- Home

- Product

- Tools

- AI Data Analyst

- Excel Formula Generator

- Excel Formula Explainer

- Google Apps Script Generator

- Excel VBA Script Explainer

- AI VBA Code Generator

- Excel VBA Code Optimizer

- Excel VBA Code Debugger

- Google Sheets Formula Generator

- Google Apps Script Explainer

- Google Sheets Formula Explainer

- Google Apps Script Optimizer

- Google Apps Script Debugger

- AI Excel Spreadsheet Generator

- AI Excel Assistant

- AI Graph Generator

- Pricing

- Home

- Blog

- Calculators

- Free Customer Acquisition Cost Calculator Online

Free Customer Acquisition Cost Calculator Online

Explore other articles

- GLM-5 is Now Available on Ajelix AI Chat

- AI Spreadsheet Generator: Excel Templates With AI Agents

- Excel Financial Modeling With AI Agents (No Formulas Need!)

- AI Landing Page Generator: From 0 To Stunning Page With Agent

- Creating Charts In Excel with Agentic AI – It Does Everything!

- Create Report From Google Sheets Data with Agentic AI

- How To Create Powerpoint Presentation Using AI Agent (+Video)

- Ajelix Launches Agentic AI Chat That Executes Business Workflows, Not Just Conversation

- 7 Productivity Tools and AI Plugins for Excel

- Julius AI Alternatives: Top 5 Choices 2026

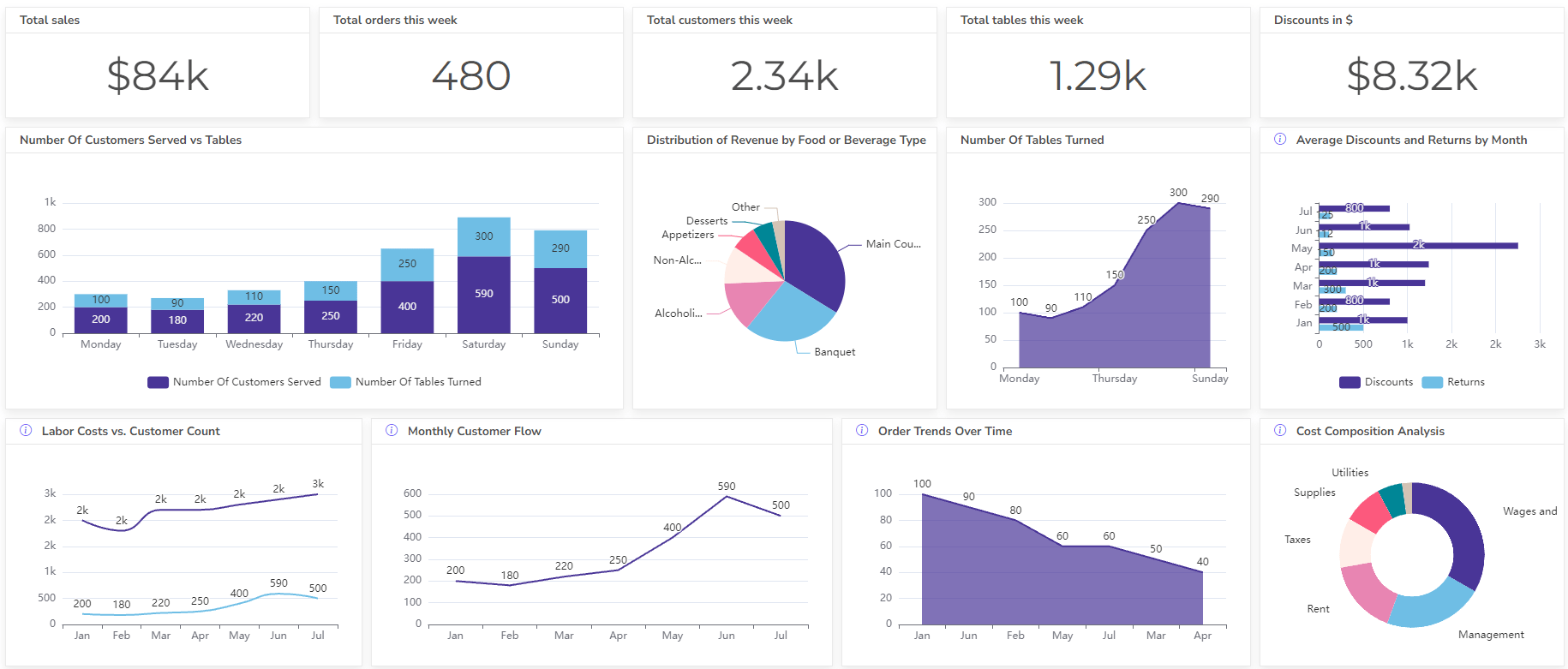

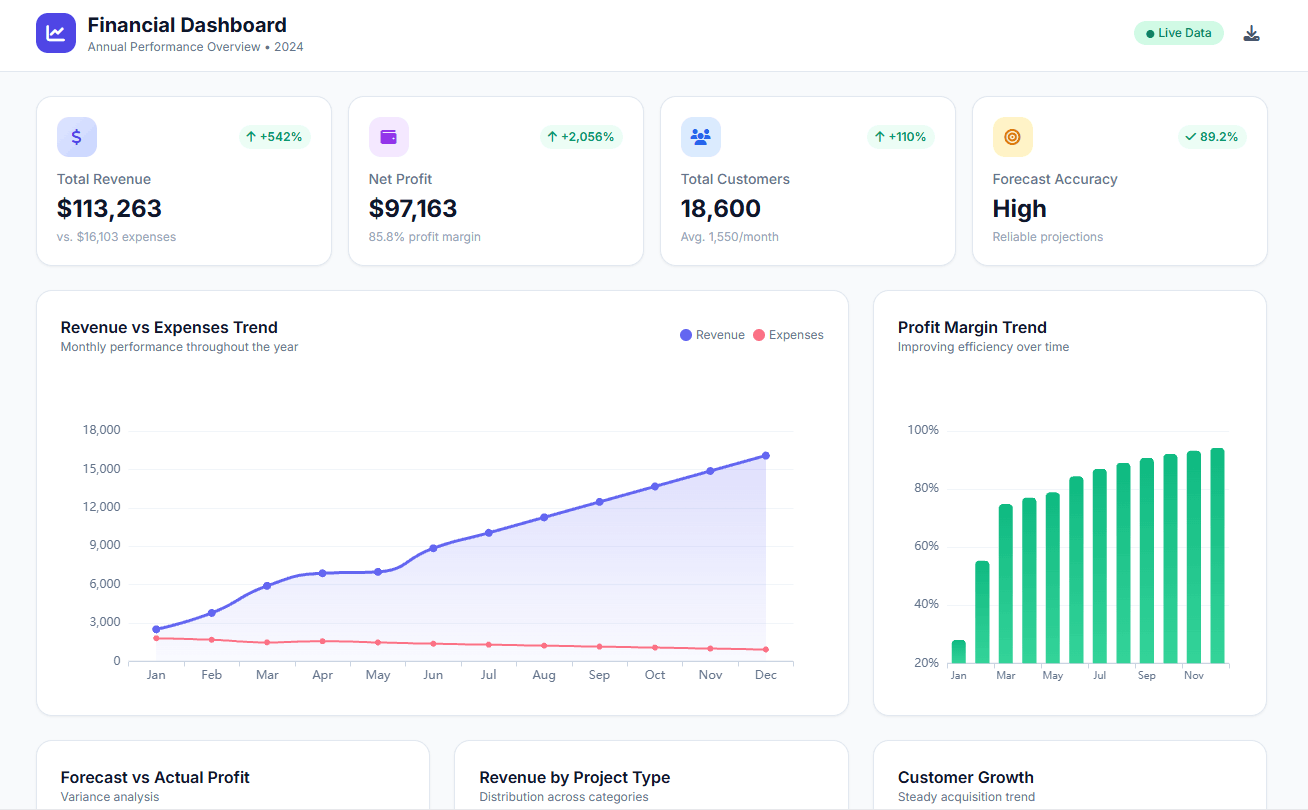

Set up dashboard & track KPIs

Customer Acquisition Cost Calculator, or CAC, is a metric that tells a business how much it costs to acquire a new customer. It factors in all the sales and marketing expenses involved in converting someone into a paying customer.

