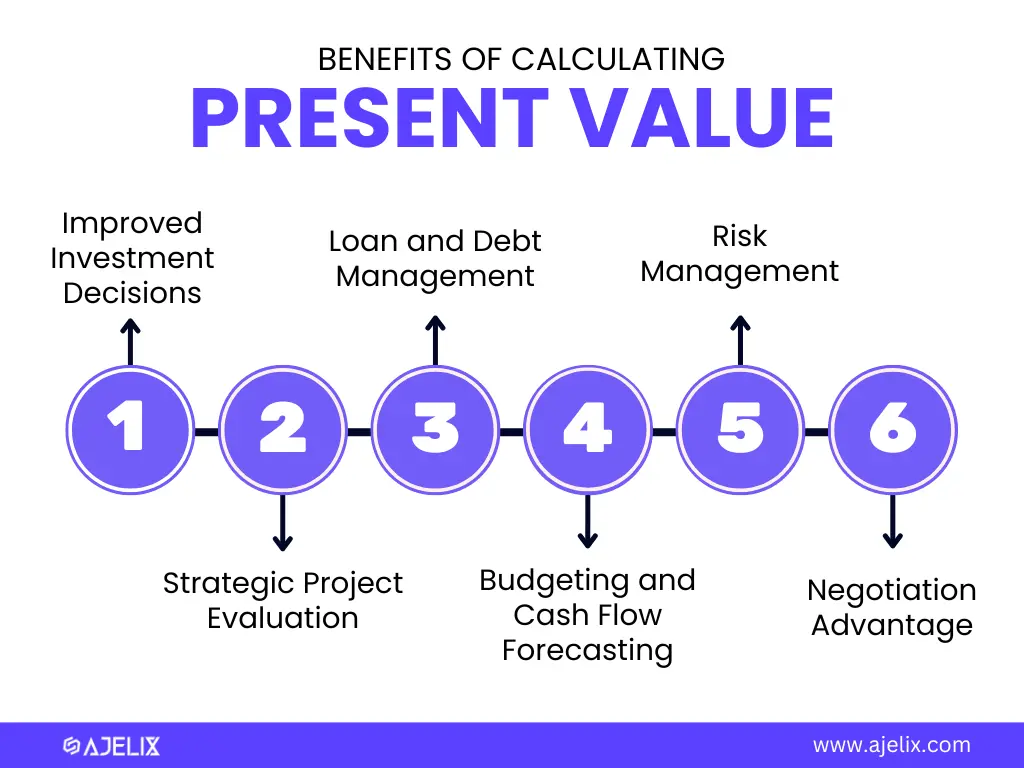

What are the benefits of the Present Value Calculator?

Infographic of 6 benefits why businesses should calculate present value, image by author

Businesses leverage Present Value (PV) calculator for several key benefits:

- Improved Investment Decisions: PV helps businesses assess the true worth of future cash flows associated with potential investments. By considering the time value of money, businesses can compare different options and choose the highest present value, indicating the greatest return on investment today.

- Strategic Project Evaluation: When evaluating new projects or ventures, PV calculations help businesses understand the upfront investment required to generate future returns. This allows for a more informed decision on whether the project aligns with financial goals and justifies the initial cost.

- Loan and Debt Management: Businesses use PV calculator to assess the affordability of loans and mortgages. By determining the present value of future loan payments, they can analyze the total debt burden and make informed borrowing decisions.

- Budgeting and Cash Flow Forecasting: PV is a valuable tool for budgeting and cash flow forecasting. Businesses can use it to estimate the present value of future receivables (incoming funds) and compare them to future expenses. This helps with better cash flow management and financial planning.

- Risk Management: By considering the time value of money in future cash flows, a PV calculator can help businesses identify and mitigate potential financial risks associated with investments or projects. Identifying scenarios where future returns might not justify the present investment allows for proactive risk management strategies.

- Negotiation Advantage: Understanding the present value of future contracts or agreements strengthens a business’s negotiating position. Businesses can use PV calculations to assess the present value of proposed terms and ensure they are receiving fair value for their commitments.

FAQ

You would use a Present Value calculator to understand the current worth of future cash flows. You can use it for loans and mortgages to see how much you need to invest today to cover future loan payments, considering interest. And for investments to compare different investments.

A negative present value (PV) typically means receiving money upfront (like a loan) but making payments later. It reflects the initial debt you incur, expressed as a negative value because money flows out of your pocket today.

Higher interest rates lead to a lower present value. This means the future cash flow is worth less today because you could earn a greater return by investing the money now at a higher interest rate.

More periods (time) generally lead to a lower present value. The further out the cash flow is received, the less it’s worth today due to the time value of money.

Other calculators

Setup and monitor your KPIs regularly using Ajelix BI