Calculate Customer Acquisition Cost (CAC)

Customer Acquisition Cost Formula

CAC = Total Cost of Sales & Marketing / Number of New Customers Acquired

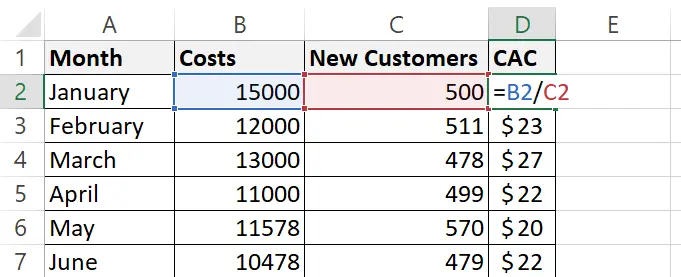

CAC formula in Excel, screenshot by author

Here’s a breakdown of the formula:

- Total Cost of Sales & Marketing: This includes all expenses incurred to acquire new customers during a specific period. This can involve advertising costs, marketing salaries, commissions, creative content production, sales software, and any other relevant expense.

- Number of New Customers Acquired: This is the total number of new customers your business gained within the same time frame used for calculating total costs.

Struggling with manual calculations & tiring setups?

Let agentic AI do the heavy lifting.

Start free

Fast sign up & easy setup

How To Calculate Customer Acquisition Metric?

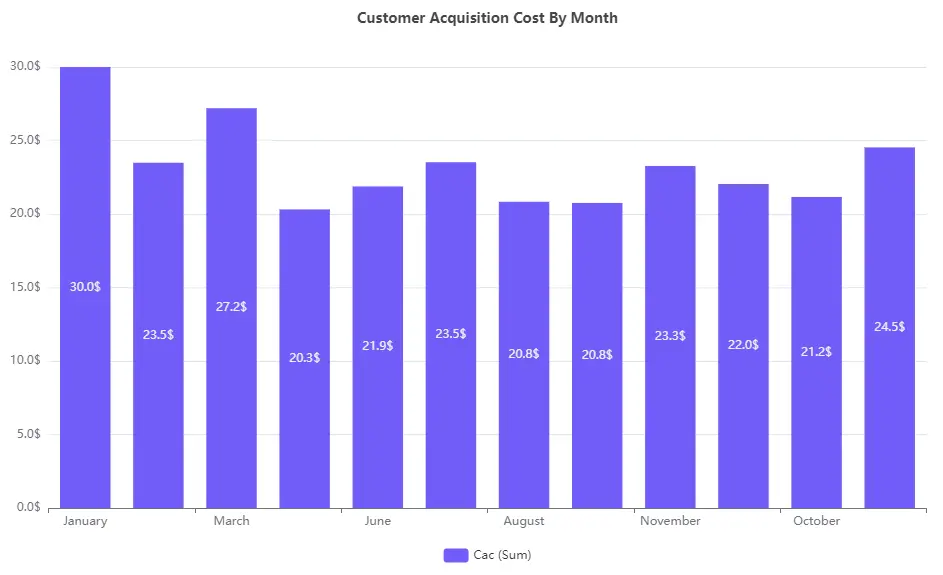

Example chart with customer acquisition cost by month, image by author

1. Define the time period: Choose a specific timeframe, such as a month, quarter, or year, to analyze your customer acquisition costs. Consistency in the timeframe is important for making comparisons over time.

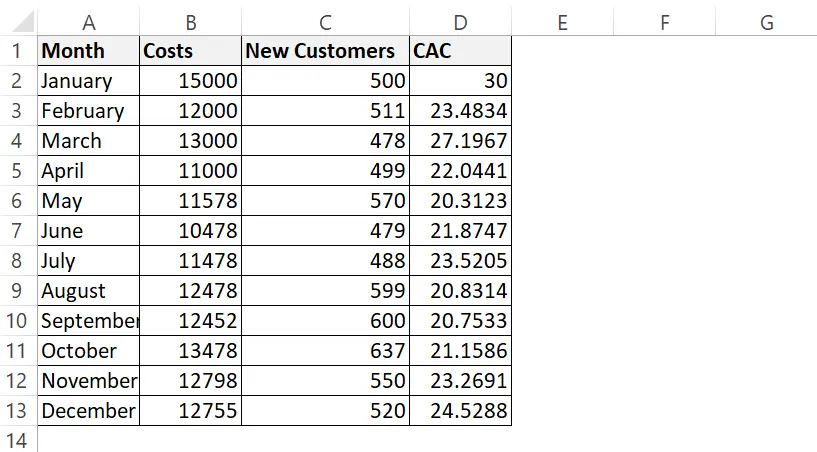

Screenshot from Excel with table data for calculation, image by author

2. Identify Sales & Marketing Costs: Gather data on all expenses incurred for sales and marketing activities during the chosen period. This can include:

- Advertising costs: Pay-per-click (PPC) ads, social media ads, print or TV commercials, etc.

- Marketing salaries and commissions: Salaries of marketing personnel, freelance fees for marketing projects, and sales commissions.

- Marketing software: Costs of marketing automation tools, CRM software, or any subscription services used for marketing purposes.

- Content creation costs: Expenses for creating marketing materials like website content, videos, infographics, etc.

- Trade show costs: Participation fees, booth setup, and travel expenses for industry events.

- Public relations (PR) costs: Costs associated with press releases, media outreach, and influencer marketing.

3. Calculate total cost: Add up all the sales and marketing expenses you identified for the chosen timeframe.

4. Track new customer acquisition: Determine the total number of new customers acquired during the same timeframe. This could involve new signups, free trial conversions, or paid subscriptions, depending on your business model.

Watch a video on how to calculate this metric 👇

CAC calculation example:

Let’s say your company spent a total of $10,000 on sales and marketing in a quarter and acquired 50 new customers during that time.

CAC = $10,000 / 50 customers = $200 per customer

Know Your Customer Acquisition Cost: Why It Matters

Understanding how much it costs to acquire a new customer is crucial for any business. This is where Customer Acquisition Cost (CAC) comes in. It’s a simple calculation that reveals a wealth of information, empowering you to:

- Optimize Marketing Spend: Identify the most cost-effective channels for reaching new customers. Are social media ads delivering better results than pay-per-click campaigns? CAC helps you allocate marketing budget wisely.

- Improve Campaign Performance: Track CAC over time to assess the effectiveness of your marketing efforts. Are certain campaigns bringing in new customers at a lower cost? Focus on replicating those successes.

- Set Realistic Goals: Knowing your CAC allows you to set achievable targets for customer acquisition. Can you afford to acquire new customers at a specific price point? CAC helps set realistic expectations.

How To Improve CAC Metric?

A lower CAC (Customer Acquisition Cost) is ideal as it indicates you’re spending less to acquire new customers. Here are some ways to tackle this:

- Target the right audience: Focus marketing efforts on channels where your ideal customers are. Analyze where high-value customers come from and tailor your approach to that segment.

- Optimize your acquisition funnel: Streamline the process from initial touchpoint to conversion. Identify and remove bottlenecks that slow down conversions. Consider using marketing automation tools to make things more efficient.

- Reduce marketing spend waste: Analyze the effectiveness of different marketing channels. Allocate the budget towards those bringing high-quality leads at a lower cost.

- Improve conversion rates: Optimize your website or landing pages for conversions. A/B test different elements to see what works best in converting leads into customers.

- Invest in customer retention: Keeping existing customers happy is often cheaper than acquiring new ones. Implement programs that encourage repeat business and reduce churn.

By implementing these strategies, you can bring down your CAC and improve your overall customer acquisition efficiency.

Where CAC Metric Is Used?

The CAC (Customer Acquisition Cost) metric is used across various industries, but it’s particularly important in:

- SaaS (Software as a Service) and subscription businesses: Since revenue comes from recurring payments, CAC helps determine how long it takes to recoup the cost of acquiring a customer.

- Ecommerce: Understanding CAC helps optimize marketing campaigns and price points to ensure profitability, with the goal of making the eCommerce business cost-neutral.

- Direct-to-Consumer (D2C) companies: For D2C businesses, CAC is crucial for evaluating the effectiveness of their customer acquisition strategies.

In general, any business that spends resources on marketing and sales can benefit from tracking CAC. It helps them understand how efficiently they’re acquiring new customers.

Other calculators

Setup and monitor your KPIs regularly using Ajelix BI